Greetings,

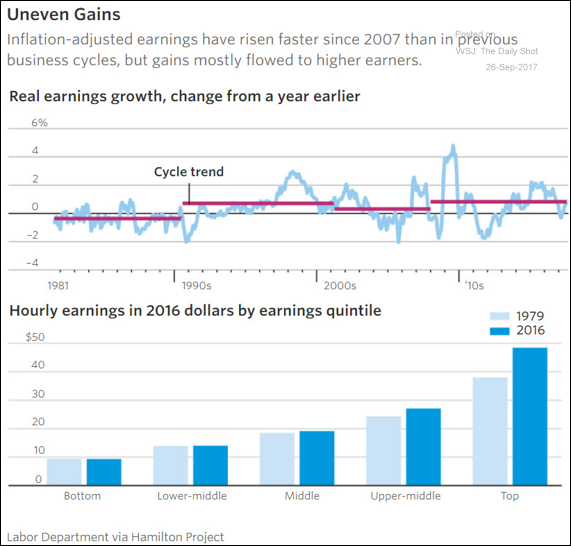

The United States: Growth in real hourly wages has been uneven.

Credit: Leveraged loan issuance in the US is on track to hit a record this year.

China: Local and regional governments continue to raise money through land sales.

And times are good to sell land, especially if it can be developed for residential use.

Energy Markets: OPEC’s output is expected to rise as oil production in Libya and Nigeria stabilizes.

Global Developments: Several indicators point to strengthening global trade volumes despite the rise in protectionist measures.

Emerging Markets: This chart shows the net easing by EM central banks, which is expected to continue through 2018. Russia, Brazil, and Indonesia are just some of the recent examples.

The Eurozone: This chart shows the interest rates on small business loans in Italy, France, and Germany. The ECB’s monetary transmission concerns have finally been addressed.

Equity Markets: Here is the year-to-date risk-return scatter plot for major asset classes. REITs continue to look terrible.

Food for Thought: Apple (and to some extent the US stock market) remains dependent on the iPhone revenues. Will the public pay nearly $1,000 for the latest product?

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com