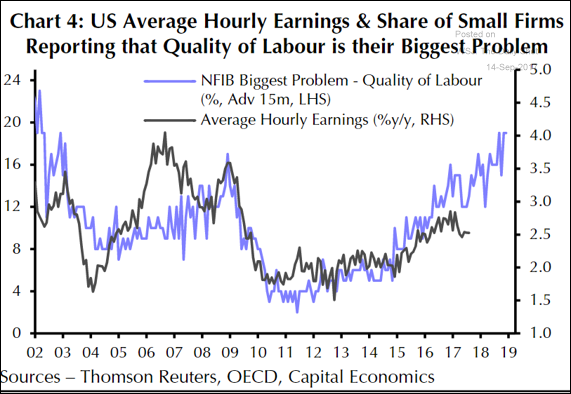

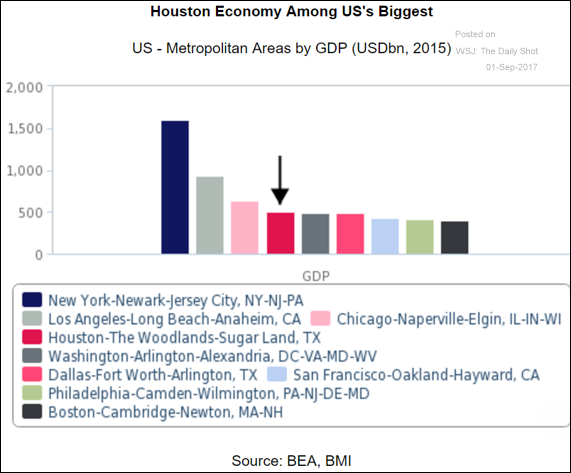

Greetings, The United States: Is wage growth about to accelerate (see more detail here)? Credit: The Moody’s bond covenant index (which measures investor protections built into the bond documents) is drifting lower. Energy: Refinery inputs took a massive hit as a result of Harvey. And this is propane production by region. China: …

Continue reading “The Daily Shot Brief – September 14th, 2017”