Greetings,

Before we begin, we wanted to alert you to one of our favorite weekend reads: the Weekly S&P500 ChartStorm by Callum Thomas — it features 10 handpicked charts covering macro, technicals, valuations, and more — it’s a quick and effective way to stay on top of the market outlook.

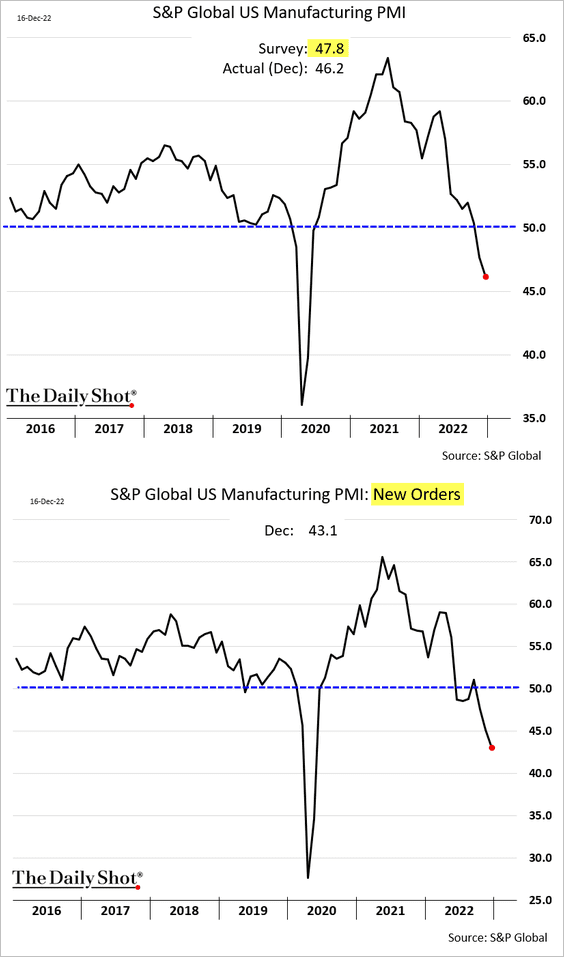

The United States: Manufacturing activity shifted deeper into contraction territory this month as demand plummets

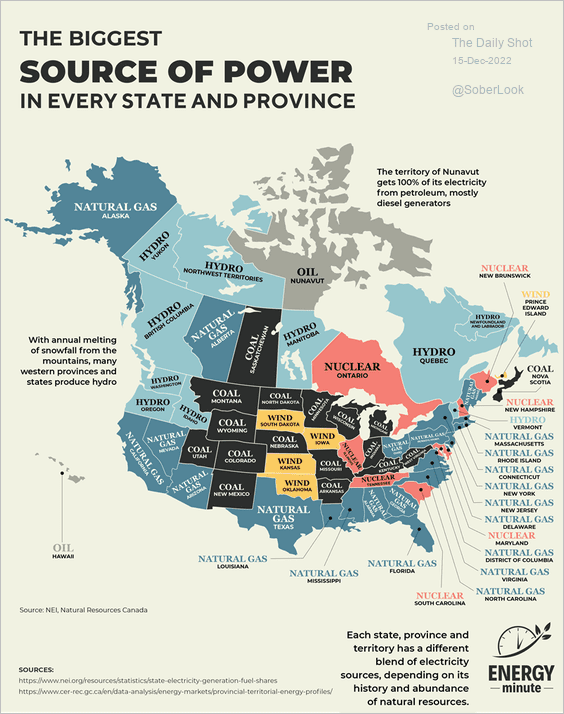

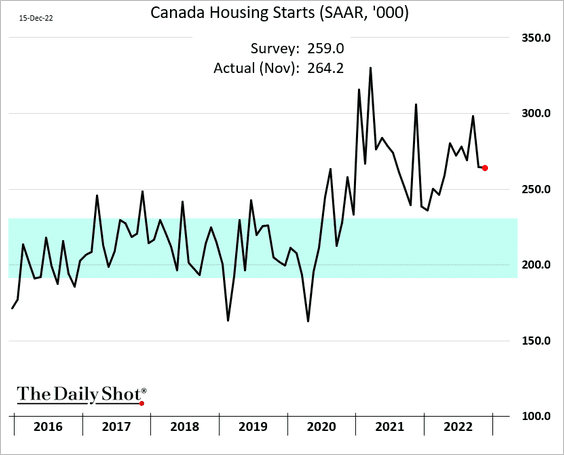

Canada: Housing starts remain well above pre-COVID levels.

