Greetings,

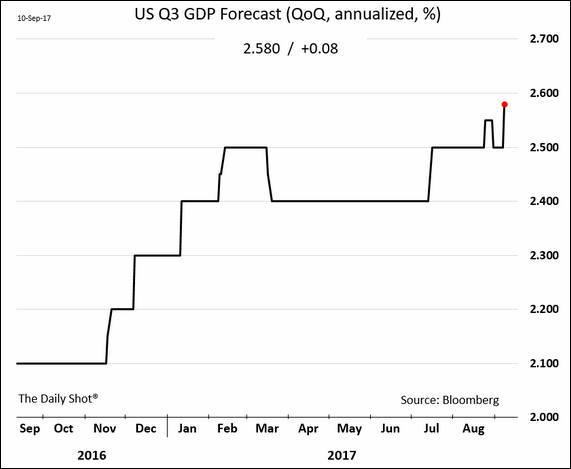

The United States: Economists have bumped up their estimates for the third quarter GDP growth. Below is the consensus forecast over time.

And here is the Atlanta Fed’s GDPNow.

Credit: Investment-grade bond inflows remain robust, even as HY debt funds experience outflows.

Energy: Crude oil and gasoline sold off on Friday, anticipating weaker demand for fuel from Florida.

China: Corporate defaults have been on the rise, and the government is not bailing these firms out. It will be interesting to see how this plays out in the wealth management product (WMPs) market.

Emerging Markets: Turkey’s industrial production surprised to the upside. Manufacturing is benefitting from the lira weakness (which makes Turkish exports cheaper).

Equity Markets: We continue to see outflows from US domestic equity mutual funds (MF Flows). That’s not the case with global and fixed-income funds.

This chart shows the breakdown of domestic mutual fund outflows by category.

Food for Thought: The history of global GDP.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com