Greetings,

The United States: Consumer spending and business investment strengthened.

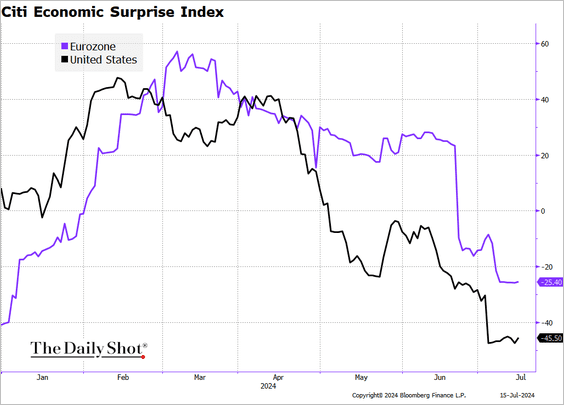

The United Kingdom: The Citi UK Economic Surprise Index is significantly higher than its US counterpart.

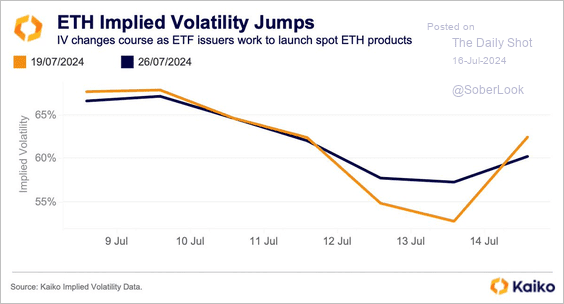

Cryptocurrency: Bitcoin’s correlation with stocks has turned negative.

Energy: Crude oil implied volatility remains low.

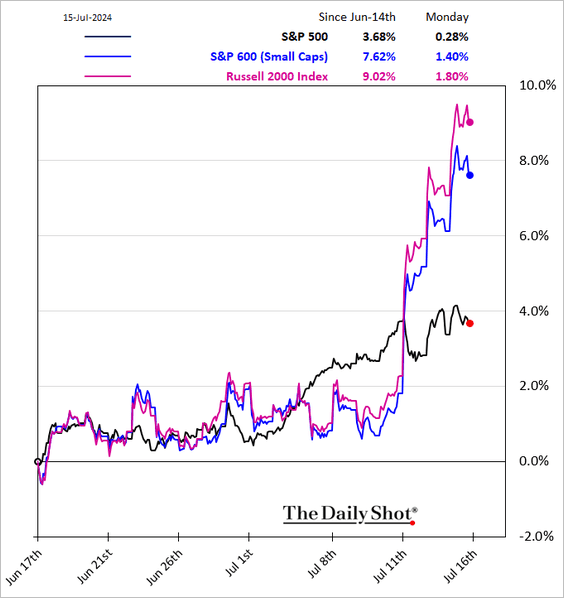

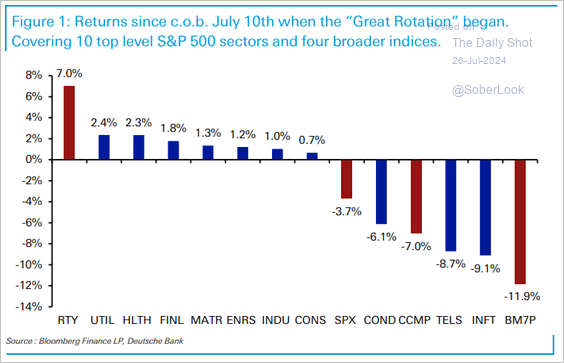

Equities: This chart shows the rotation from the current tech sell-off, which started on July 11th.

Credit: How might various asset classes perform in soft landing or recession scenarios?

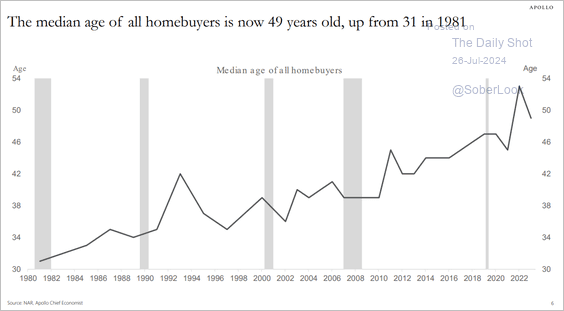

Food for Thought: The median age of US homebuyers:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief

Source:

Source: