Greetings,

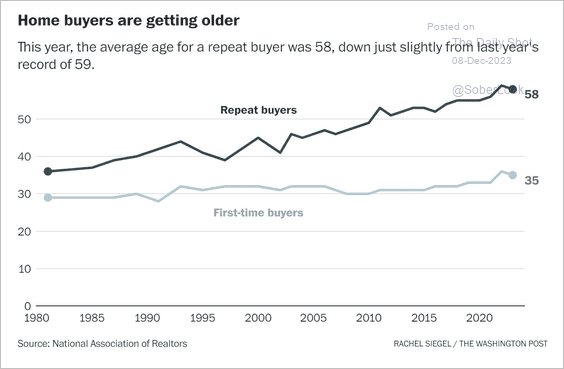

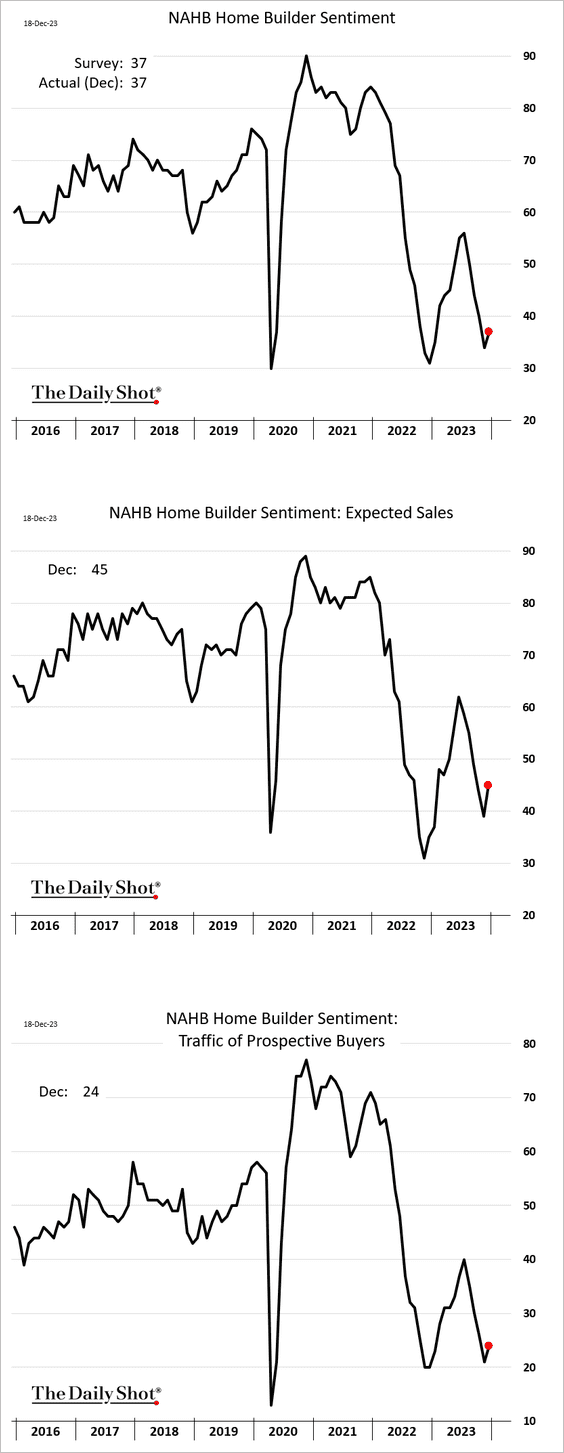

The United States: The NAHB homebuilder sentiment index showed a modest improvement this month, driven by a pullback in mortgage rates.

