Greetings,

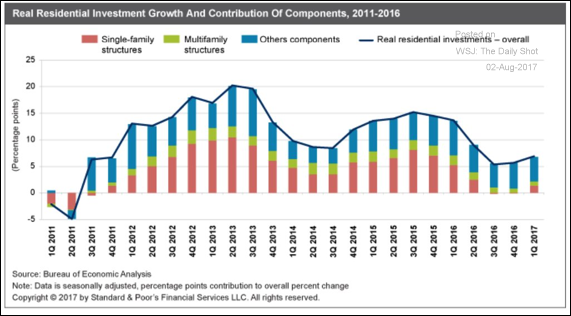

The United States: This chart shows quarterly residential investment growth.

It’s important to note that residential investment impacts far more than just construction jobs.

China: The Markit PMI report shows solid manufacturing sector growth in China.

Equity Markets: The President’s tweets about the stock market have increased in frequency.

Emerging Markets: Brazil’s manufacturing sector stalls again.

The Eurozone: Both input and output price increases for euro area’s businesses have been slowing. A stronger euro has been one of the contributors to these declines.

Energy Market: Oil prices fell as a private inventory estimate (American Petroleum Institute) showed an increase in crude stockpiles. A decline was expected.

Canada: Canada’s factory activity has been quite robust.

Food for Thought: Compensation increases by industry in the US this year.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com