Greetings,

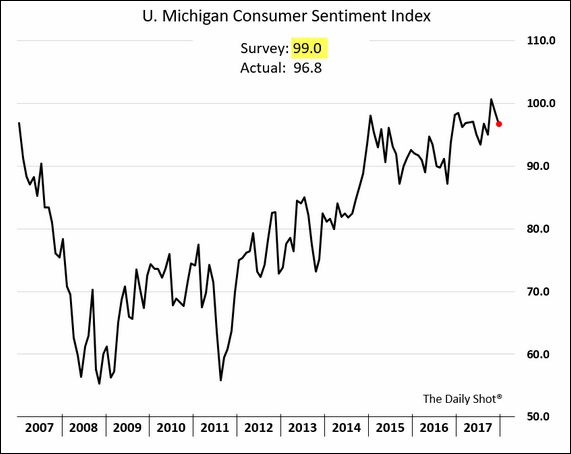

The United States: The University of Michigan consumer sentiment was below consensus but remains elevated.

Americans are extremely positive about their current situation but are less enthusiastic about the future. This chart shows the spread between the U. Michigan indices of current conditions and economic expectations.

Rates: This chart shows that the recent yield increases were primarily driven by real rates, while inflation expectations remain anchored.

The Eurozone: Hedge funds are maintaining substantial net-long euro positions which makes the currency vulnerable to a downside correction.

Canada: Non-oil trade deficit remains elevated.

Emerging Markets: Merrill Lynch forecasts Brazil’s GDP growth to hit 3% next year.

Japan: Merrill Lynch expects Japan’s economic growth to slow significantly in a couple of years.

Energy Markets: Hedge funds’ net-long position in NYMEX crude oil remains at record highs.

Bitcoin: Bitcoin’s capitalization remains relatively small when compared to other major markets.

Food for Thought: Islamic State’s revenues.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com