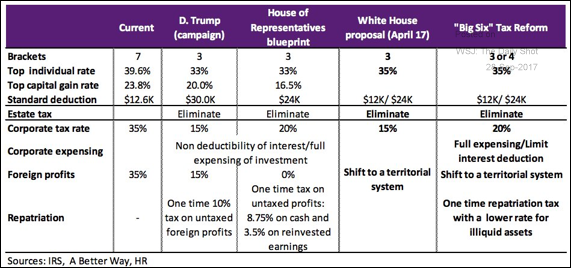

Greetings, The United States: This table provides a comparison of the latest GOP tax proposal with the earlier versions. The Atlanta Fed GDPNow model still predicts just over 2% (annualized) GDP growth for the third quarter. Credit: Cat bond issuance approaches record levels. Global Developments: No major economy is expected to be in contraction next …

Continue reading “The Daily Shot Brief – September 28th, 2017”