Greetings,

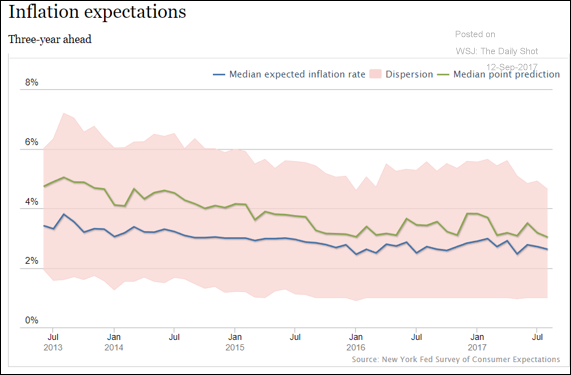

The United States: Consumer inflation expectations three years out hit a record low. This trend will add to the argument for waiting with the Fed rate hikes until next year.

However, US financial conditions continue to ease despite the quarterly rate hikes. Some at the Fed will focus on this trend to argue for a rate hike in December.

Credit: Investment-grade (IG) credit default spreads are near multi-year lows, outperforming HY CDS (chart shows the spreads for IG and HY CDX).

Energy: Who is selling refined fuel to North Korea?

China: China’s cross-border M&A activity has slowed amid pushback both at home and abroad.

Emerging Markets: Russia’s economic growth continues to recover, as the impact of negative “shocks” (collapse in oil price, hike in rates, etc.) fade.

Equity Markets: Which S&P 500 companies have the greatest exposure to Asia?

Food for Thought: The happiness index around the world.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com