Greetings,

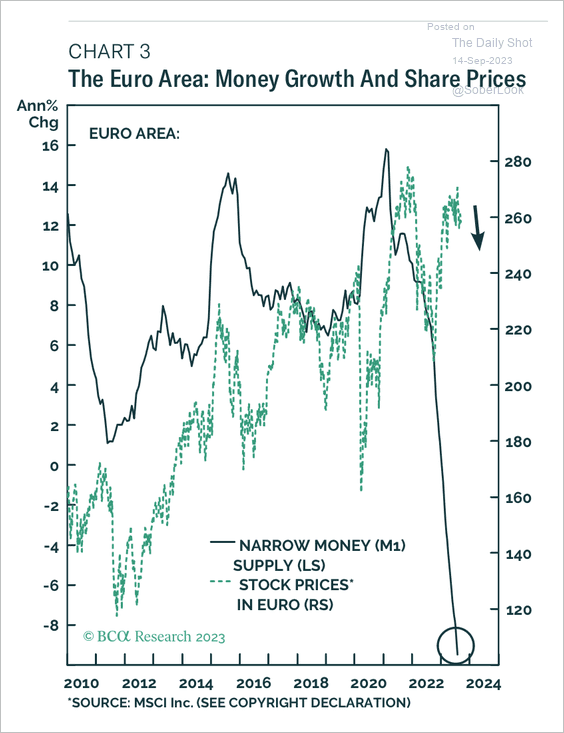

The Eurozone: Money supply continues to contract, driven by weak bank credit and a shift to long-term liabilities. What does that mean for euro-area stocks?

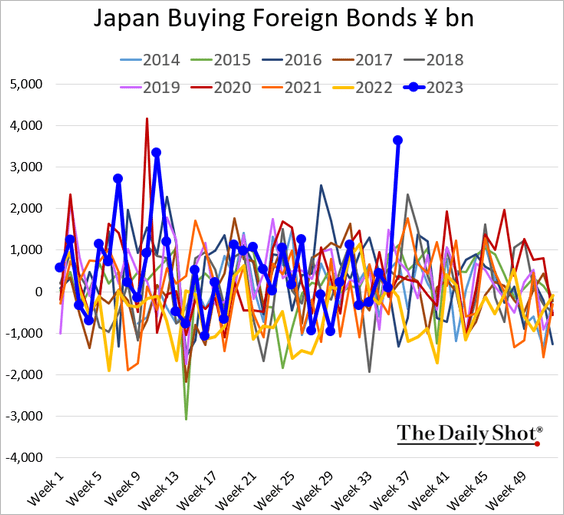

Japan: Japanese investors bought a lot of foreign bonds last week.

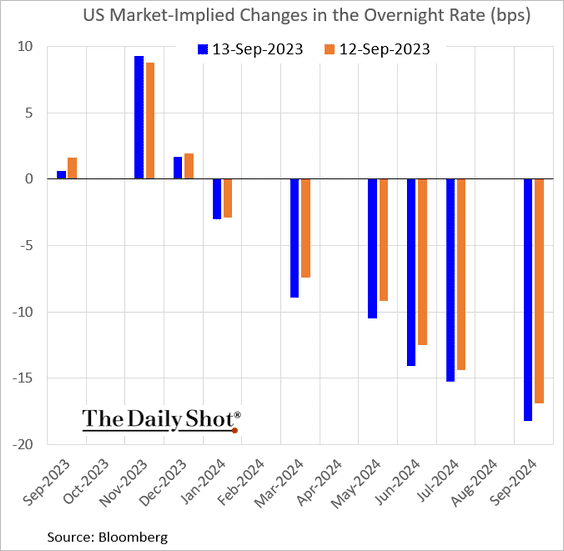

The United States: Even with the core CPI coming in above expectations, the market’s response to the inflation report remained subdued. The Fed is expected to keep the target rate unchanged this month, with about a 40% chance of a hike in November.

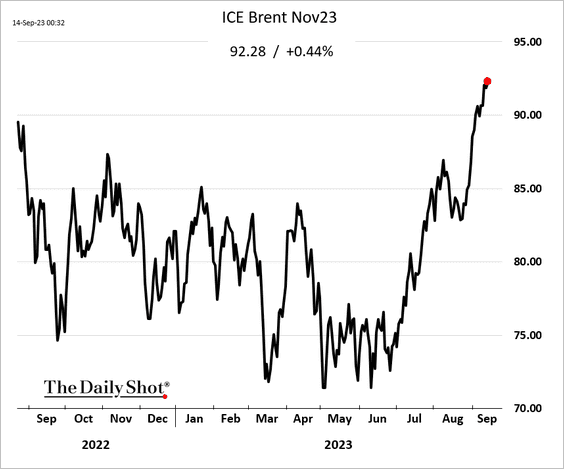

Energy: Crude oil prices continue to surge on expectations of tight supplies.

