Greetings,

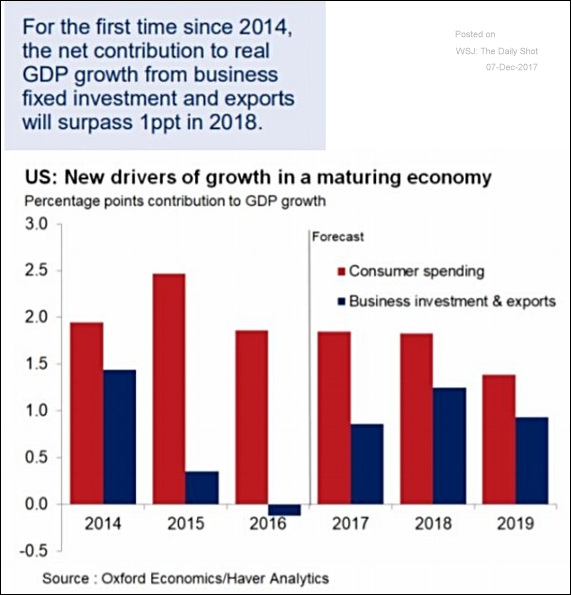

The United States: This forecast shows business investment and net exports contributing more to the GDP over the next couple of years.

China: Tighter liquidity conditions will be a headwind for the property markets and the economy as a whole.

The Eurozone: It’s surprising that there is so much anti-EU sentiment in the Czech Republic, Hungary, and Poland. These nations have prospered because of and are completely dependent on the European Single Market.

Equity Markets: Business activity (PMI) correlates quite well with global stock market returns.

Emerging Markets: Qatar’s banks are trying to reduce dependence on external funding, which remains relatively high.

Credit: This chart shows the trend in Islamic bond issuance.

Energy Markets: Here is a map of crude oil exporters in 2016. It will look different this year.

Global Developments: The combined balance sheet of the four major central banks will begin to shrink in mid-2019, according to this forecast.

Food for Thought: Private colleges increasingly discount tuition to attract students. We should see consolidation and even defaults in the years to come (especially with small colleges).

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com