Greetings,

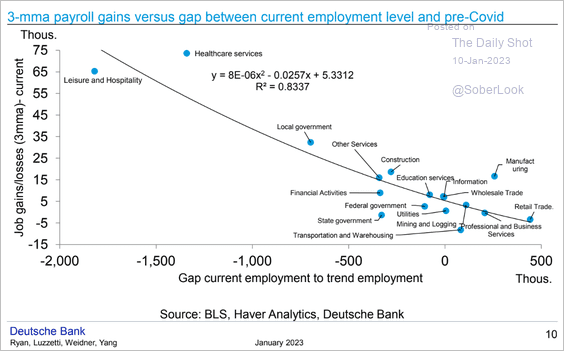

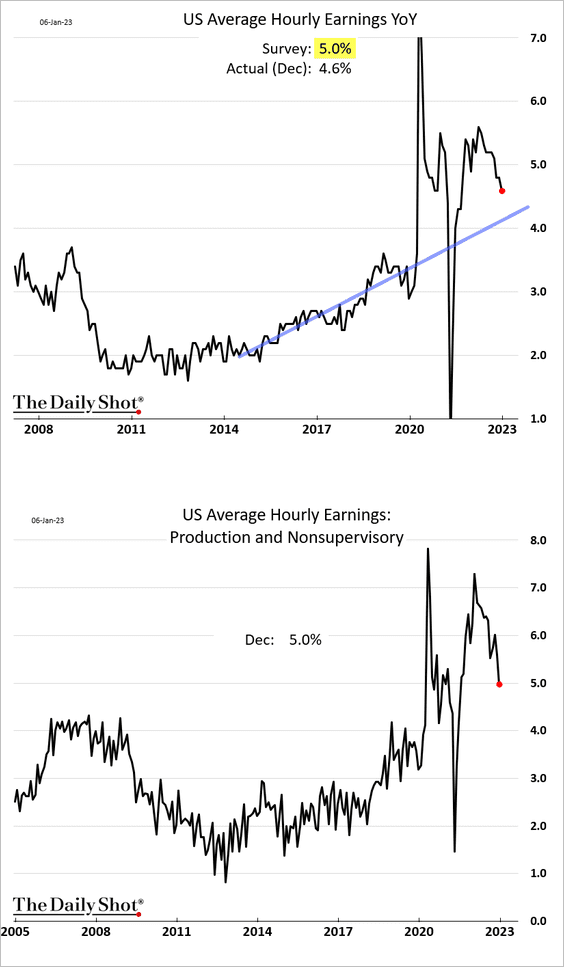

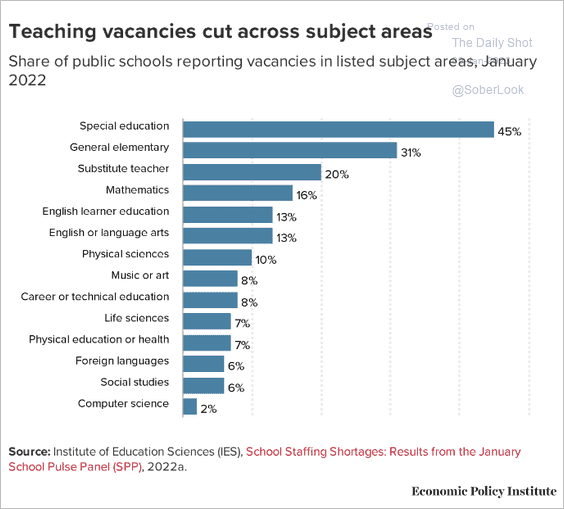

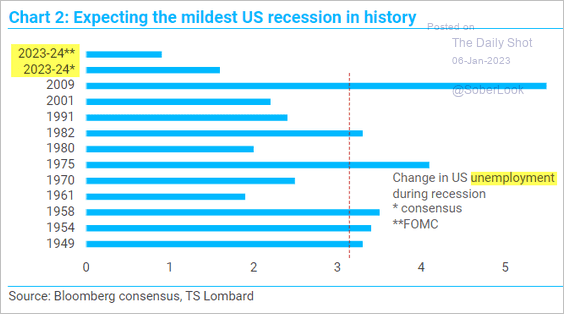

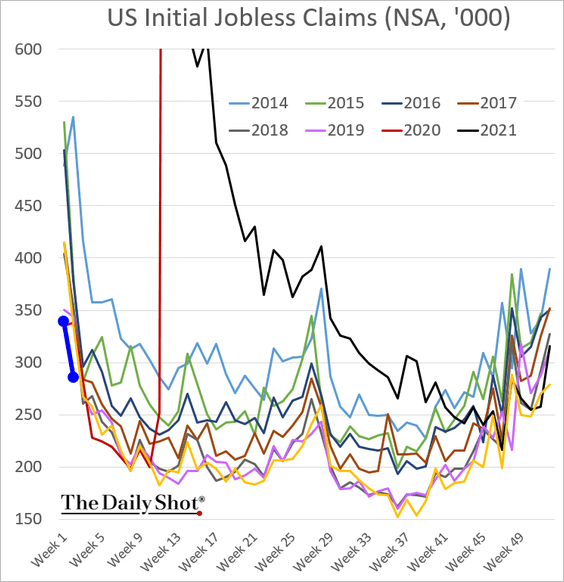

The United States: Unemployment claims continue to signal tightness in the labor market. Initial applications for jobless benefits hit a multi-year low for this time of the year.

