Greetings,

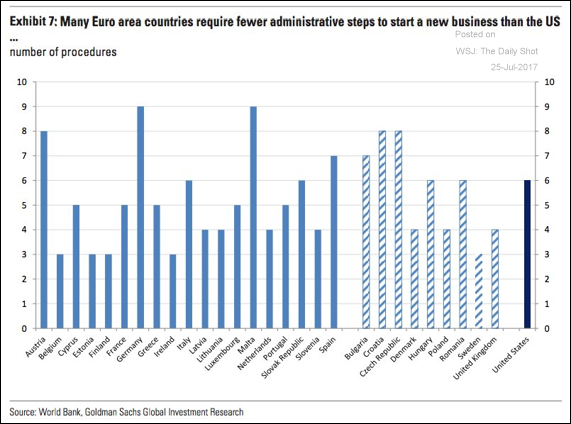

The United States: It takes more steps to start a business in the US than in many European countries.

However, it takes less time than in some other nations.

The United Kingdom: Despite the lowest unemployment rate in decades, British households are becoming more stressed financially. Declining real wages are the likely culprit.

Credit: ETFs are holding a growing share of investment-grade corporate bonds.

Equity Markets: US banks are planning to make generous payouts to the shareholders.

Emerging Markets: Venezuela

It now takes almost 9k bolivares to buy just one US dollar on the black market.

As international airlines exit the country, Venezuela is selling excess jet fuel to stay afloat.

The Eurozone: Rates of business creation vary significantly across the Eurozone.

Canada: Canada’s GDP volatility is one of the highest in the developed world.

Food for Thought: President Trump’s approval ratings by state.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com