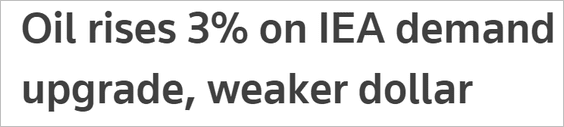

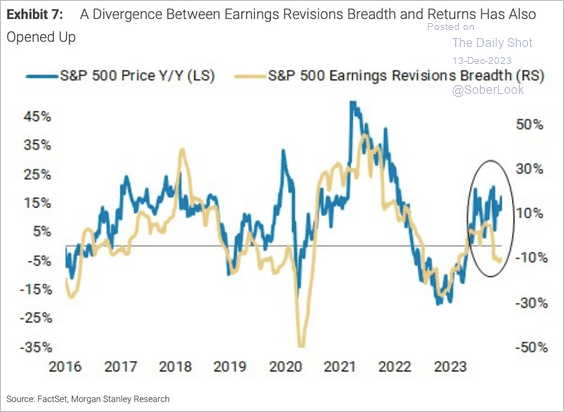

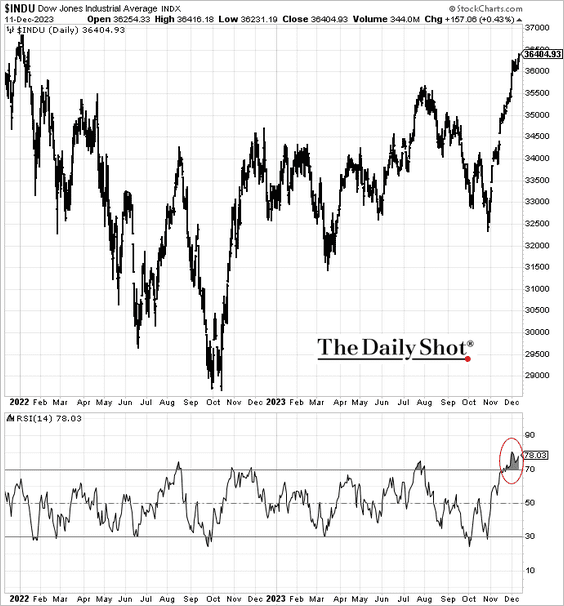

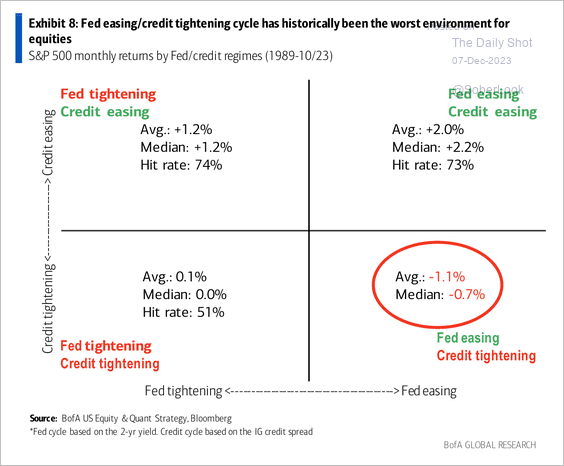

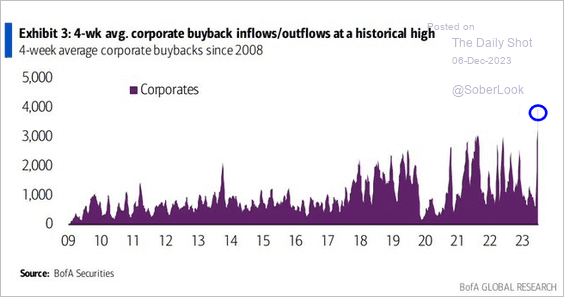

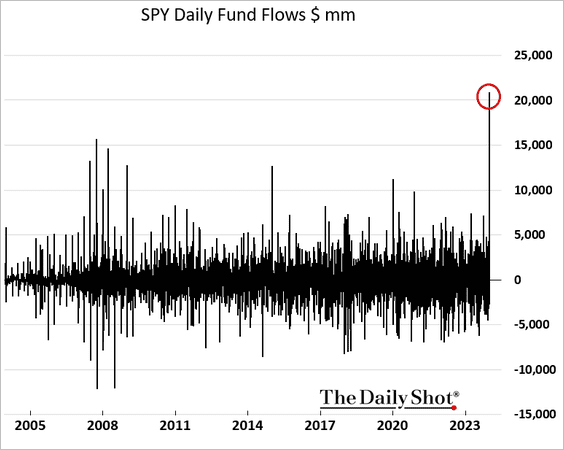

Equities: The SPDR S&P 500 ETF (SPY) saw a record spike in inflows last Friday (SPY is the largest ETF).