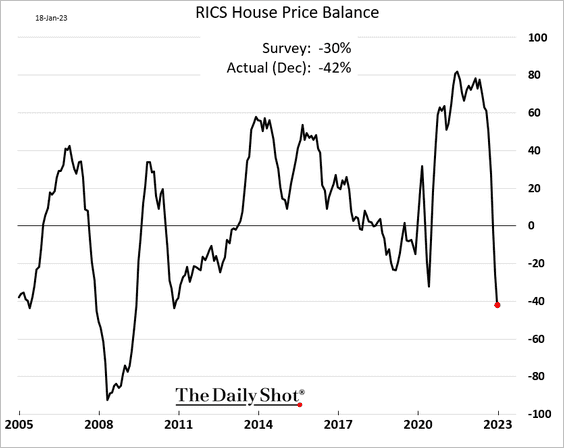

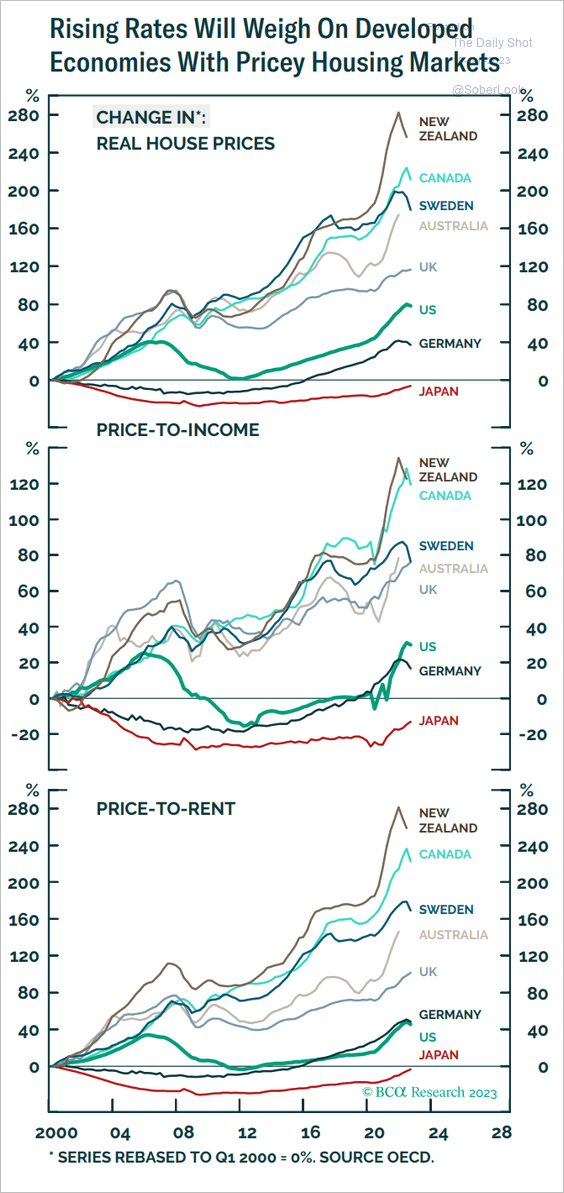

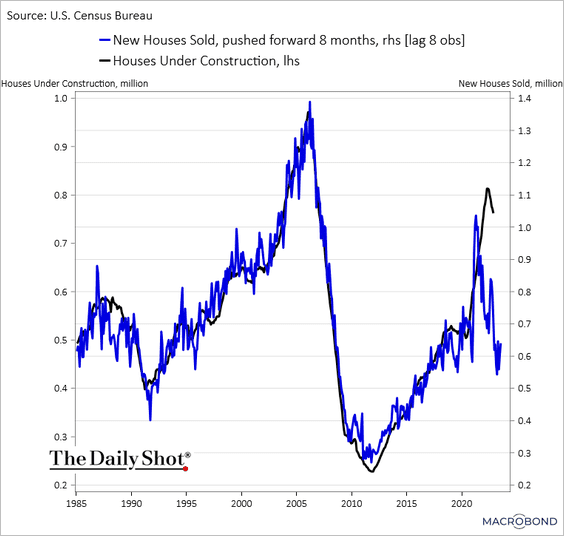