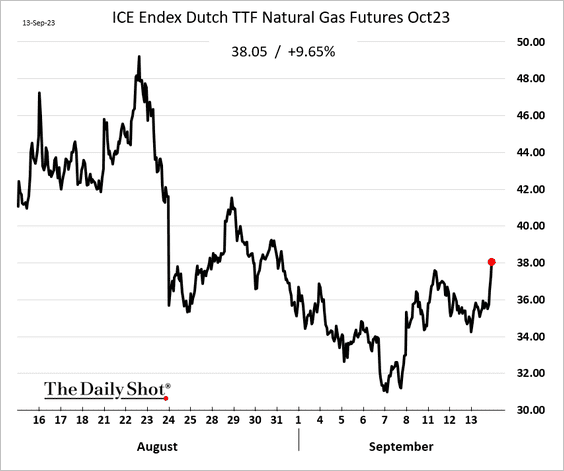

European natural gas prices rose 10% on Wednesday.

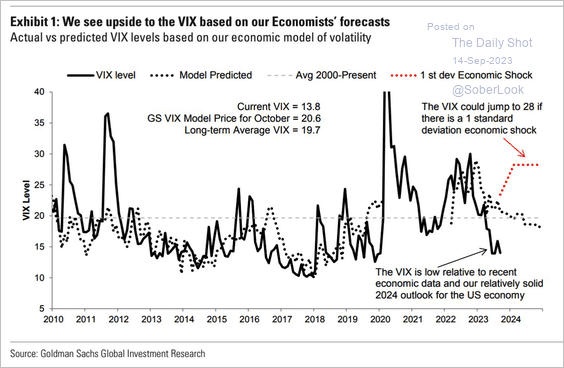

Equities: Will we see a jump in VIX as the economy slows?

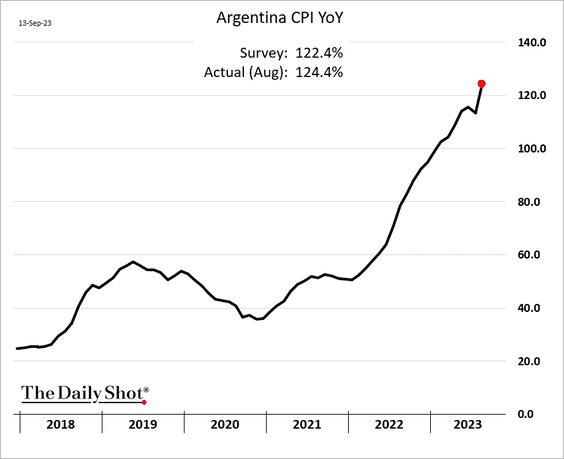

Emerging Markets: Argentina’s central bank held rates steady despite hyperinflation.

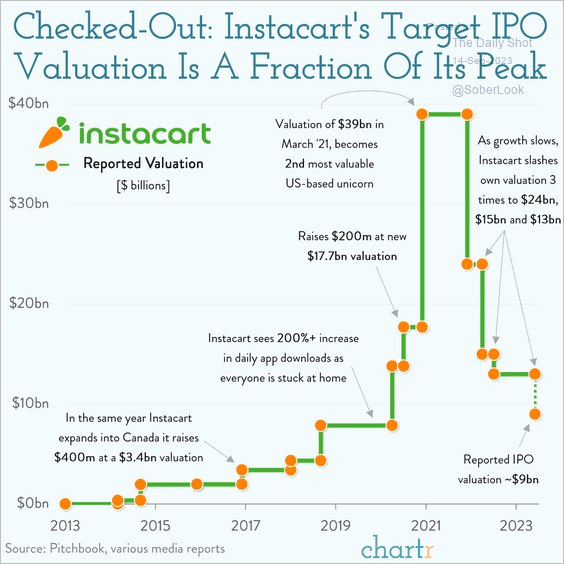

Food for Thought: Instacart’s IPO pricing is well below peak valuations.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief