Greetings,

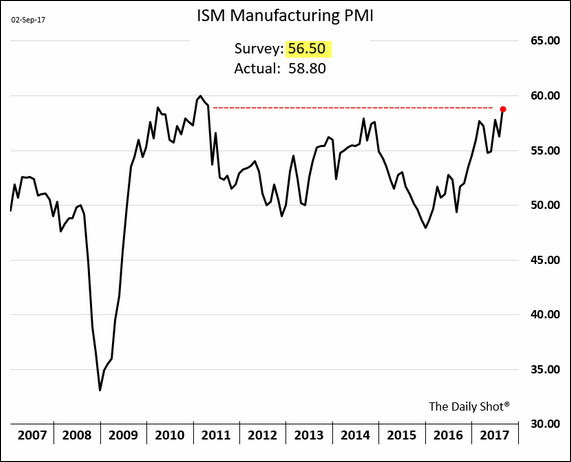

The United States: The regional Fed surveys have been pointing to a solid national manufacturing report. Indeed, the August ISM index reached the highest level since 2011.

The NY Fed Nowcast model indeed showed an increase in the GDP projection as a result of the ISM data.

China: With the currency stable, foreign fixed income investors turn their attention to China’s government bonds. Compared to opportunities in the developed markets, the nation’s yields look attractive.

Energy Markets: Money managers have sharply reduced their exposure to crude oil in recent weeks. A bullish sign?

The Eurozone: The recent strength in the Eurozone’s currency has pushed out the likelihood of an ECB rate hike until 2019. The central bank has become concerned that a strong euro could bring back disinflationary pressures and tighten financial conditions.

Emerging Markets: This chart shows the bounce in India’s banknotes in circulation after last year’s demonetization.

Equity Markets: North Korea’s latest nuclear weapon test and the subsequent preparation to test an ICBM (see story) brought jitters back into the market.

Food for Thought: Nuclear tests since 1945.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com