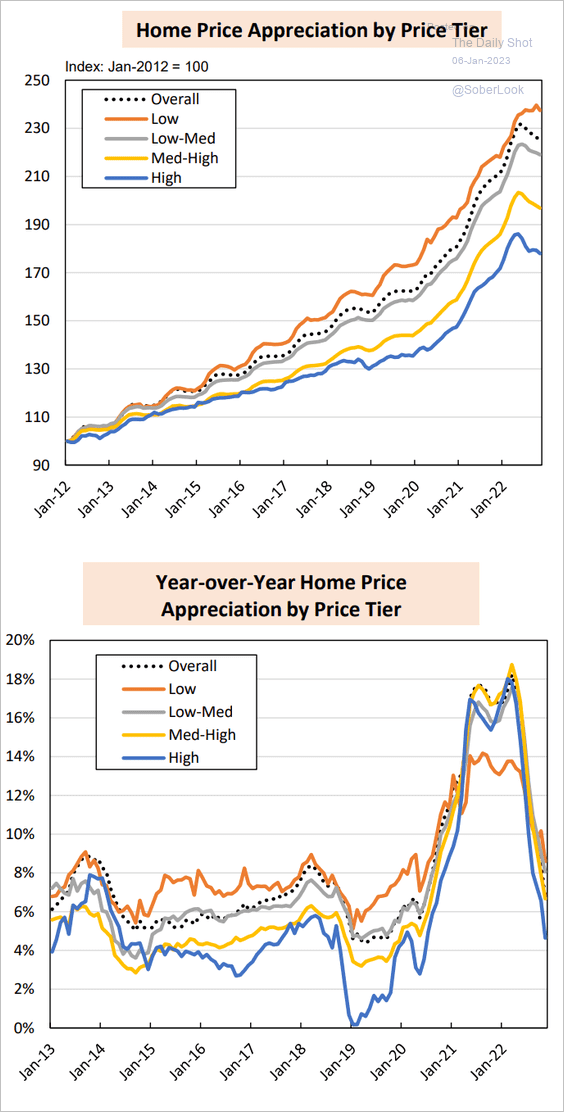

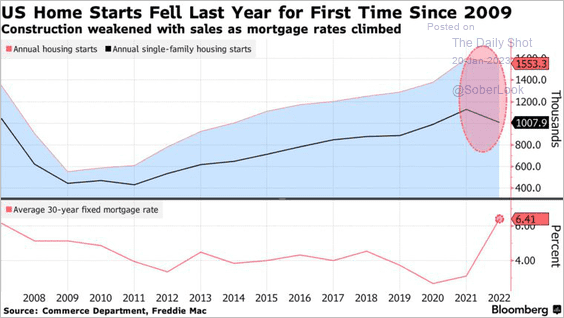

Housing starts registered their first annual decline since 2009.

