Greetings,

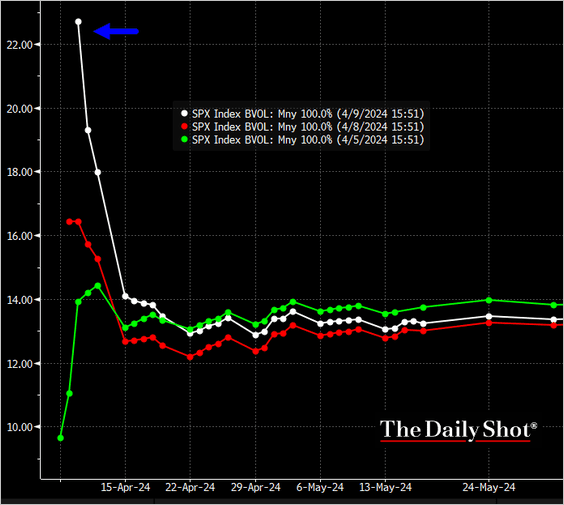

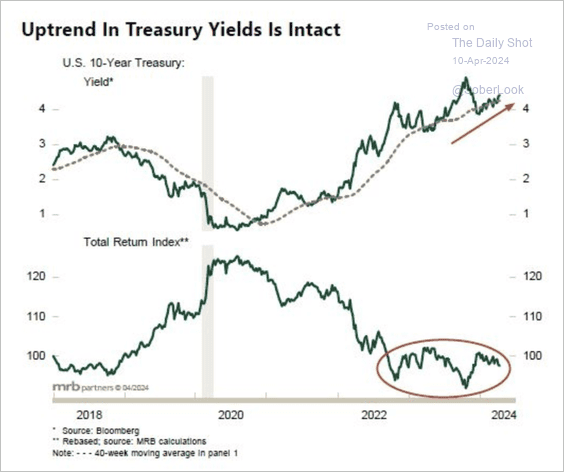

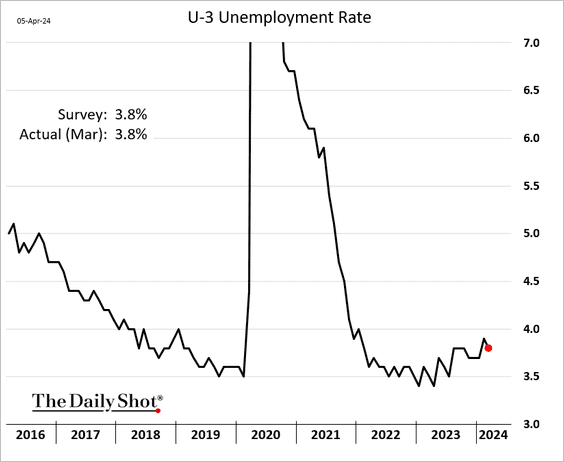

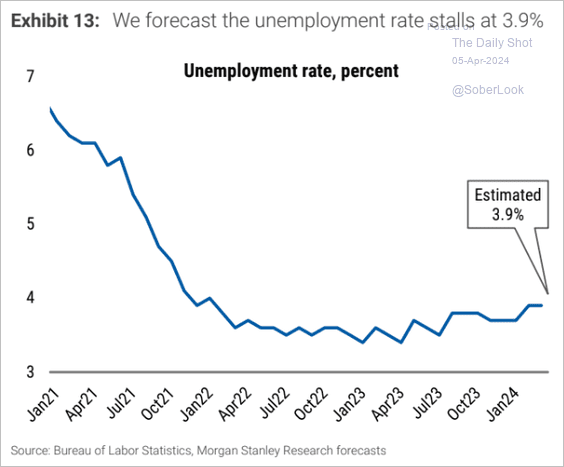

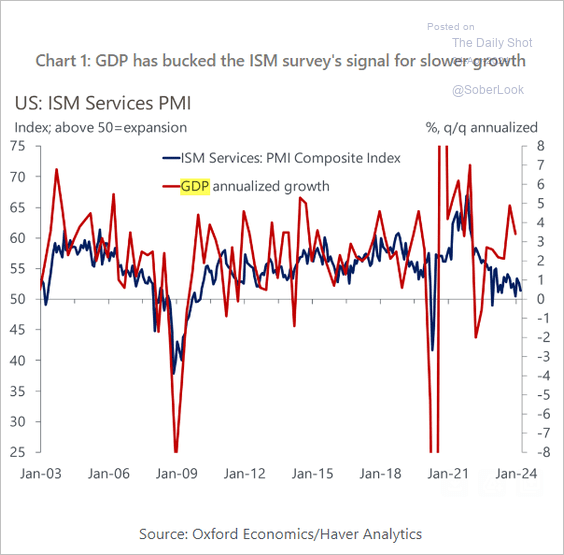

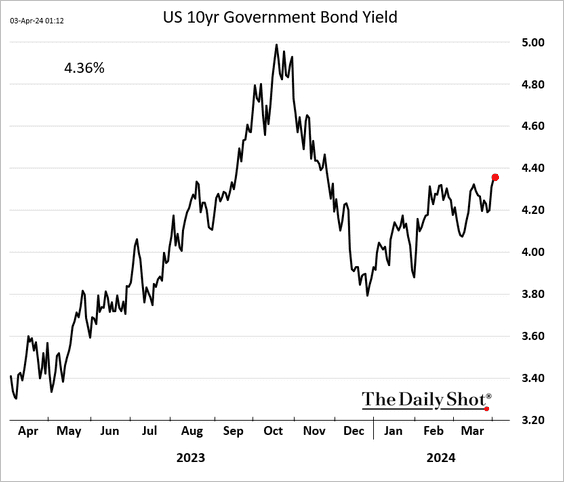

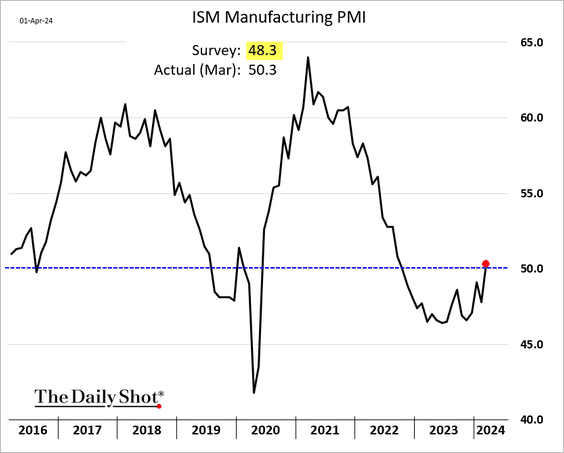