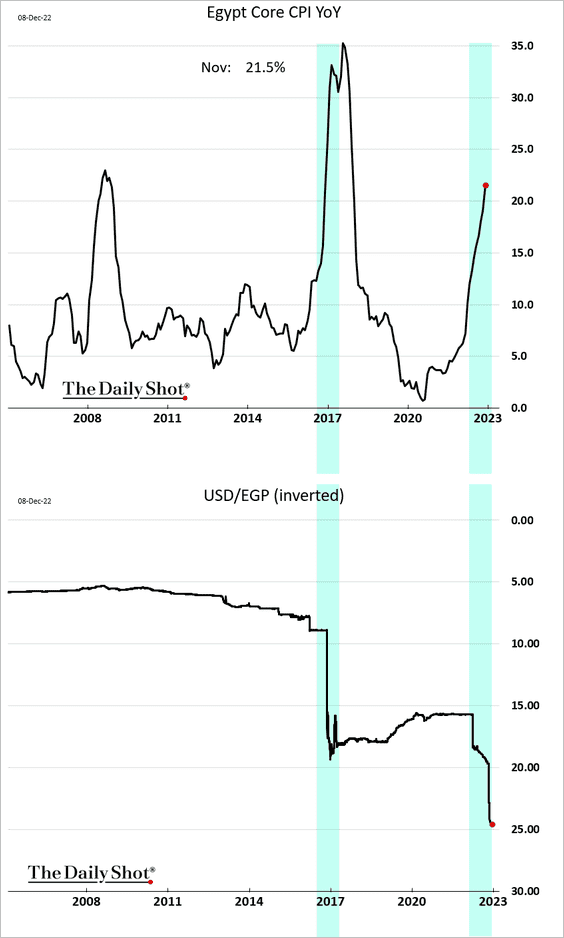

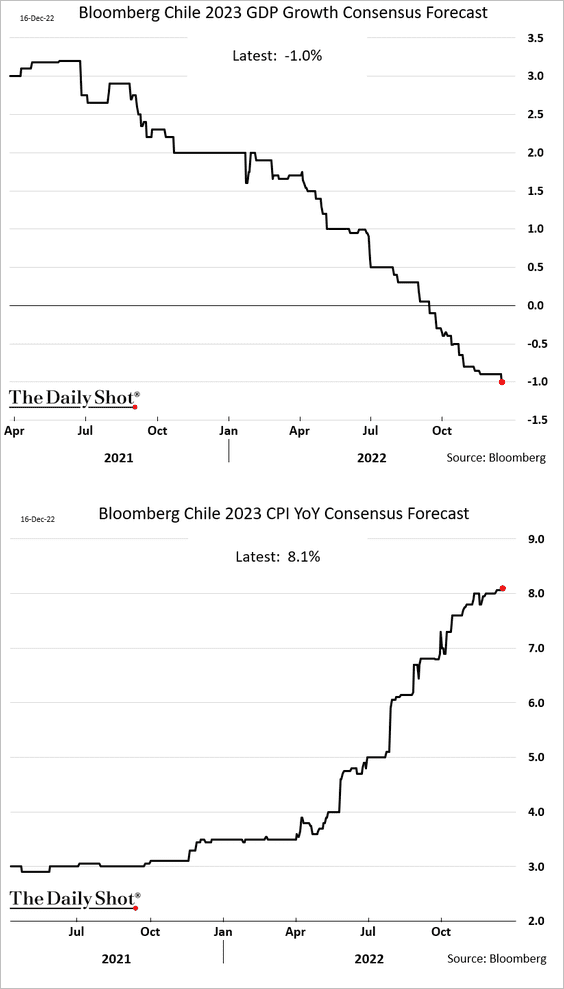

Emerging Markets: Economists see a painful onset of stagflation in Chile next year.