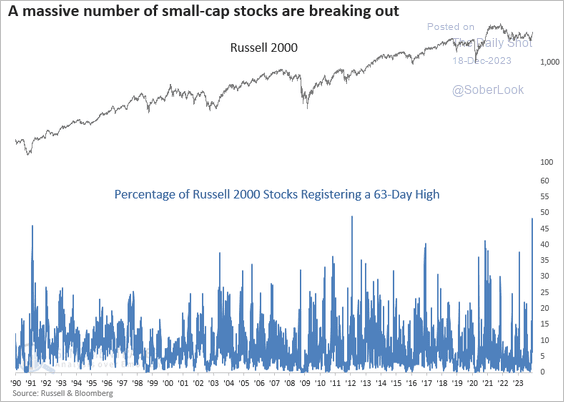

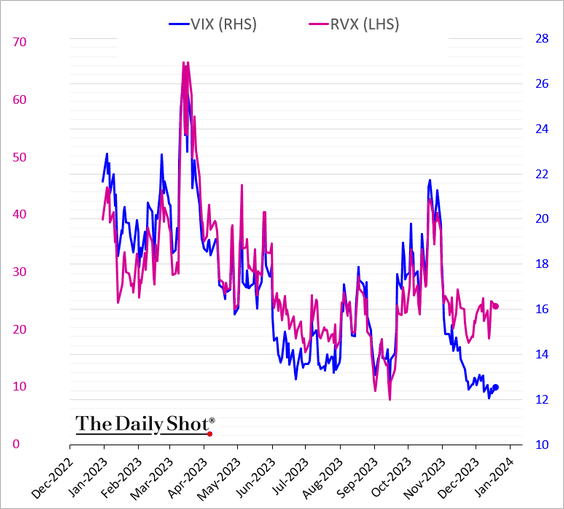

Demand for small-cap options created a sharp divergence between VIX and RVX (Russell 2000 VIX equivalent).

