Greetings,

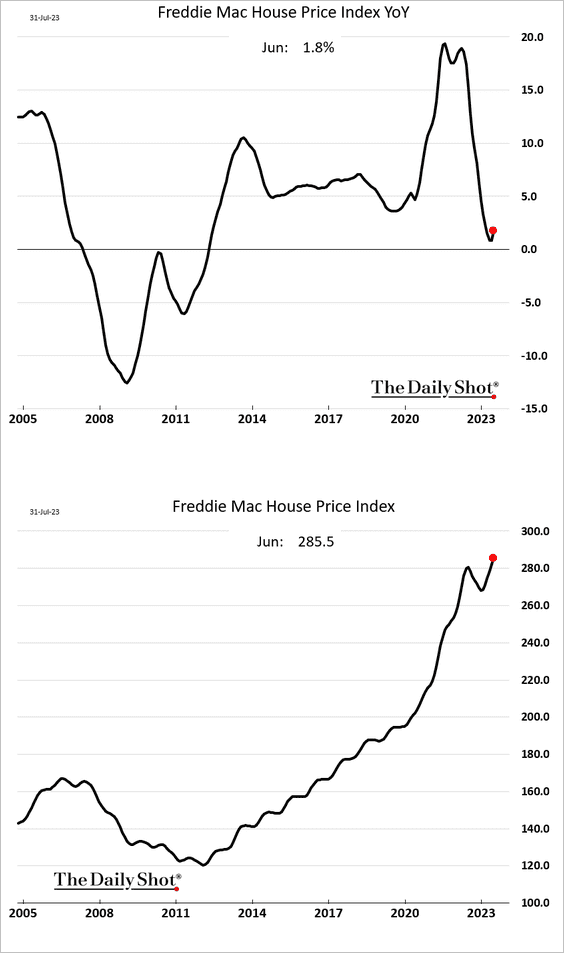

The United States: Freddie Mac’s house price index was up in June on a year-over-year basis. Note that the index didn’t cross the zero mark in this cycle.

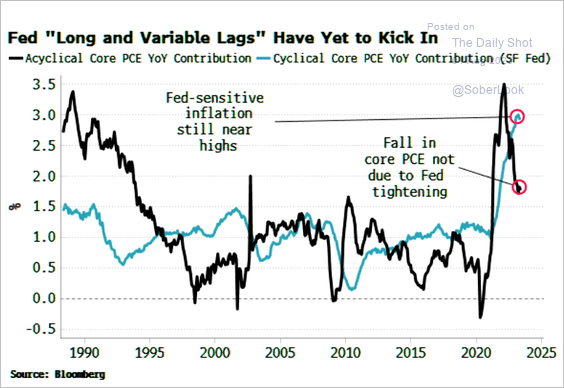

Fed rate hikes have yet to kick in. The Fed-sensitive (cyclical) CPI component is still near the highs.

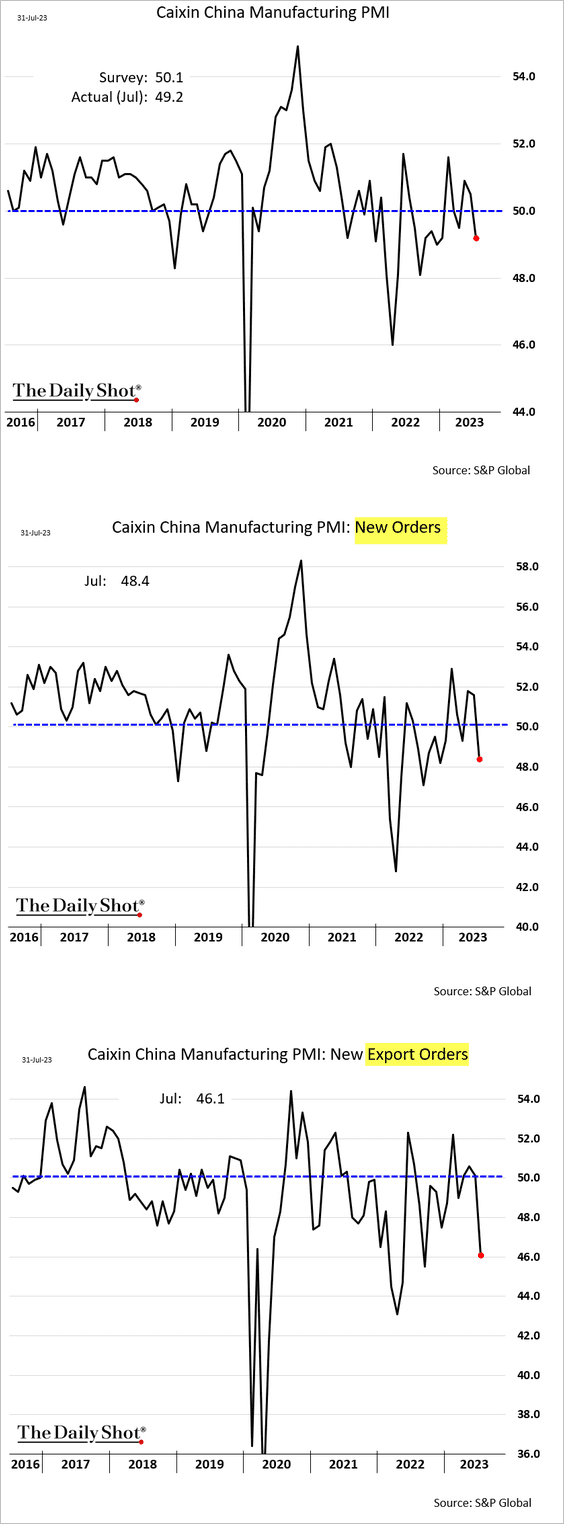

China: The manufacturing PMI from S&P Global showed an unexpected contraction as demand slows.