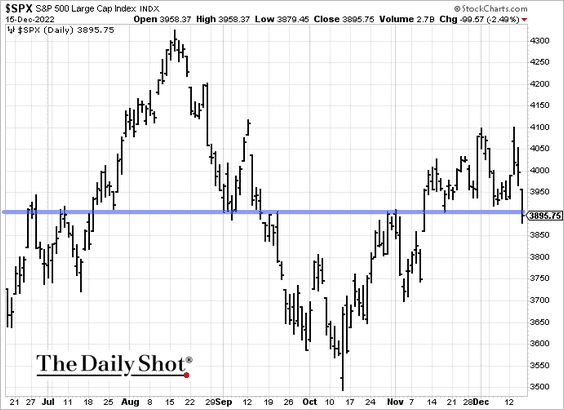

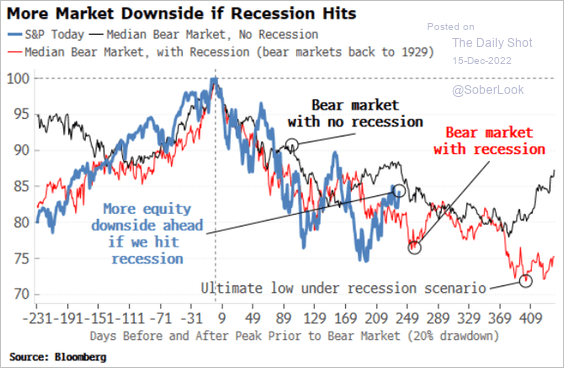

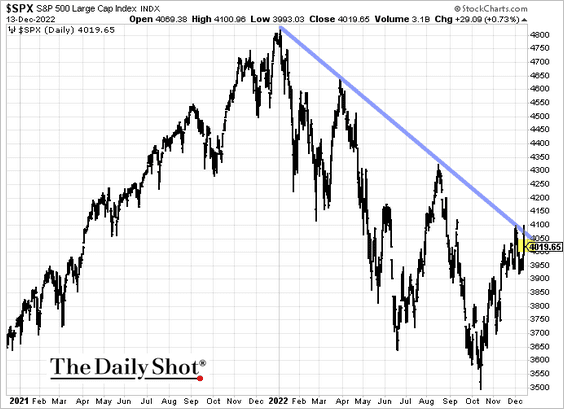

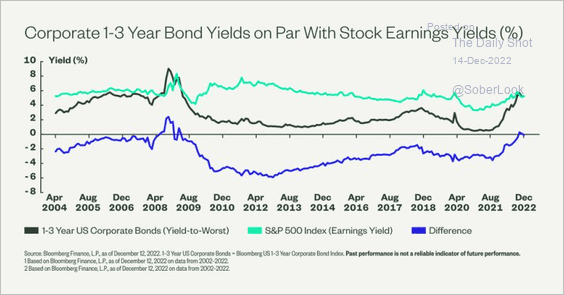

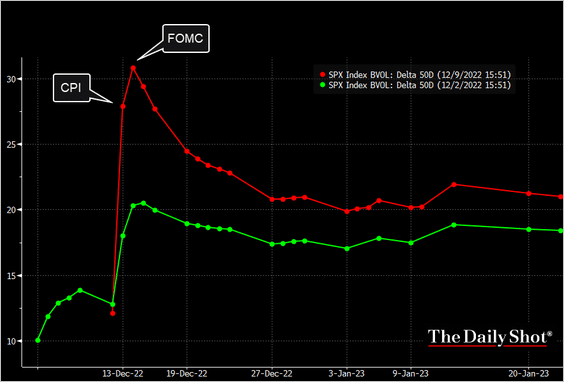

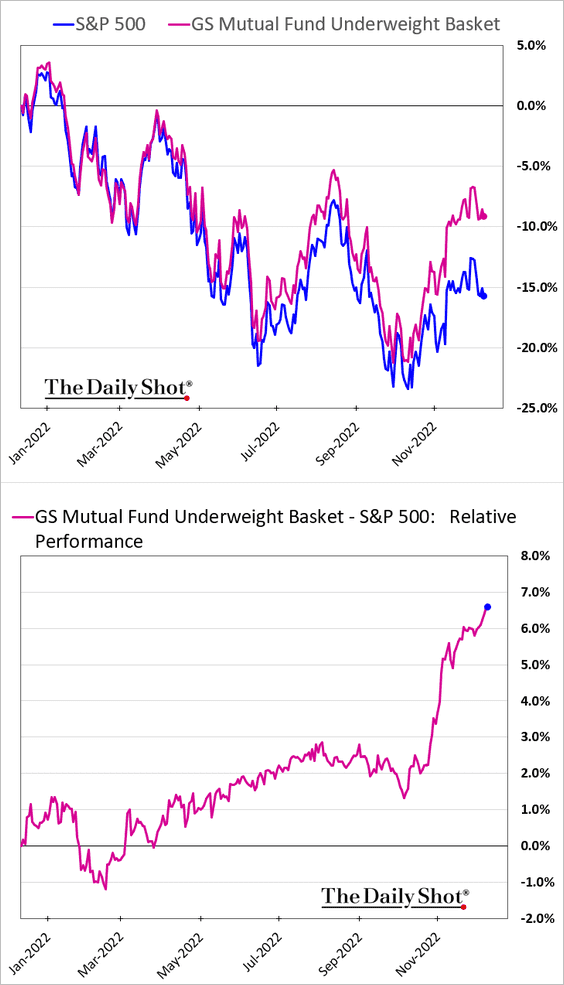