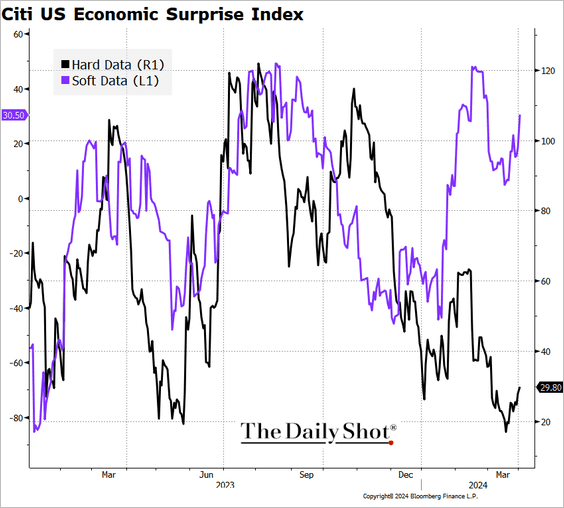

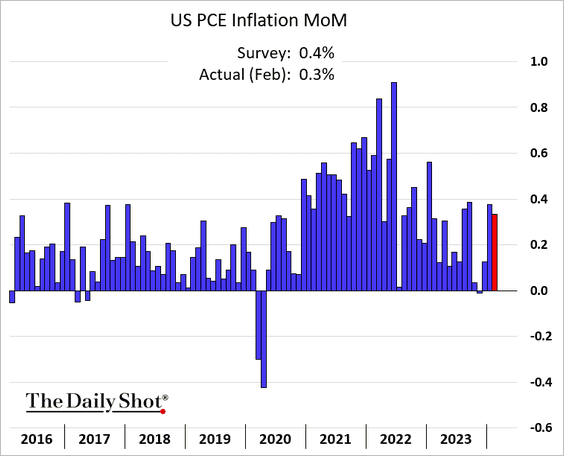

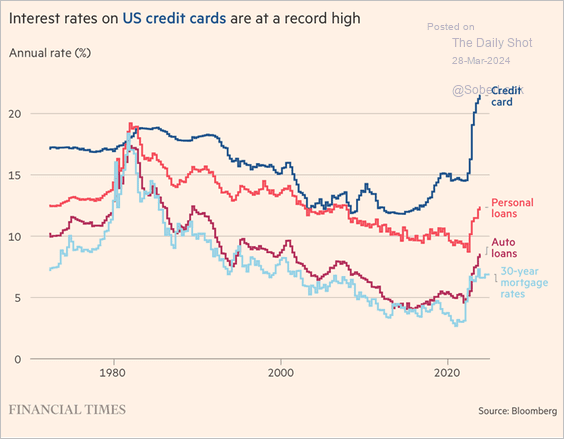

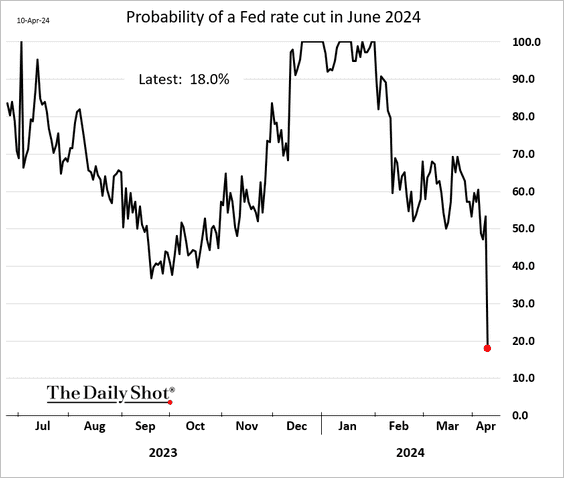

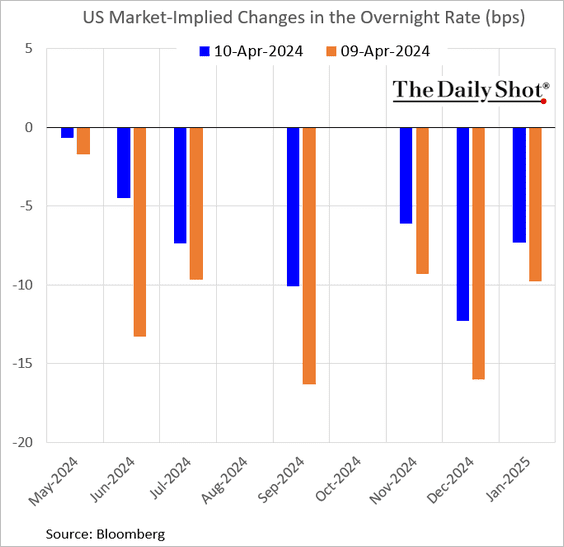

The United States: The probability of a Fed rate cut in June has collapsed. Will we see any rate reductions at all this summer?

