Greetings,

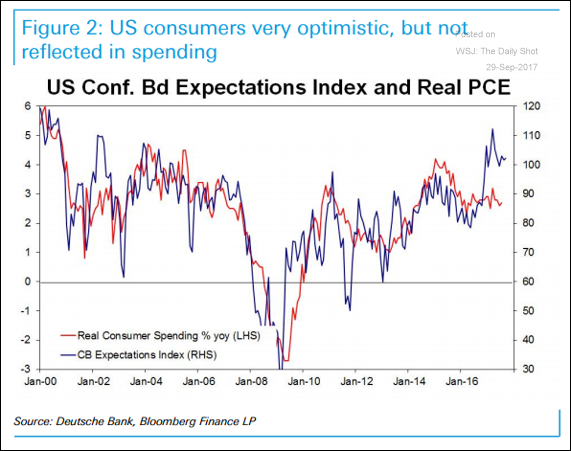

The United States: Here is a chart comparing consumer confidence (expectations) and real consumer spending.

Source: Deutsche Bank, @joshdigga

Credit: Are the loose structural characteristics of the leveraged loan market here to stay?

The United Kingdom: Here is a dashboard of what happened to the economy since the vote and more recently.

Emerging Markets: Brazil is still struggling with the private sector credit crunch, but there are signs of improvement.

The Eurozone: It’s becoming increasingly likely that the ECB will announce a QE tapering program next month or shortly after. Here is why.

Consumer and business confidence is at multiyear highs.

German “super core” CPI (excluding the volatile components of the index) is climbing.

Source: @fwred

Equity Markets: Finally, when investors look at the float of a particular stock, they should be adjusting for the shares “trapped” inside passive funds/ETFs. The trapped amount is less likely to follow the company’s fundamentals as it “blows in the wind” of index trading.

Food for Thought: Media coverage of the three major hurricanes.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com