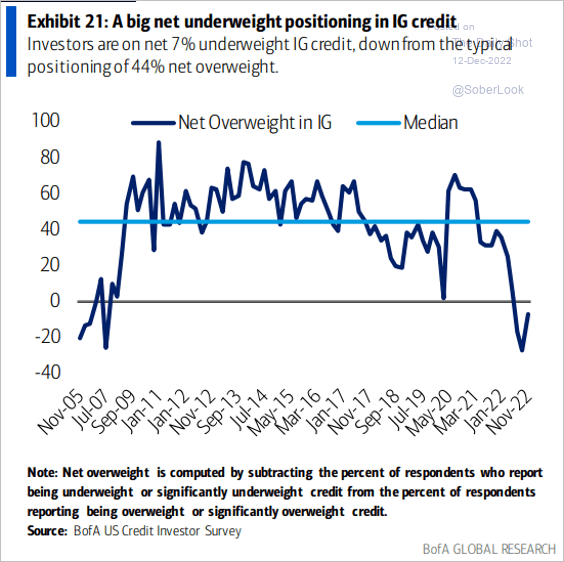

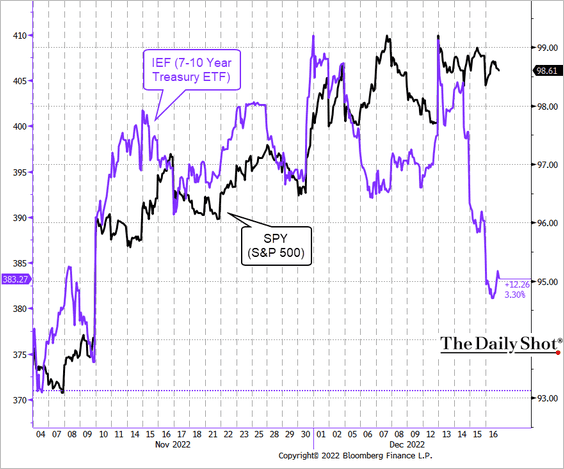

Equities: Stocks decoupled from bonds last week as recession worries grow.

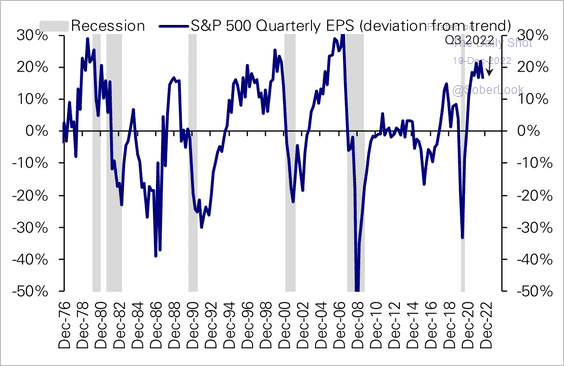

S&P 500 earnings are nearly 20% above their long-term trend.