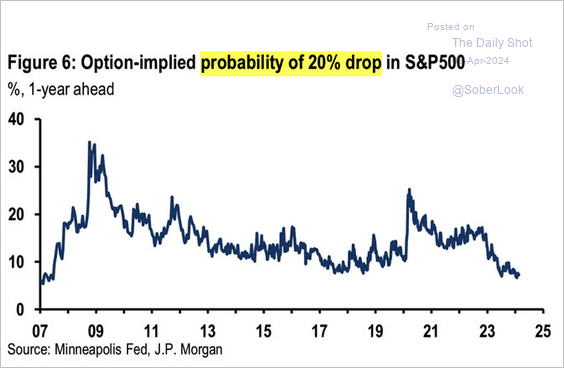

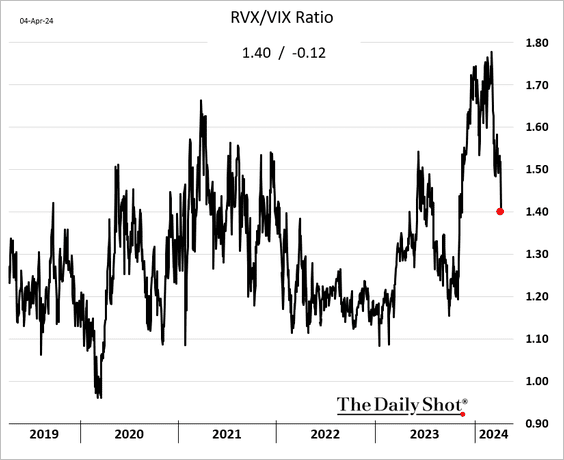

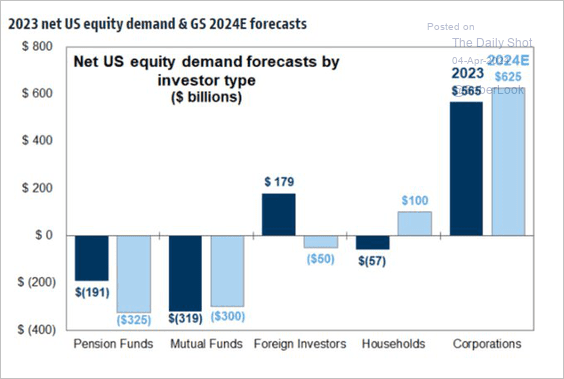

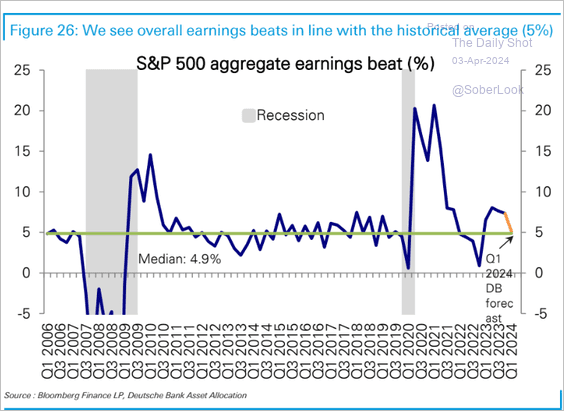

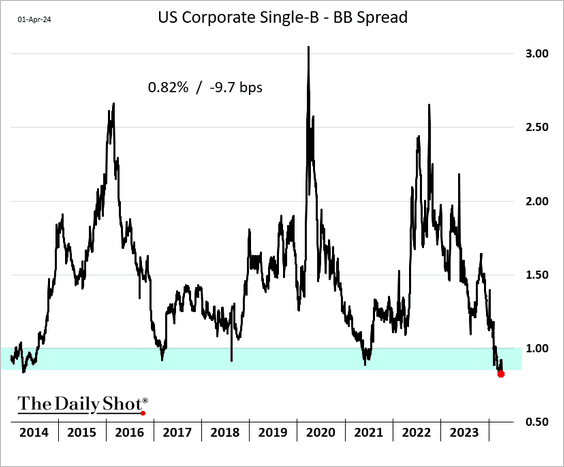

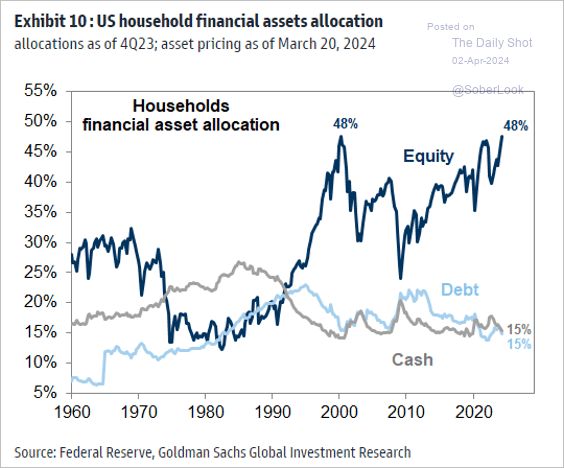

