Greetings,

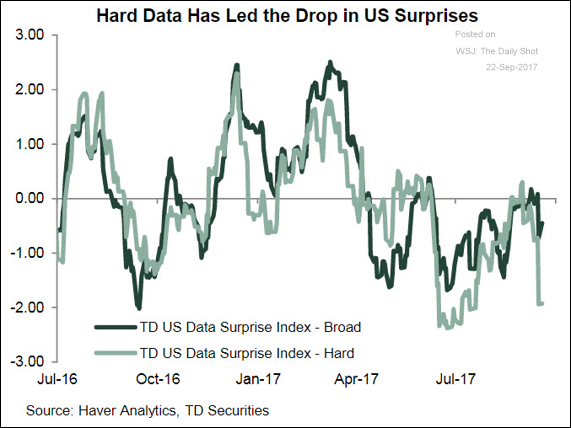

The United States: “hard data” has been disappointing lately. This weakness, according to many economists, was to a large extent driven by Hurricane Harvey.

Will the dollar continue to weaken, boosting US export competitiveness? Historical trends tell us that it’s a real possibility. And hedge funds are betting on it (second chart below).

The growth in US broad money supply keeps trending lower, indicating slower bank lending activity.

Credit: This chart shows the spread between the stock market dividend yield and the yield on HY bonds (for European and US markets). In Europe, the two yields have converged. Something is wrong with this picture.

Rates: Rate market volatility continues to contract. Here is the 3m x 10y swaption implied vol.

Commodities: China’s industrial commodities rally is rapidly reversing. Here is copper, steel, and iron ore.

Japan: The Bank of Japan is gradually slowing its purchases of JGBs.

Emerging Markets: India’s debt yields jump as some investors become concerned about the nation’s fiscal situation.

The Eurozone: The euro’s use as a reserve currency has been declining since 2009 (as % of total reserves).

This chart shows a widening gap between the French and the German debt-to-GDP ratios.

Food for Thought: Fewer teens have jobs.

Edited by Josh Marte

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com