Greetings,

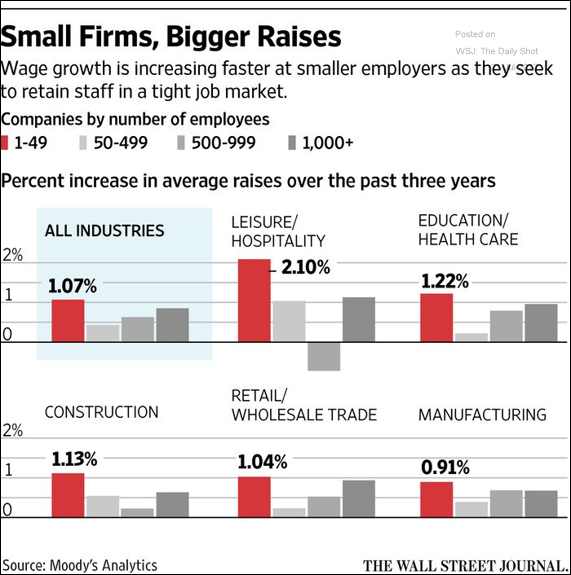

The United States: Wages are rising faster at smaller US firms.

Rates: The market-implied probability of a third Fed rate hike this year dipped below 40%.

Credit: The Moody’s stressed/distressed corporate credit universe has been gradually shrinking.

Equity Markets: Valuation models show diminishing equity risk premium (vs. bonds). Fed officials have expressed concerns about this trend.

Energy Markets: The chart below shows the “fiscal breakeven” for major oil exporters. Below these oil price levels, the governments of these countries run a deficit. This breakeven point has been moving lower for many exporters as their governments do some belt tightening.

Emerging Markets: Venezuela’s FX reserves continue to dwindle.

More investors are preparing for debt restructuring as time is running out.

The Eurozone: The economies of smaller Eurozone nations have been outperforming.

Global Developments: Finally, here is the Moody’s financial stress scenario for all the major banking systems around the world.

Food for Thought: Some college majors have high employment rates but meager wages.

Have a great weekend!

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com