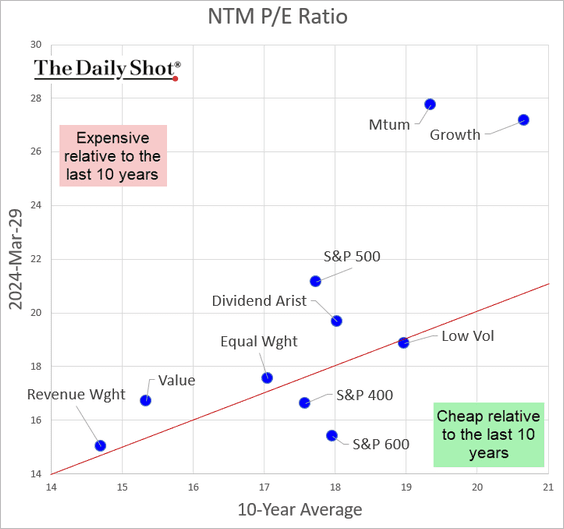

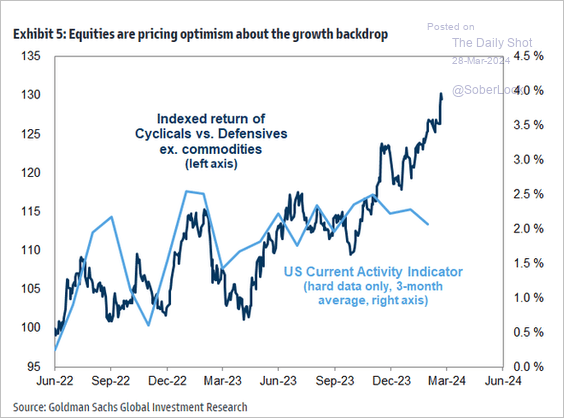

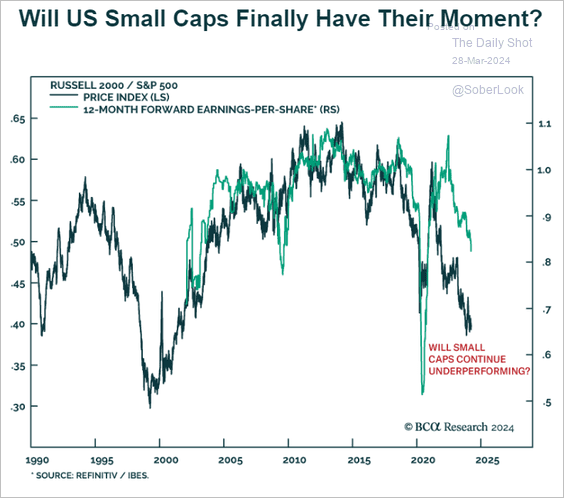

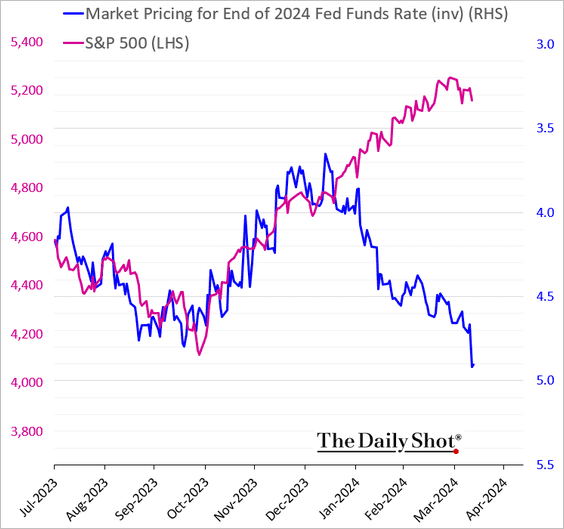

Equities: The rally has been partly driven by expectations of Fed rate cuts, many of which are no longer anticipated.

