Greetings,

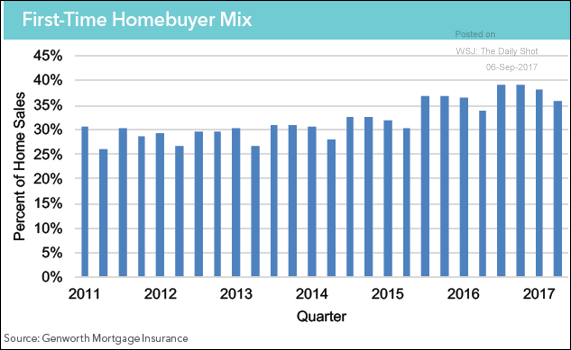

The United States: The percentage of first-time homebuyers is on the rise.

Homebuilders have been putting out more “starter” new homes (in blue and red). But those increases haven’t been sufficient to accommodate the demand from first-time homebuyers.

China:Is the softening credit impulse telling us that China’s economy will weaken in the months to come?

Global Developments: Manufacturing activity across advanced economies hit the highest level since 2011.

The Eurozone: Here is the euro area’s gross government debt as well as a forecast (by country).

Emerging Markets: Here is the manufacturing PMI across emerging economies.

Equity Markets: According to TD Ameritrade, retail investors went into September with the most bullish sentiment in years. Institutional investors often view this level of retail exuberance as a significant red flag for the market.

Food for Thought: Here are some items on DACA.

Most common jobs:

Age distribution:

Education currently pursuing (among those in school):

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com