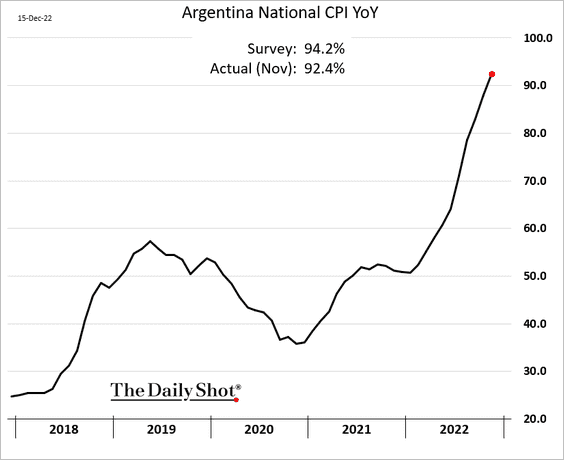

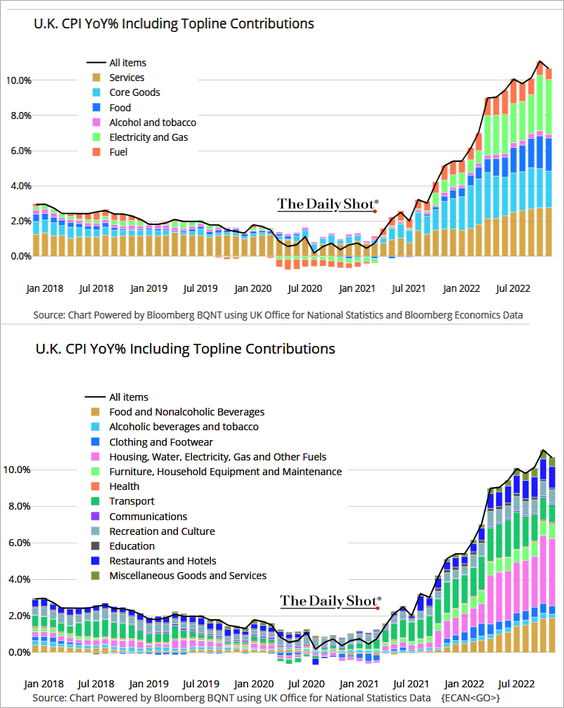

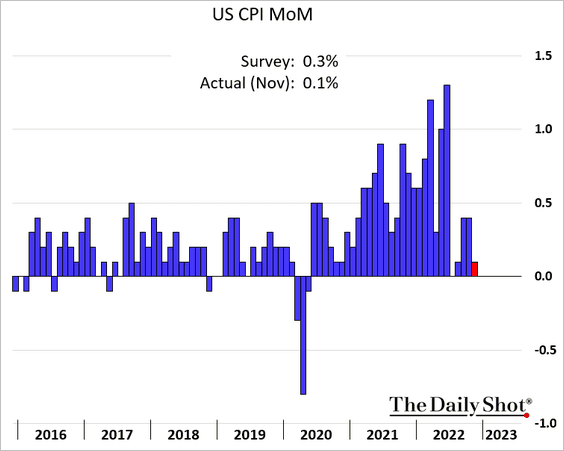

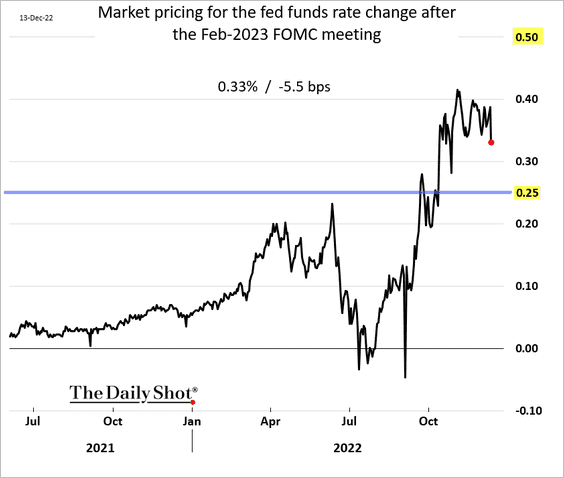

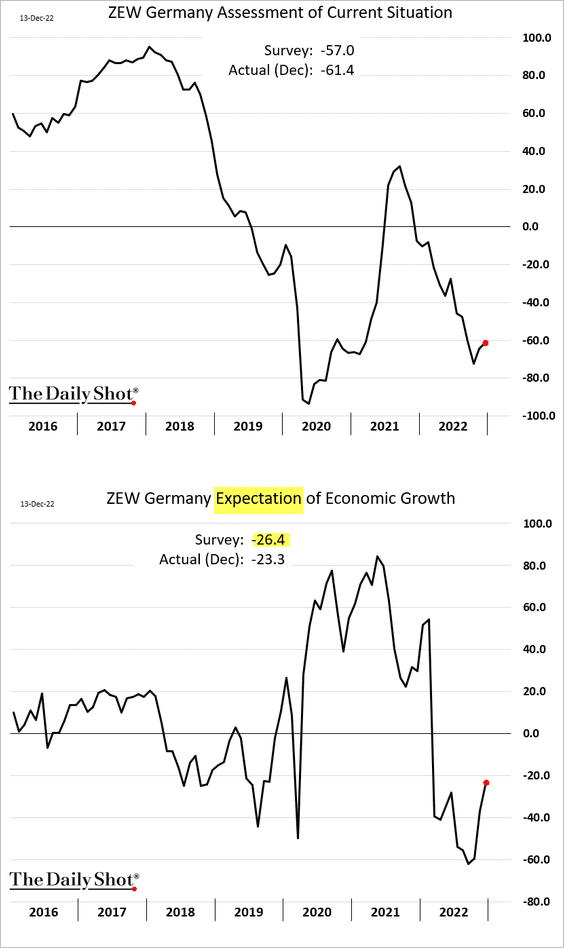