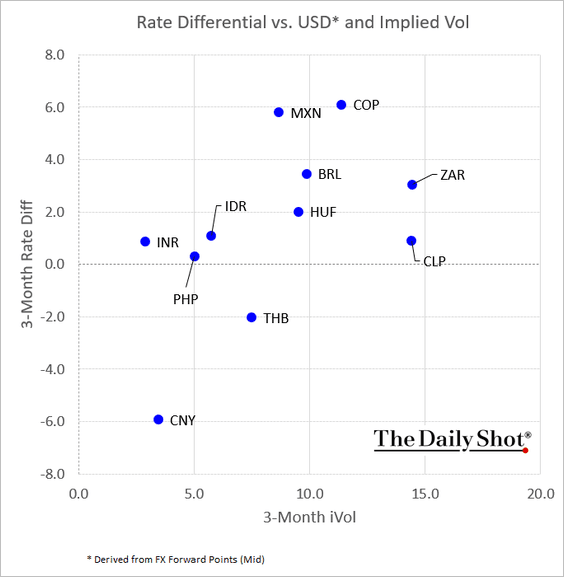

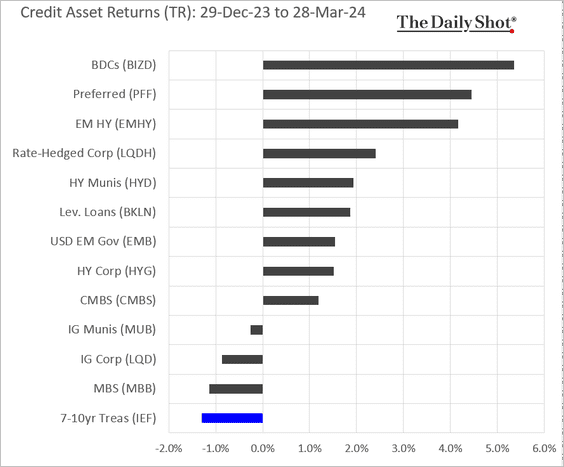

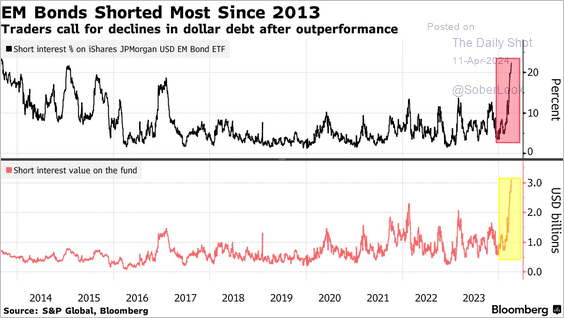

Emerging Markets: Traders have been shorting dollar-denominated EM debt.

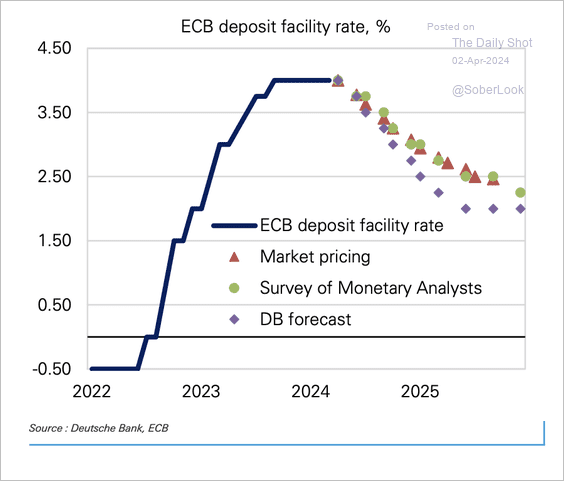

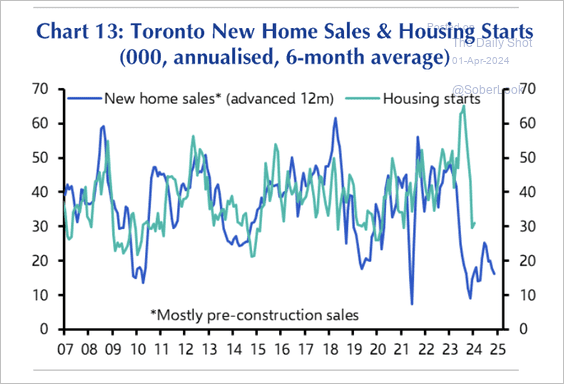

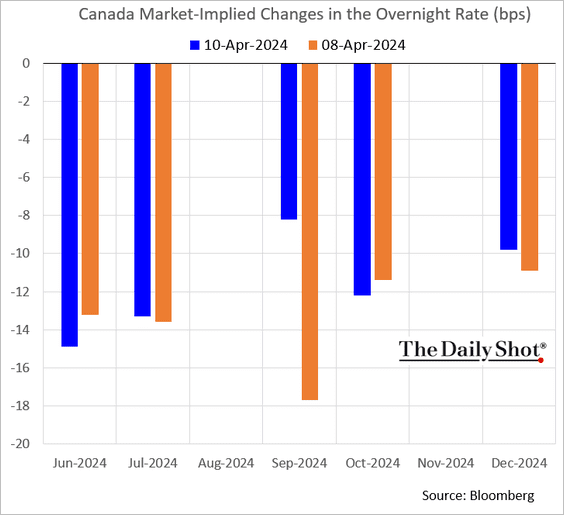

Canada: The BoC signaled a possible rate cut in June.

