Greetings,

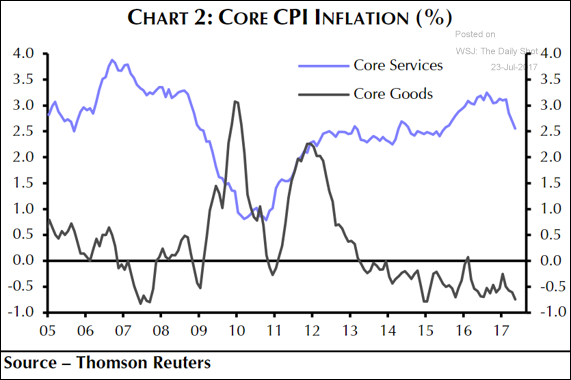

The United States: Below is the breakdown of the core CPI between goods and services. A weak US dollar is likely to ease the persistent goods deflation.

Global Developments: Below is a comparison of leading indicators for the largest economies.

Credit: This map shows the Moody’s general obligation (municipal debt) rating for each state.

Equity Markets: The S&P 500 index is increasingly dominated by tech shares.

Energy Markets: US coal exports are picking up again.

Emerging Markets: Improved growth and falling inflation (on average) across emerging markets continue to attract capital.

The Eurozone: Hedge funds don’t think the euro is overvalued and continue to increase their bets that the currency will climb further.

Japan: Fund managers have turned bullish on Japan’s stock market.

Food for Thought: US news coverage of disasters.

So how many deaths does it take to get the media’s attention?

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com