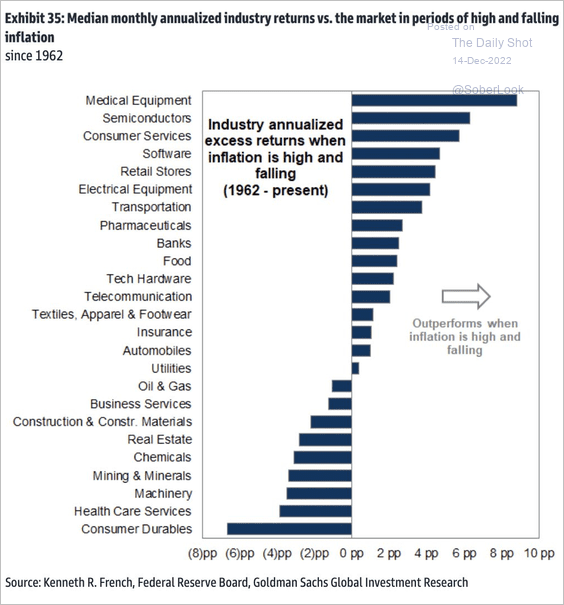

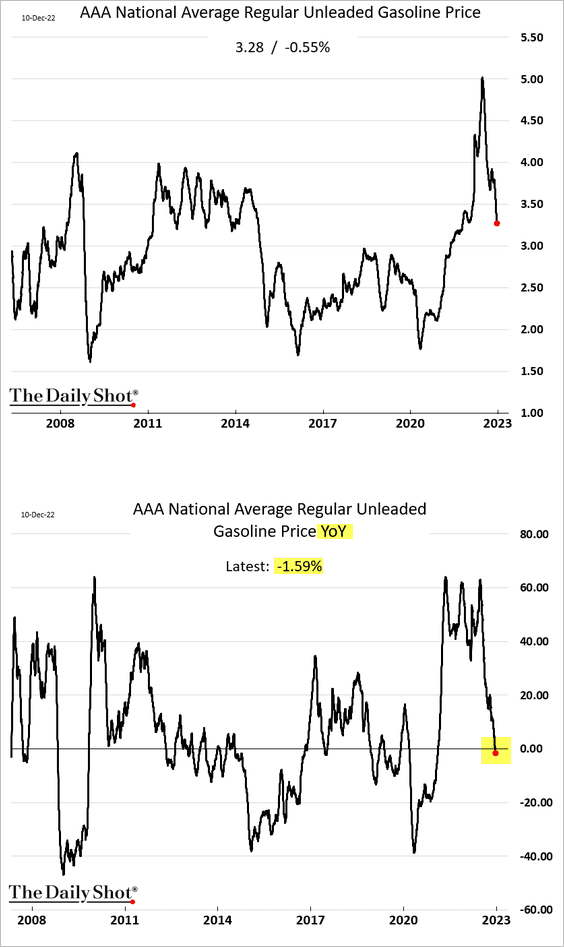

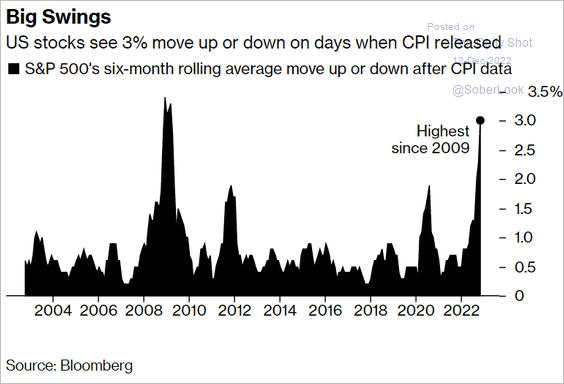

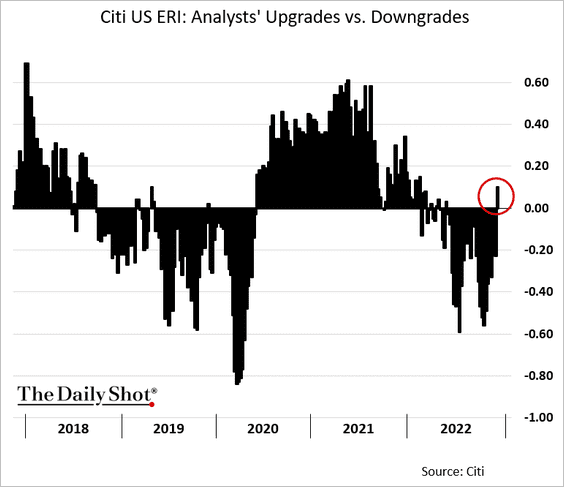

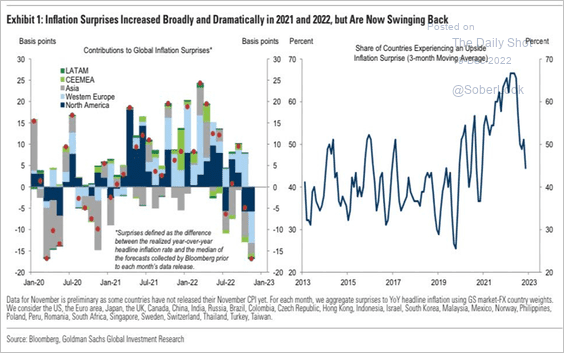

Global Developments: Inflation reports have been surprising to the downside.

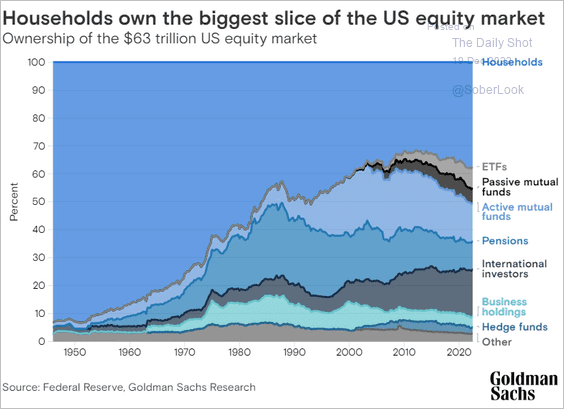

Food for Thought: Lastly, let’s take a look at who owns the US stock market.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com