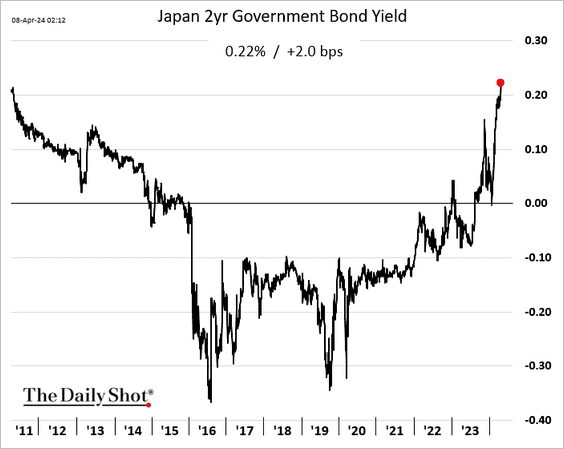

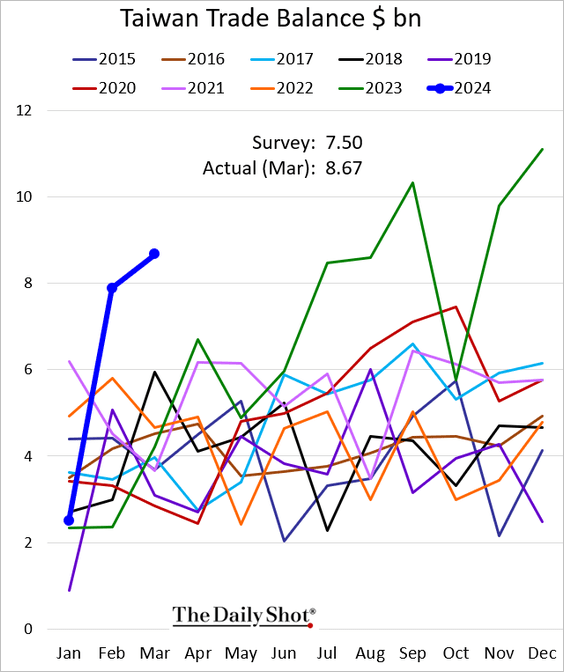

Asia-Pacific: Taiwan’s exports surprised to the upside.