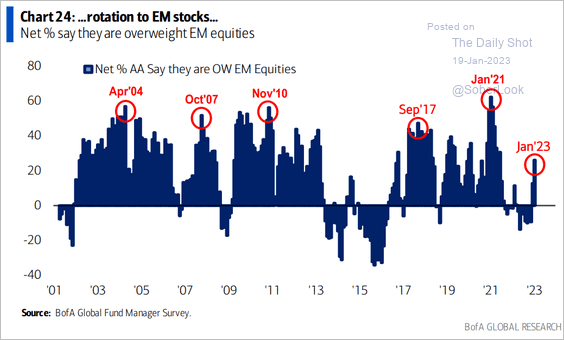

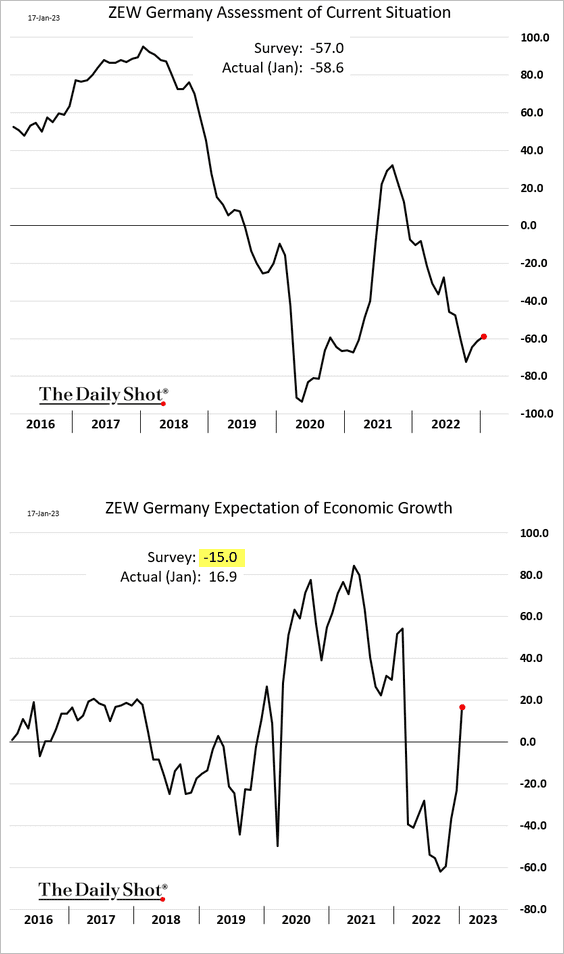

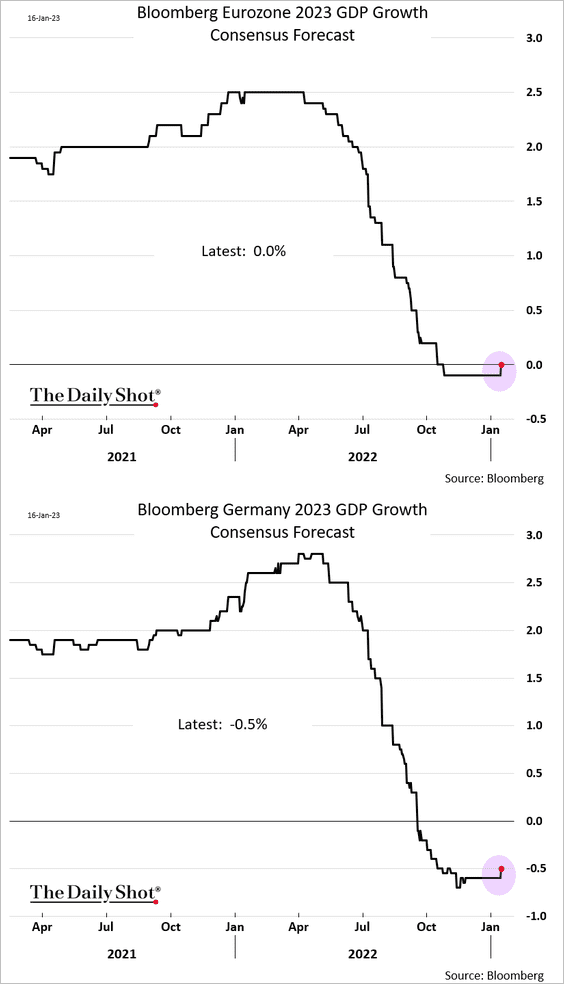

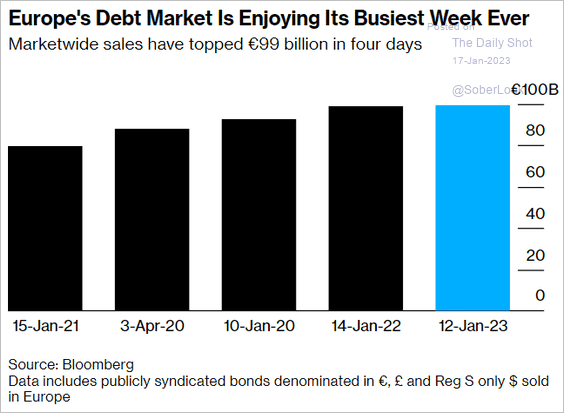

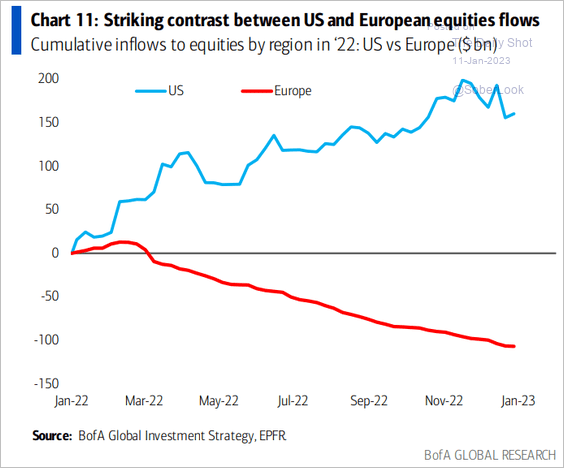

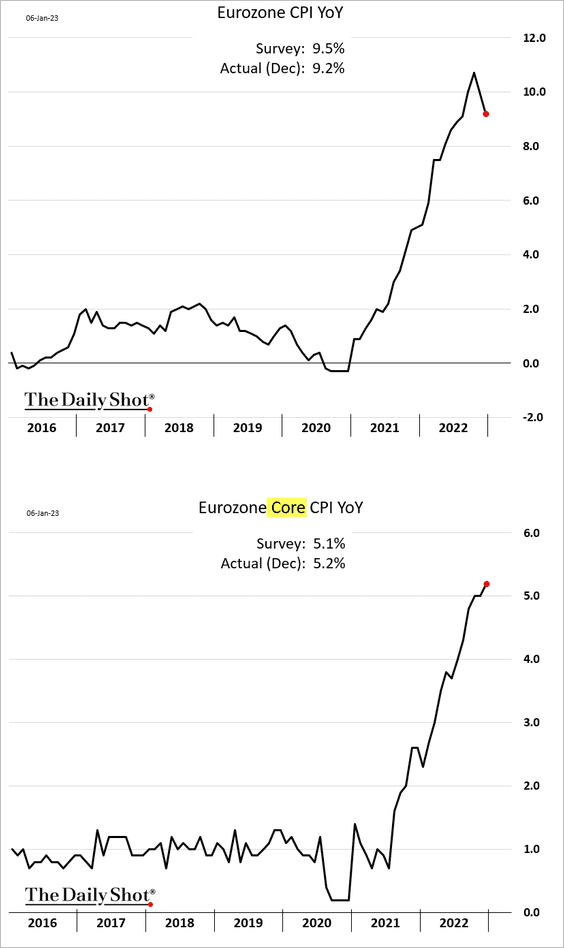

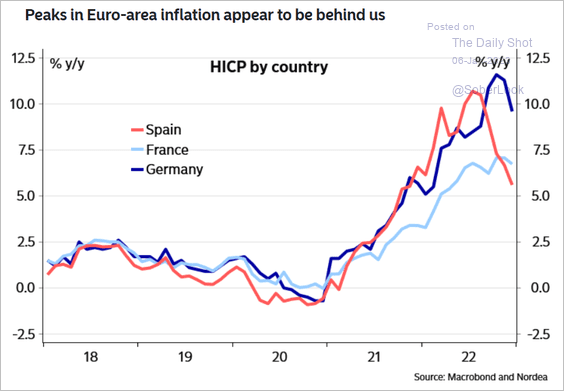

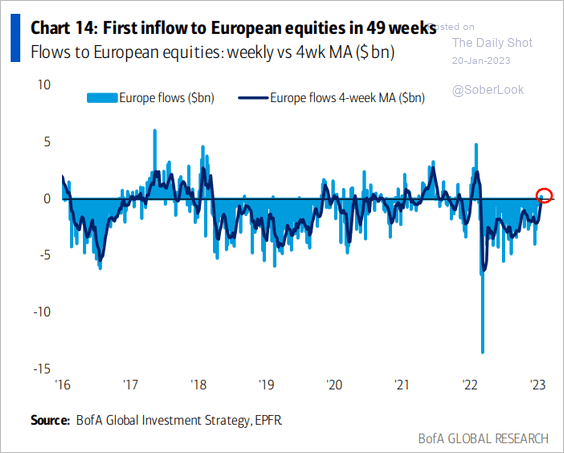

Europe: European stocks had a strong start to the year as fund flows turned positive.

