Greetings,

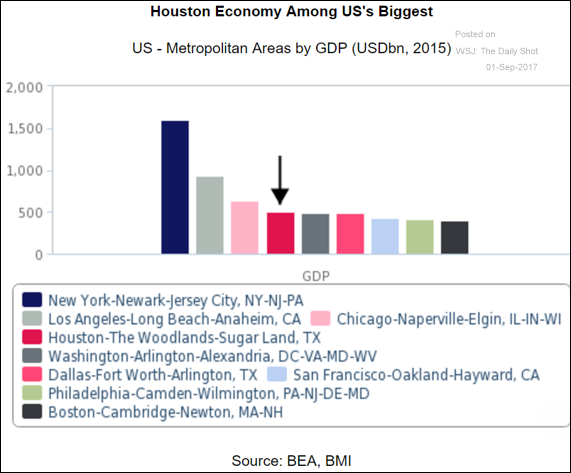

The United States: The tremendous damage to the Houston-area economy will create a temporary drag on the US GDP.

• The Houston metro area economy is one of the largest in the US.

• In fact, by itself, the Houston-area GDP is greater than the economy of Sweden or Poland.

China: China’s property markets remain hot, with land prices rising rapidly.

Energy Markets: Here is a long-term chart of US coal production and coal mining employment.

Now, there is a rising concern about Hurricane Irma. Even though Irma is a few days away and its path is not entirely certain, US natural gas futures jumped on concerns over disruption.

The Eurozone: Fundamentals, such as real yield differentials, suggest that the euro is significantly overvalued.

Emerging Markets: Brazil is trying to export its way out of the economic slump.

Equity Markets: Historically, September has not been a great month for the US stock market.

Food for Thought: Where a typical working family can or cannot afford to live.

Heads up! The next Daily Shot Brief will be on Tuesday, September 5th. Have a great weekend!

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com