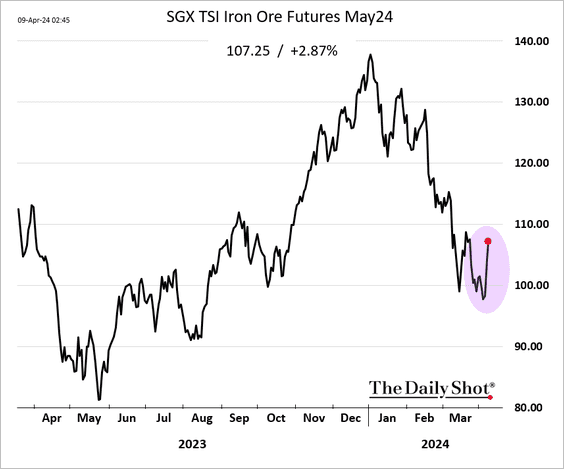

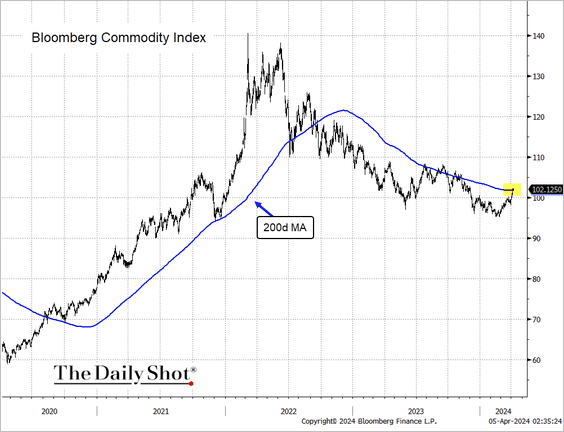

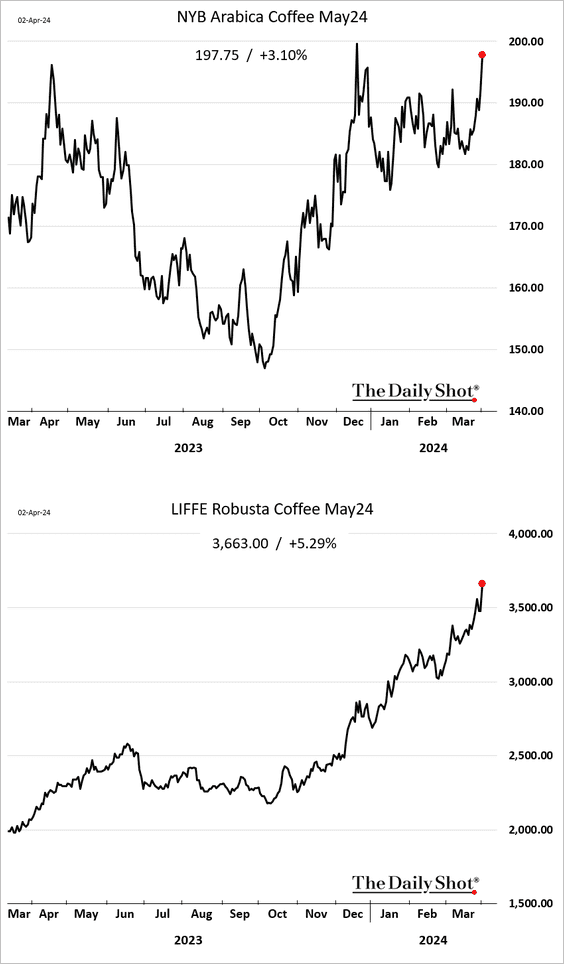

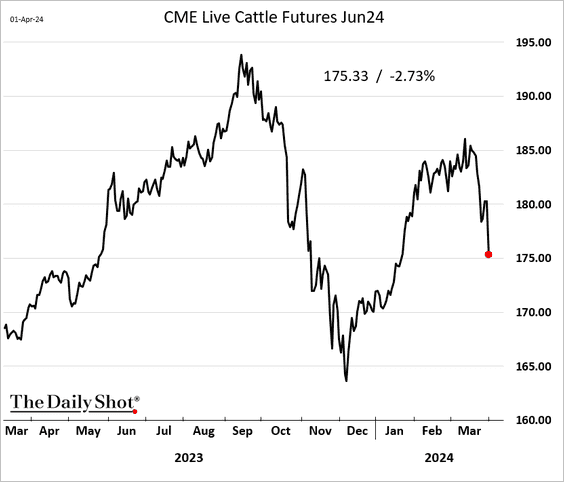

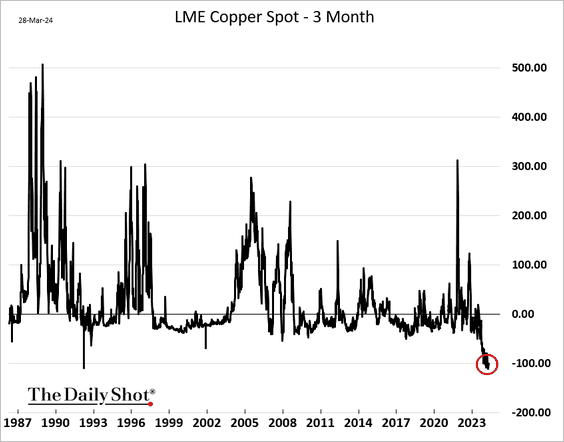