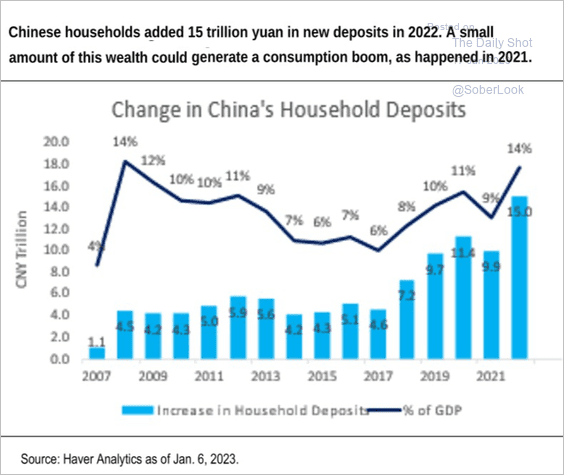

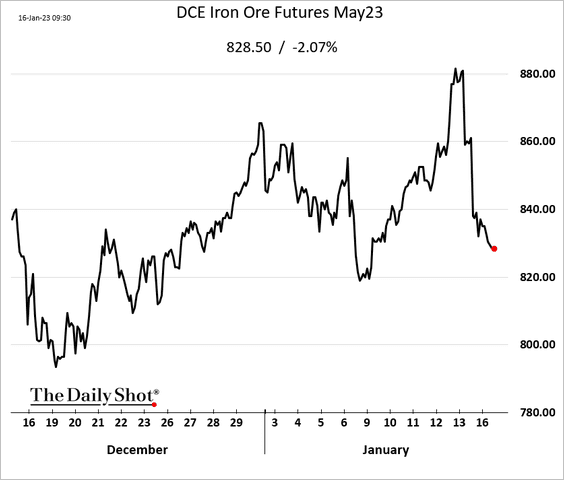

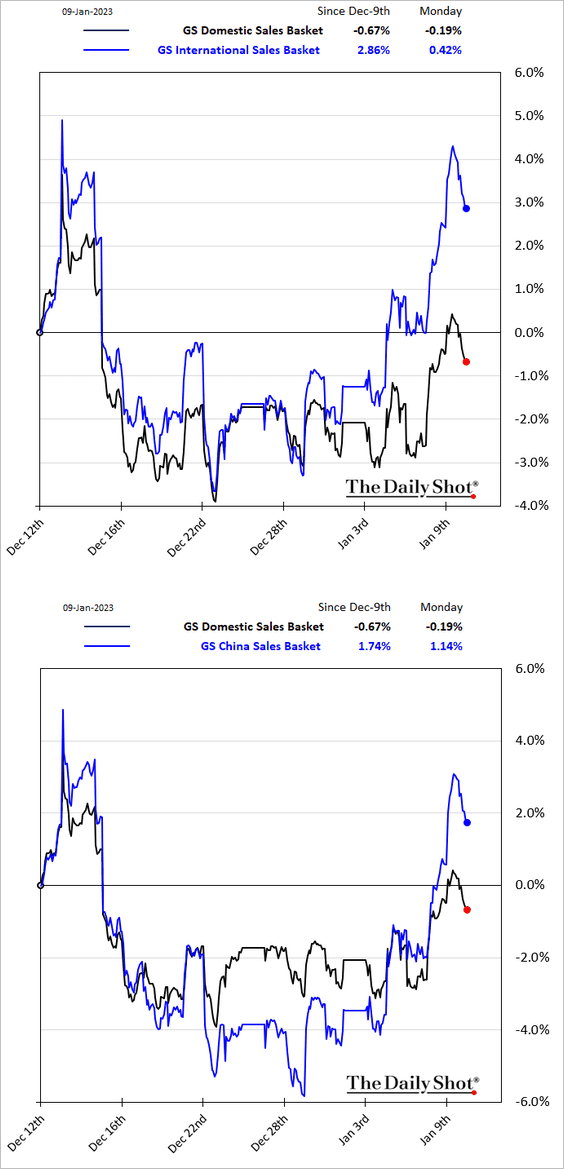

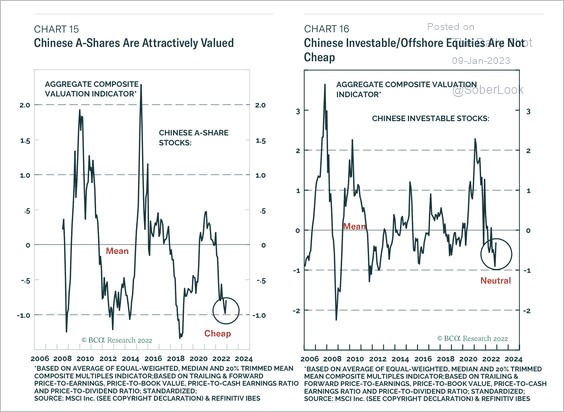

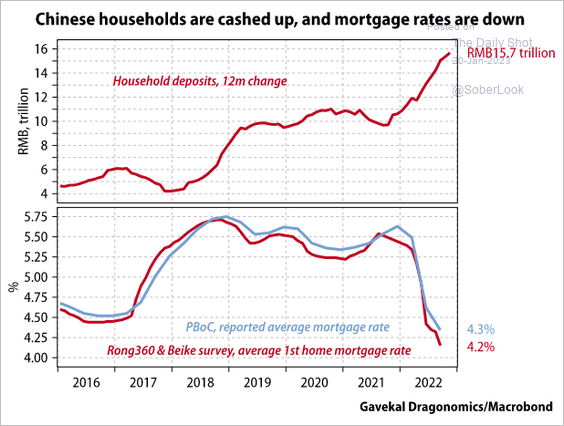

China: The housing market is primed for a bounce.

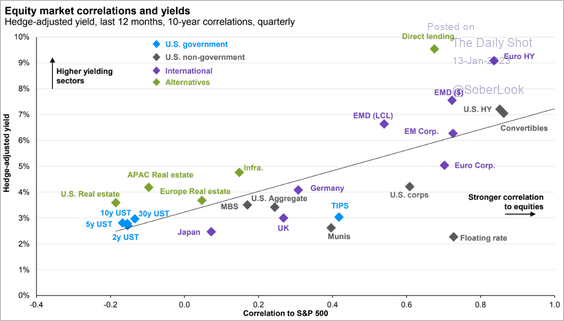

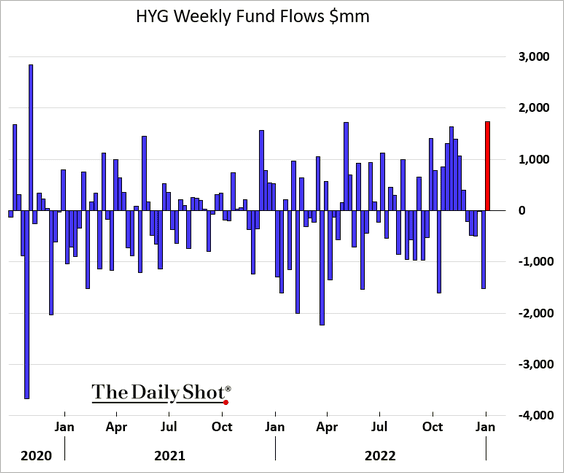

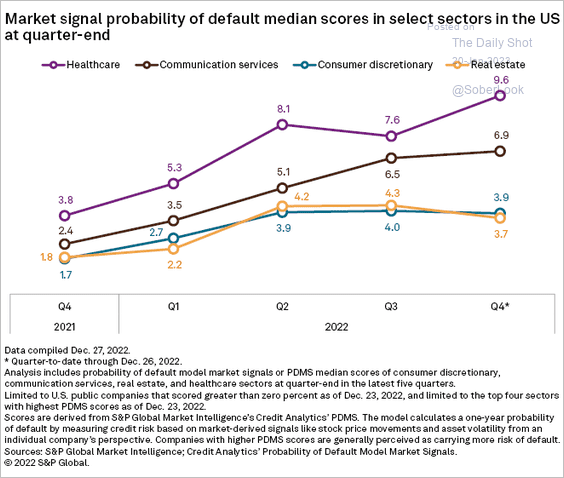

Credit: Default probabilities have been rising in some sectors.

