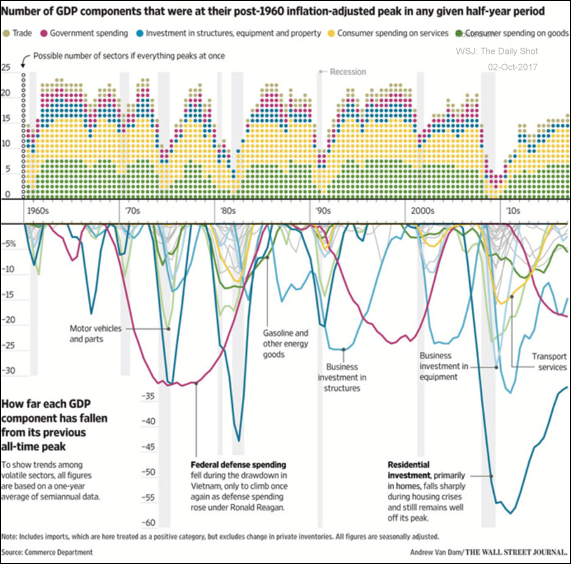

Greetings, The United States: This chart shows the number of the GDP components which were at peak level in each 6-month period. It’s an interesting way to see what’s driving growth. Credit: This chart shows the middle-market loan volume by purpose (use of proceeds). Canada: Here is an interesting chart from the …

The Daily Shot Brief – September 29th, 2017

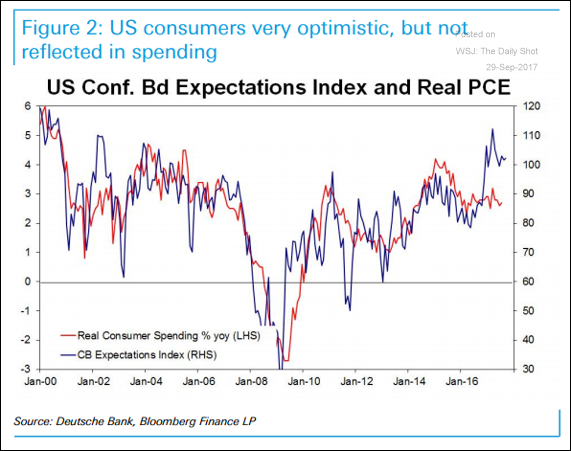

Greetings, The United States: Here is a chart comparing consumer confidence (expectations) and real consumer spending. Credit: Are the loose structural characteristics of the leveraged loan market here to stay? The United Kingdom: Here is a dashboard of what happened to the economy since the vote and more recently. Emerging Markets: …

Continue reading “The Daily Shot Brief – September 29th, 2017”

The Daily Shot Brief – September 28th, 2017

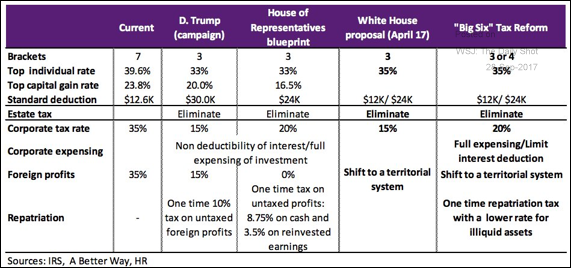

Greetings, The United States: This table provides a comparison of the latest GOP tax proposal with the earlier versions. The Atlanta Fed GDPNow model still predicts just over 2% (annualized) GDP growth for the third quarter. Credit: Cat bond issuance approaches record levels. Global Developments: No major economy is expected to be in contraction next …

Continue reading “The Daily Shot Brief – September 28th, 2017”

The Daily Shot Brief – September 27th, 2017

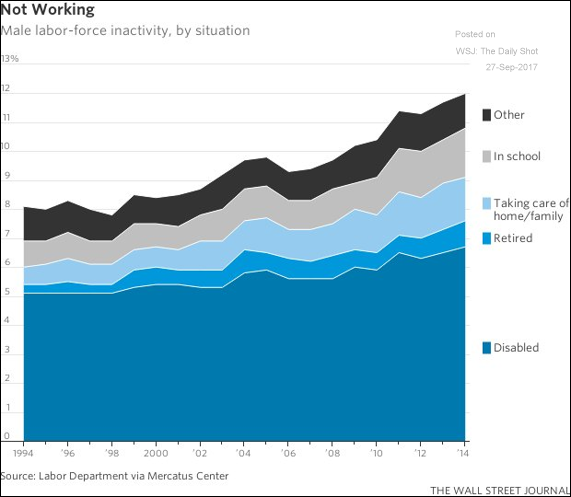

Greetings, The United States: This chart is a bit dated, but it breaks down the reasons why some prime-age men are not working. As discussed previously (#3 here), male participation rates are not improving much. Credit: This chart shows corporate leverage levels (debt/EBITDA) by industry and rating. Rates: Goldman’s forecast for the …

Continue reading “The Daily Shot Brief – September 27th, 2017”