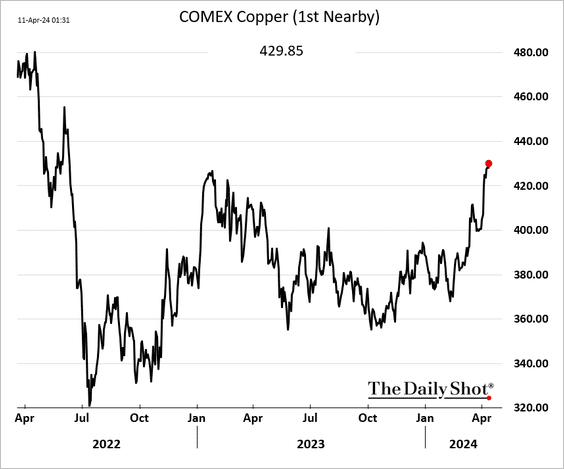

Commodities: Copper continues to rally.

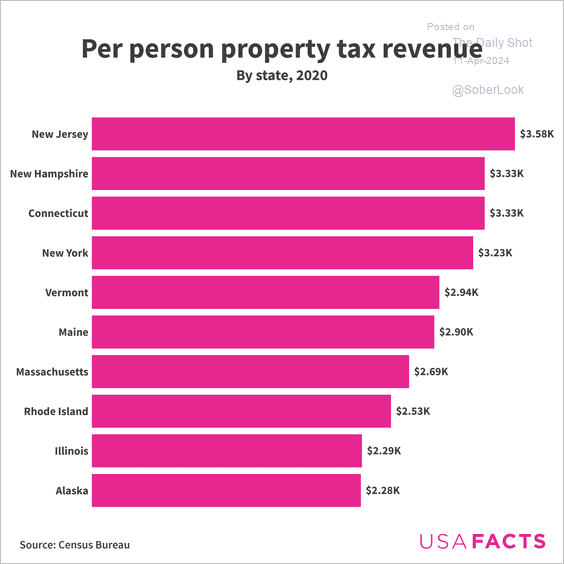

Food for Thought: Property tax revenue per person, by state:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com