Greetings,

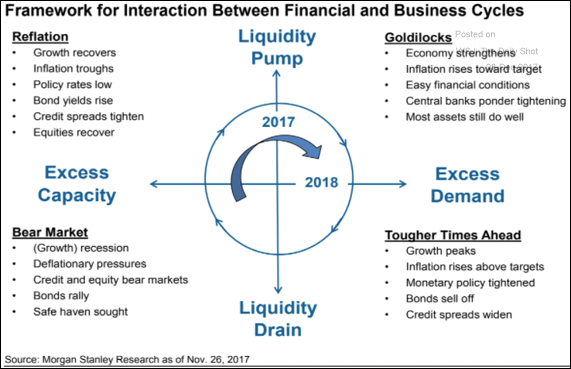

The United States: Where are we currently in terms of the financial and business cycles?

Rates: Will the 10yr Treasury yield resistance line hold next year?

The Eurozone: Analysts remain convinced that based on the real rate differentials, the euro is significantly overvalued.

Equity Markets: Flows into US large cap ETFs have been impressive.

Emerging Markets: Are EM currencies out of line with the fundamentals?

Credit: Leveraged firms have been dragging down the telecom equity sector. They are also weighing on the high-yield bond index.

Energy Markets: Houston is becoming a major hub for oil storage, competing with Cushing, OK. Is it time for Houston-settled crude oil futures?

Bitcoin: Bitcoin blasts past $15k, $16k, $17k in less than 24 hours.

Food for Thought: Bars vs. grocery stores.

Have a great weekend!

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com