Greetings,

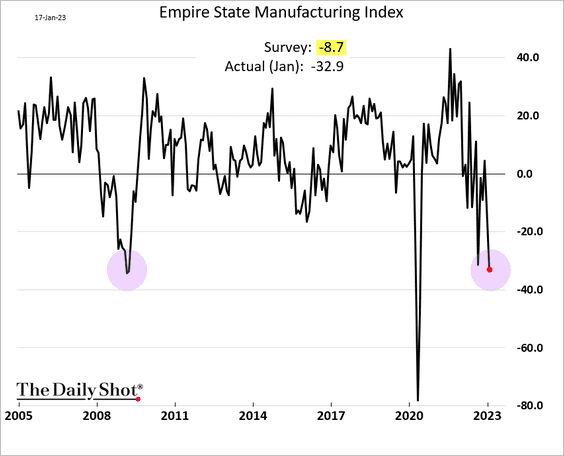

The United States: The first manufacturing report of the month was a disaster. The NY Fed’s regional factory activity index dipped to the 2008 lows.

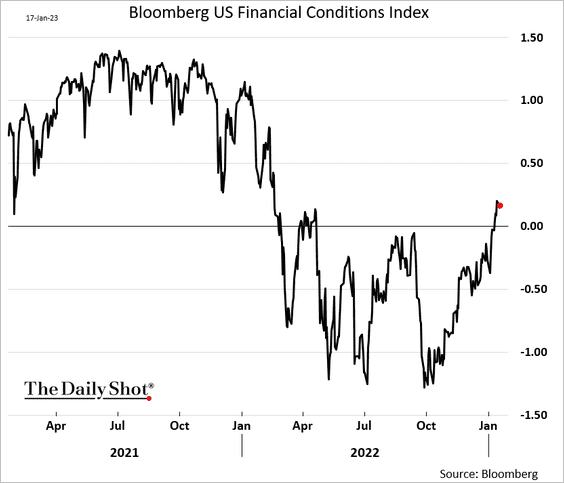

Financial conditions continue to ease, frustrating Fed officials. This index is a Z-score tracking the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit.

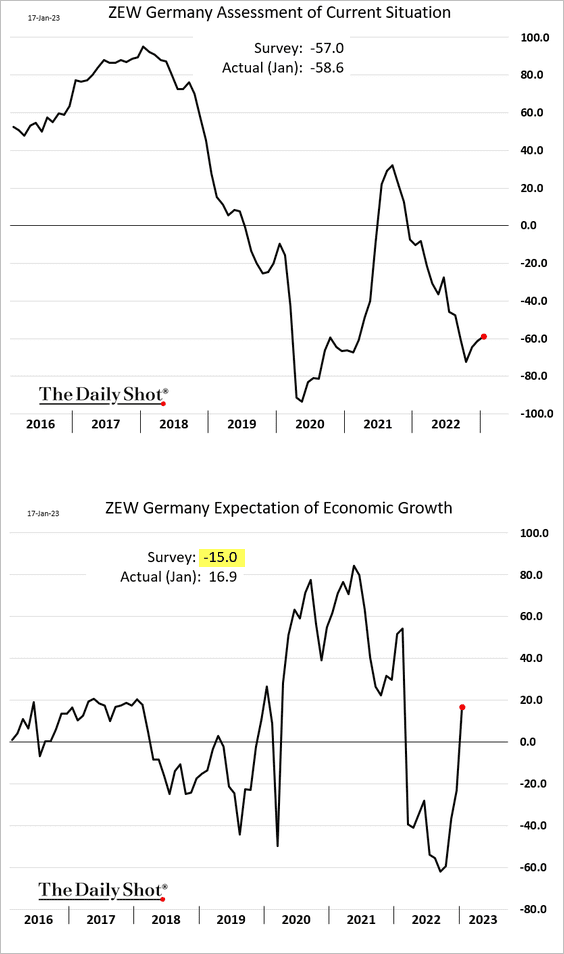

The Eurozone: Germany’s economic sentiment is rebounding rapidly.

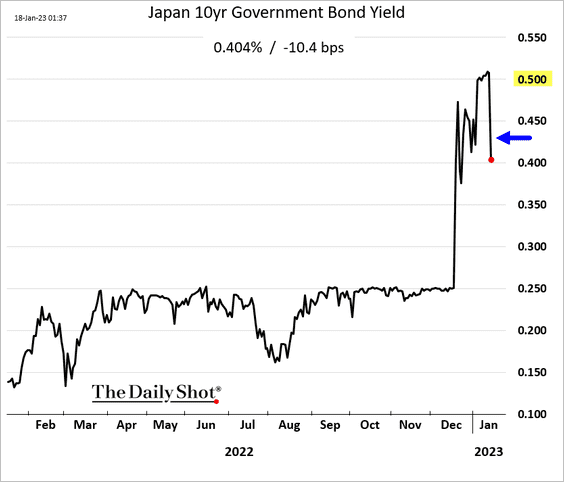

Japan: The BoJ is not budging on yield control. Here is the market reaction.

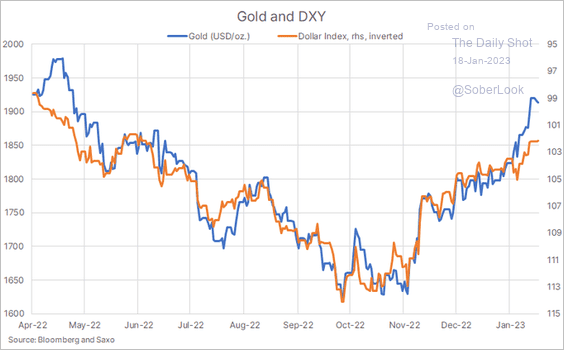

Commodities: The rally in gold has been too fast relative to the dollar’s decline.