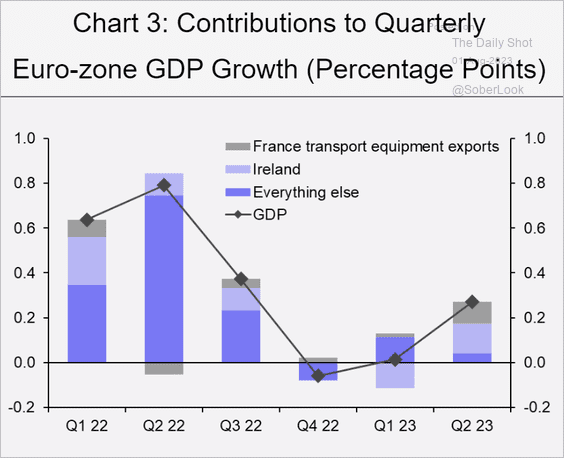

The Eurozone: The factors propelling the surge in the Euro-area’s Q2 GDP are unlikely to be sustainable. The lion’s share of these gains can be attributed to the notoriously volatile Irish GDP, which is often subject to significant revisions, and the exports of transport equipment in France, predominantly from a single cruise boat.

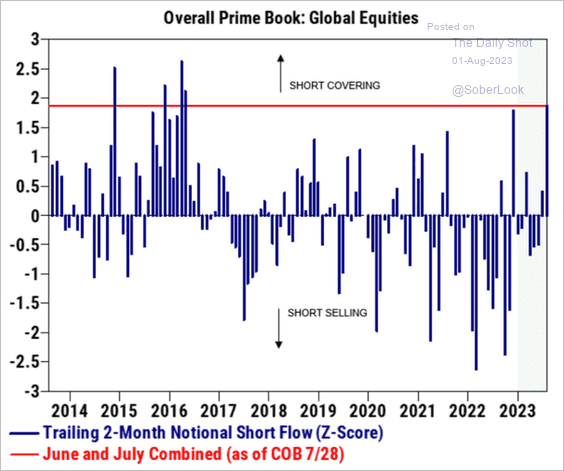

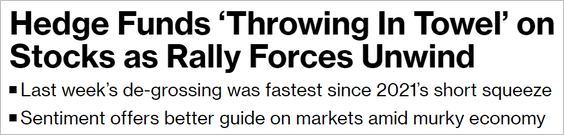

Equities: Hedge funds’ short-covering this summer hasn’t been this aggressive since 2016.

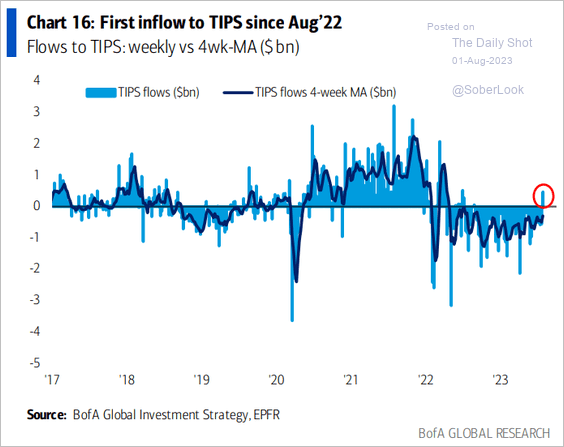

Credit: TIPS flows finally turned positive last week.

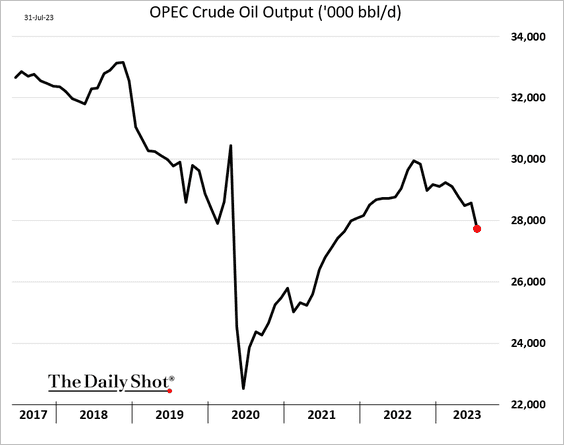

Energy: OPEC’s output declined in July

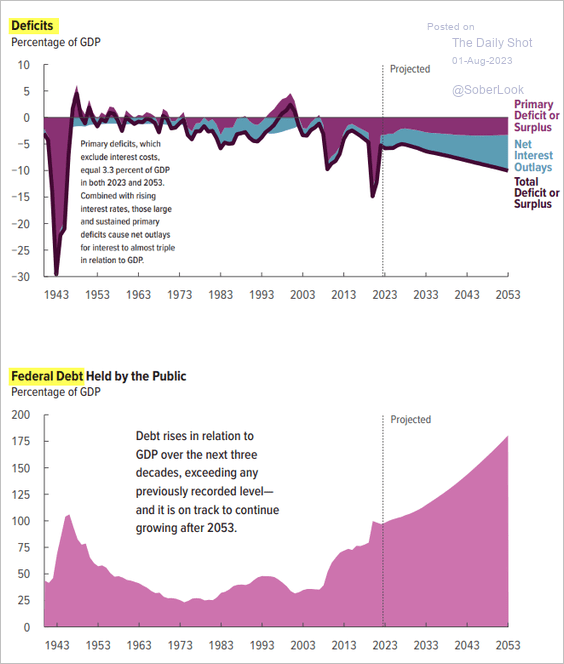

Food for Thought: Here is the projected US federal deficit and debt:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief