Greetings,

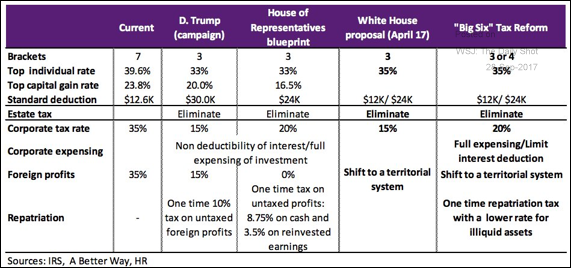

The United States: This table provides a comparison of the latest GOP tax proposal with the earlier versions.

The Atlanta Fed GDPNow model still predicts just over 2% (annualized) GDP growth for the third quarter.

Credit: Cat bond issuance approaches record levels.

Global Developments: No major economy is expected to be in contraction next year.

China: Here is how China’s tourism spending compares to other large economies – now and a decade ago.

What are the nation’s tourists’ favorite destinations (now vs. a decade ago)?

Emerging Markets: This chart shows the volatility of the GDP growth rates for a number of “frontier market” nations.

The Eurozone: Germany’s “Jamaica Coalition” (named after the colors of Jamaica’s flag) looks like the most likely outcome for the new government. There aren’t any other viable options that hold enough seats. However, the FDP and Greens are quite far apart on many issues, which makes a deal among the parties rather challenging. Whatever the case, Angela Merkel’s position has been weakened, increasing the possibility that she doesn’t serve out the full term

Equity Markets: Assets under management of inverse-VIX exchange-traded product (ETP) hit a record, catching up to the long-VIX ETP.

For the first time since 2005, there hasn’t been a 2% daily move in the S&P 500.

Food for Thought: According to this map, Germans work the lowest number of hours per week. Greeks, on the other hand, work the most hours.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com