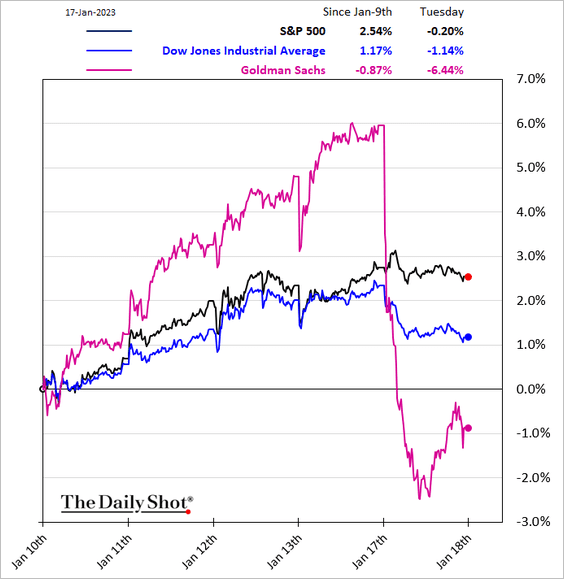

Equities: Financials dragged the Dow lower on Tuesday.

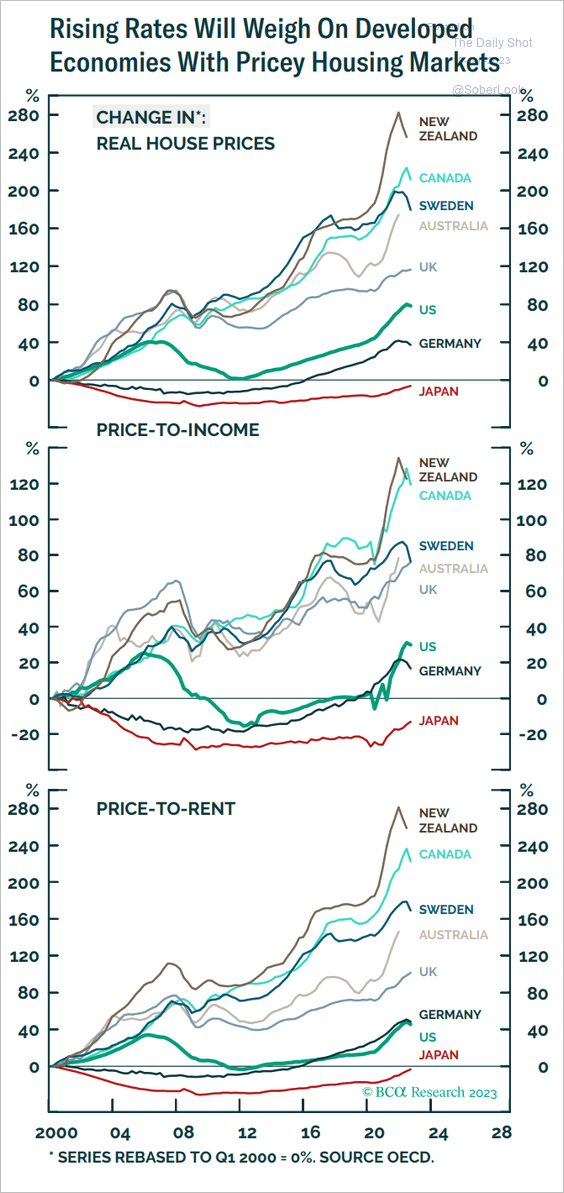

Global Developments: We have some home price indices and valuations.

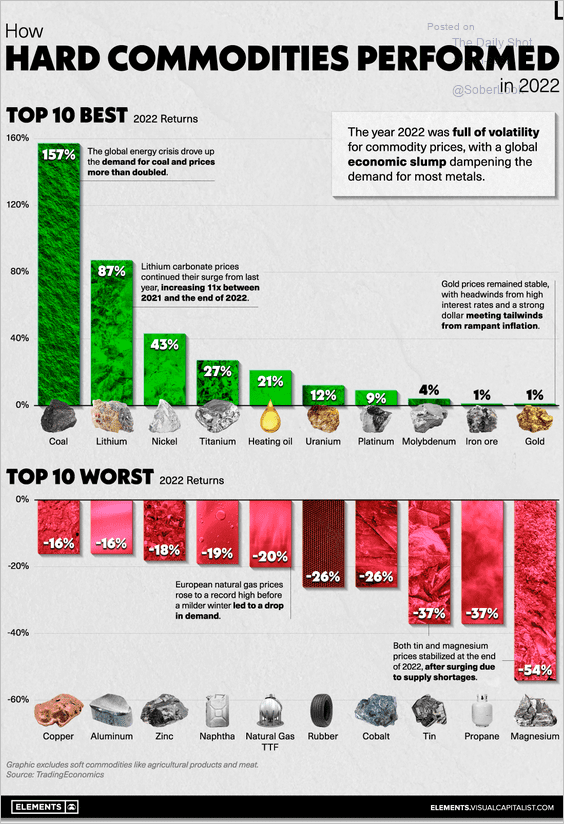

Food for Thought: Lastly, here’s a look at the best and worst-performing hard commodities in 2022.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com