Greetings,

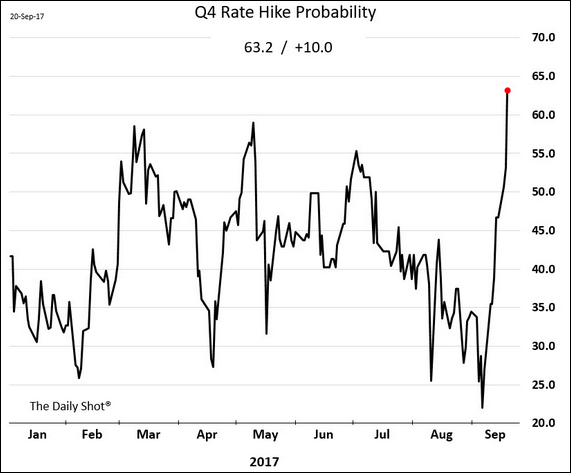

The United States: As expected, the Federal Reserve will begin the long-awaited balance sheet unwind next month. But to the surprise of some economists, the central bank also appears to be on target to raise rates in December. The futures-based probability of a December rate hike jumped in response to the FOMC announcement.

Below is the breakdown and the forecasts of medical care CPI

Existing home sales dipped again, missing economists’ forecasts. Affordability is becoming more of an issue.

Credit: This year we had quite a few large leveraged loan transactions.

Equity Markets: The market shrugged off a more hawkish stance from the Fed, with VIX closing below 10 again. Amazing.

UK: The market is now pricing in two rate hikes over the next year.

Asia/Pacific: China’s insurance firms are loading up on alternative investments.

Emerging Markets: Short-term bond yields in Russia and Brazil continue to tumble amid expectations of further rate cuts in both countries.

The Eurozone: This chart shows unit labor cost for the largest Eurozone economies since 1999. Germany remains competitive.

Food for Thought: This chart shows health insurance premium inflation which has been outpacing the CPI and wages.

Edited by Josh Marte

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com