The Daily Shot Brief – September 26th, 2017

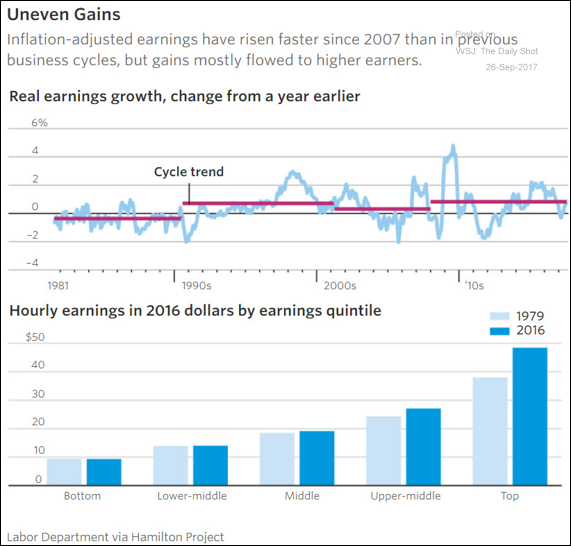

Greetings, The United States: Growth in real hourly wages has been uneven. Credit: Leveraged loan issuance in the US is on track to hit a record this year. China: Local and regional governments continue to raise money through land sales. And times are good to sell land, especially if it can be …

Continue reading “The Daily Shot Brief – September 26th, 2017”

The Daily Shot Brief – September 25th, 2017

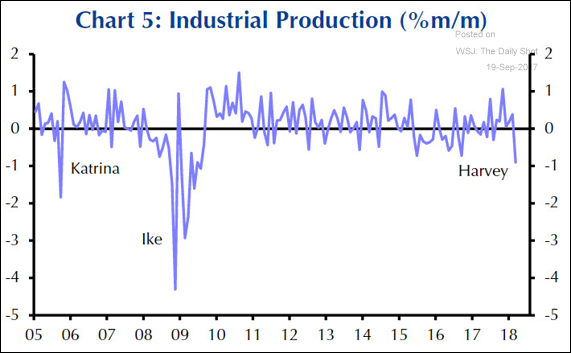

Greetings, The United States: Hurricanes Harvey and Irma trimmed US economic activity in September, slowing manufacturing output. However, the nation’s economy remains resilient. Here is a comment from IHS Markit. Credit: The Toys R Us filing has catapulted this year’s DIP financing to the highest level since 2009. China: Goldman expects to see inflows in …

Continue reading “The Daily Shot Brief – September 25th, 2017”

The Daily Shot Brief – September 22th, 2017

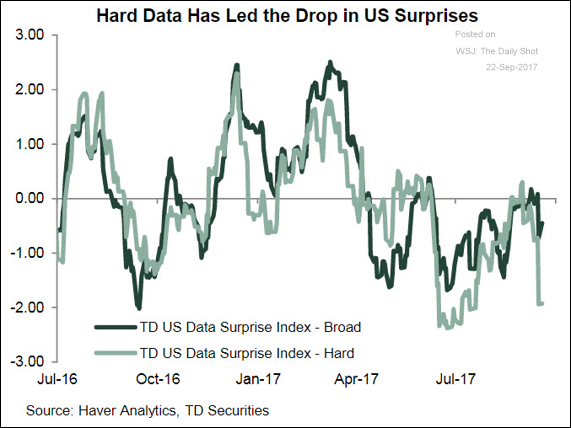

Greetings, The United States: “hard data” has been disappointing lately. This weakness, according to many economists, was to a large extent driven by Hurricane Harvey. Will the dollar continue to weaken, boosting US export competitiveness? Historical trends tell us that it’s a real possibility. And hedge funds are betting on it (second chart below). The …

Continue reading “The Daily Shot Brief – September 22th, 2017”

The Daily Shot Brief – September 21th, 2017

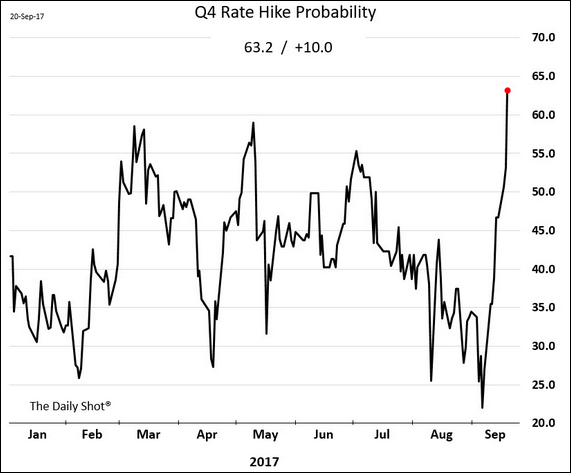

Greetings, The United States: As expected, the Federal Reserve will begin the long-awaited balance sheet unwind next month. But to the surprise of some economists, the central bank also appears to be on target to raise rates in December. The futures-based probability of a December rate hike jumped in response to the FOMC announcement. Below is …

Continue reading “The Daily Shot Brief – September 21th, 2017”

The Daily Shot Brief – September 20th, 2017

Greetings, The United States: As expected, US import prices have increased. Credit: Here is how Toys R Us compares with other retail bankruptcy filings. Equity Markets: This chart puts some market capitalization figures into perspective. Emerging Markets: The increasing percentage of tech stocks in emerging markets has been fueling the recent rally. …

Continue reading “The Daily Shot Brief – September 20th, 2017”

The Daily Shot Brief – September 19th, 2017

Greetings, The United States: As expected, US import prices have increased. Credit: Here is how Toys R Us compares with other retail bankruptcy filings. Equity Markets: This chart puts some market capitalization figures into perspective. Emerging Markets: The increasing percentage of tech stocks in emerging markets has been fueling the recent rally. …

Continue reading “The Daily Shot Brief – September 19th, 2017”