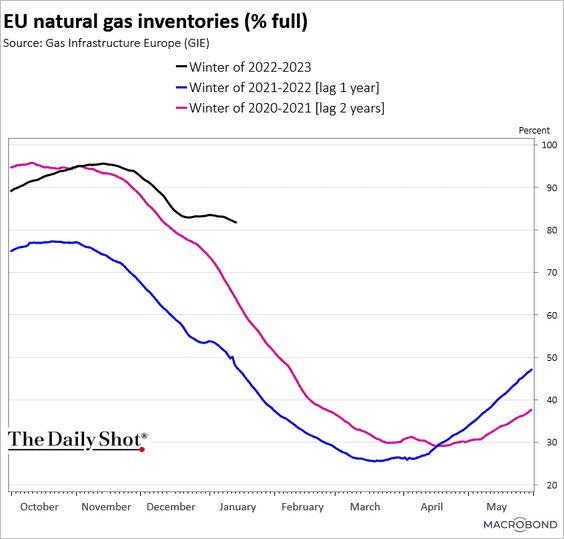

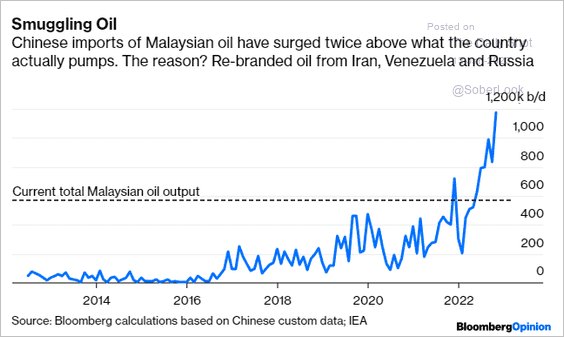

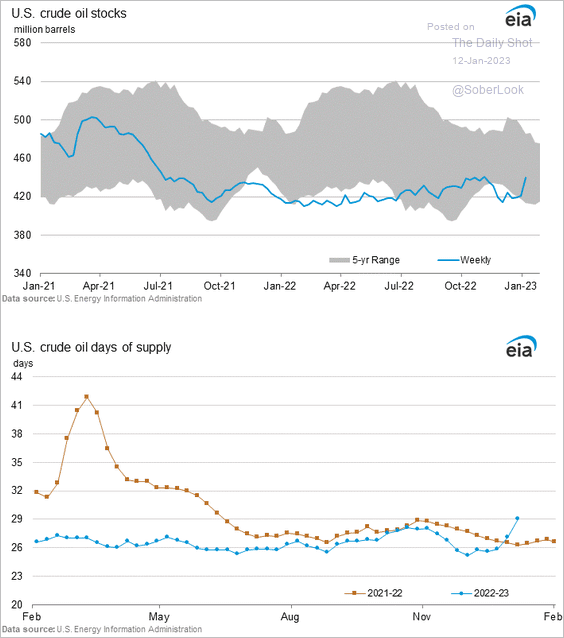

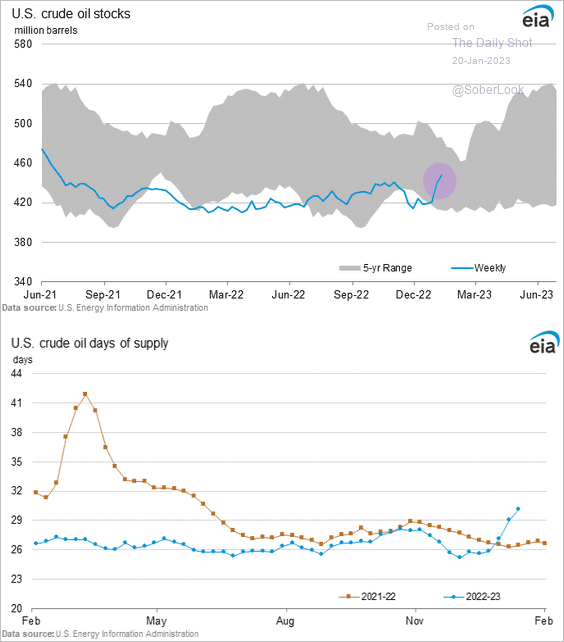

Energy: US oil stockpiles continue to rise.

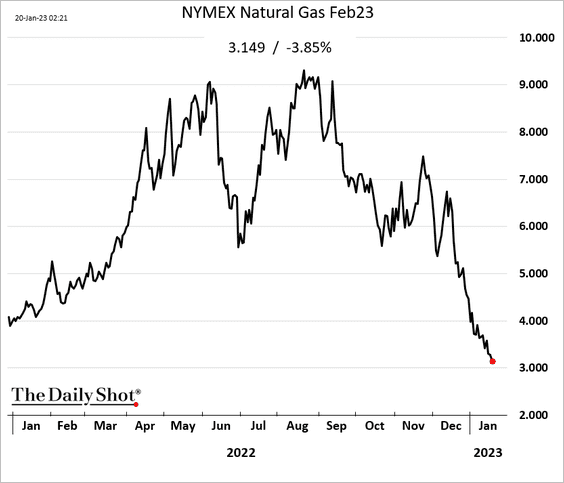

US natural gas is nearing $3/mmbtu.

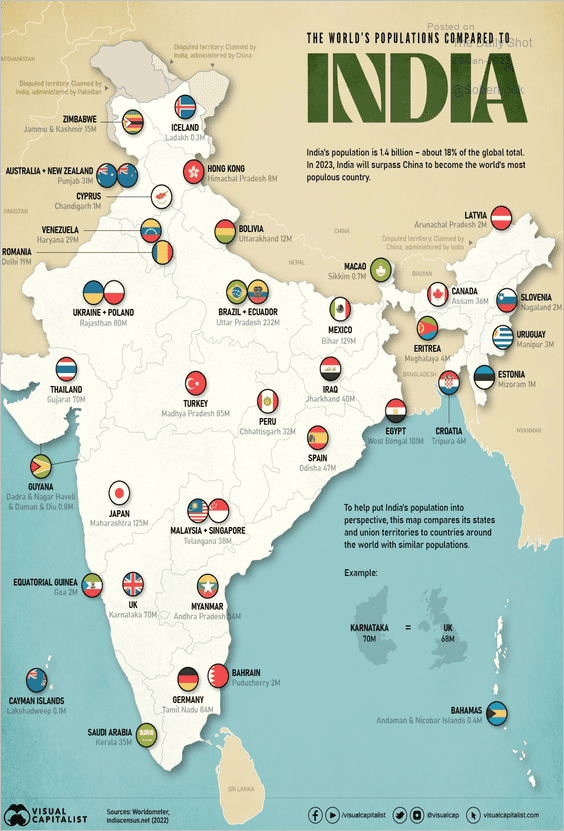

Food for Thought: To end the week, here is the population of India’s states compared with different countries:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com