Greetings,

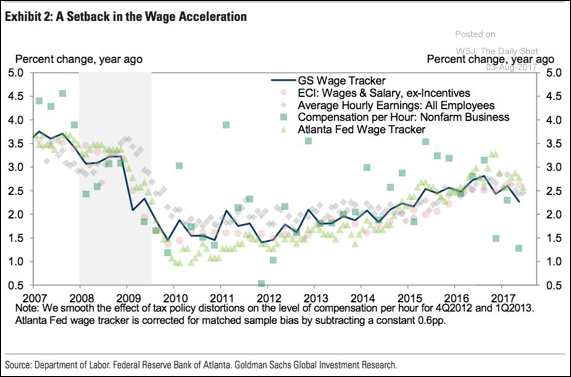

The United States: The Goldman Sachs wage tracker, which takes into account various earnings indicators, shows a meaningful slowdown as well.

While younger workers saw their annual pay increases improve (on average), wages for those who are 55 and older are growing at the slowest pace in recent decades (light blue line).

China: China’s local government debt issuance seems to be slowing (LGFV stands for local-government financing vehicles).

Equity Markets: This chart shows where we are relative to the historical seasonal pattern of the Dow Jones Industrials (which hit 22k on Wednesday – a new record).

Emerging Markets:The Kazakh tenge is tanking despite firmer oil prices. As usual, the authorities are blaming speculators. Some suggest that the ex-Soviet republic’s currency is simply following the ruble lower. However, the ruble’s selloff (second chart below) hasn’t been as severe.

The Eurozone: There is still quite a bit of labor slack in the Eurozone.

Macron, for example, has his work cut out for him as the number of jobseekers in France remains elevated.

Energy Market: Oil’s share of total global energy demand has been shrinking.

Global Developments: Does the dollar have more room to decline? According to the data below (from the IMF), the US currency is still quite overvalued.

Food for Thought: The WSJ’s Greg Ip argues that people shouldn’t fear artificial intelligence. When spreadsheets showed up, bookkeeping jobs contracted dramatically, but employment in accounting and financial analysis took off. Will the same happen with AI?

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com