Greetings,

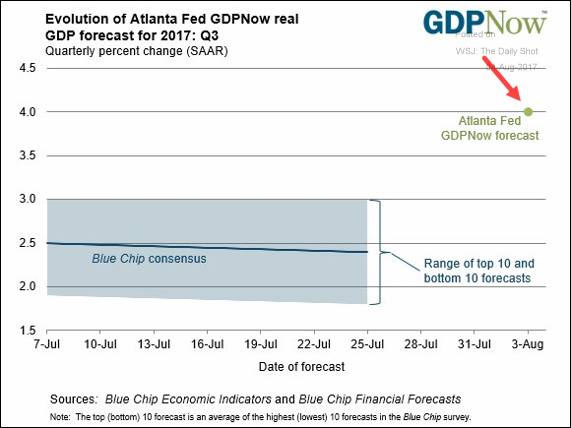

The United States: The first estimate of the Atlanta Fed GDPNow forecast for the third quarter GDP is a whopping 4%.

However, this estimate is likely to drift lower. Despite a strong labor market, US households are saving less than previously thought. The chart below shows the declining savings rate. The latest BEA adjustment (discussed here) tells a much weaker consumer story than economists had believed.

Credit: This year we’ve seen a big wave of CLO refinancings (lowering senior debt spreads).

Equity Markets: Lately, many companies have seen their shares drop immediately after reporting earnings.

Emerging Markets: Investment flows into emerging markets remain robust.

The Eurozone: Retail sales across the Eurozone are on the rise.

Global Developments: The dollar (in blue below) has diverged from the 2-year rate differentials with other countries.

Food for Thought: The opioid epidemic by state.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com