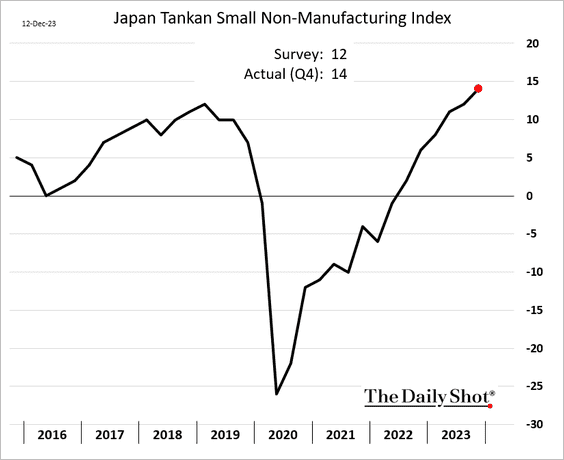

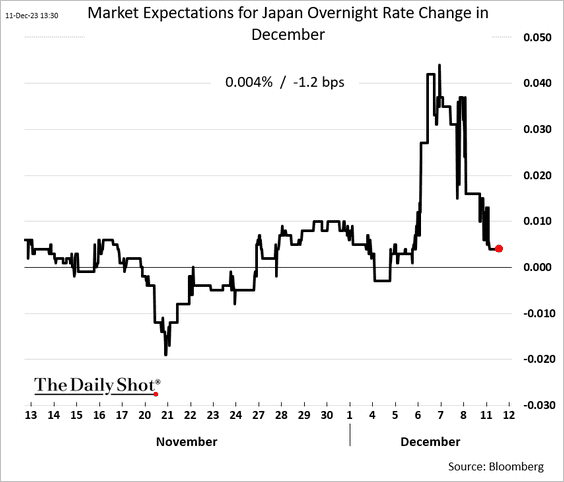

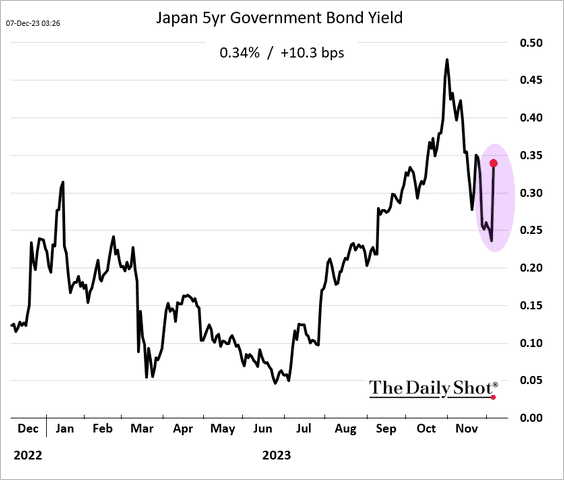

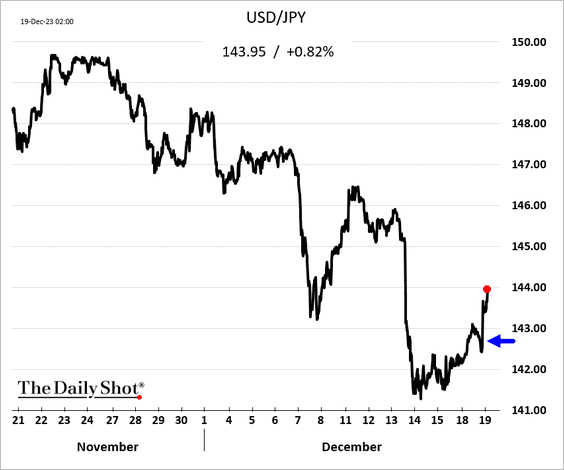

Japan: Despite all the rumors of policy tightening, the BoJ did not signal a rate hike ahead. The yen dropped in response.

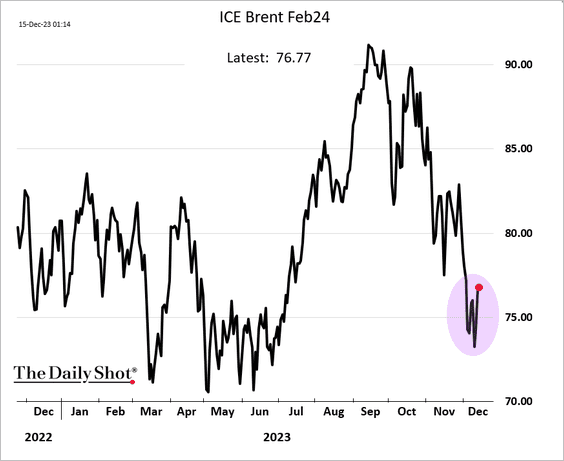

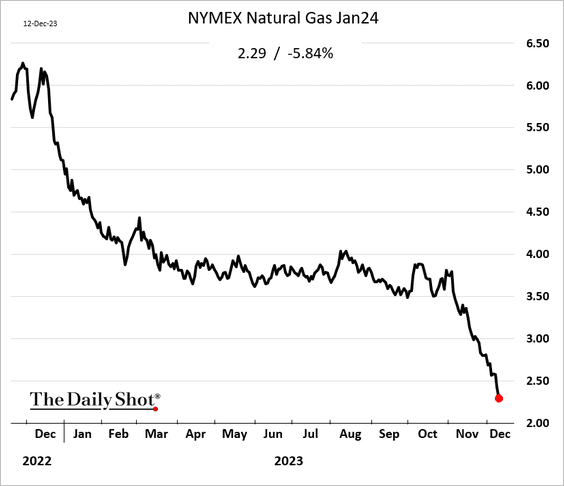

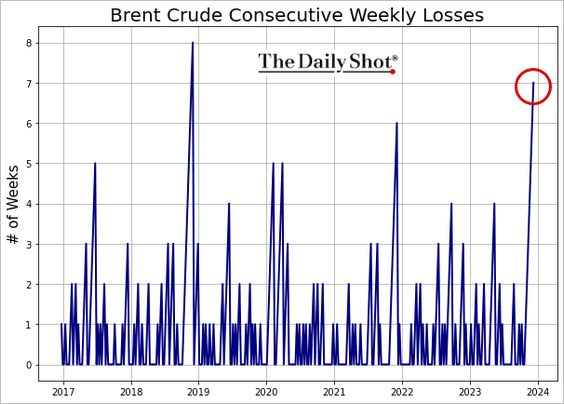

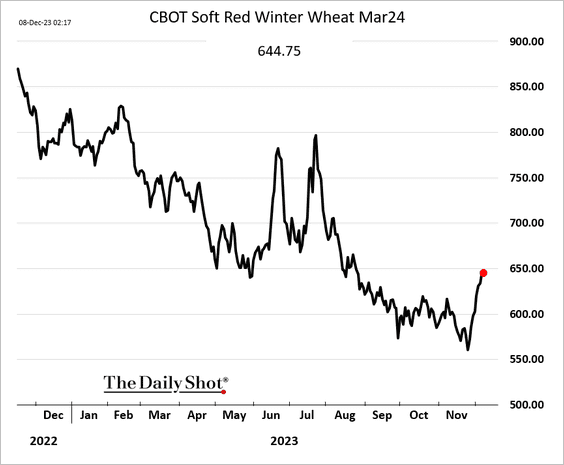

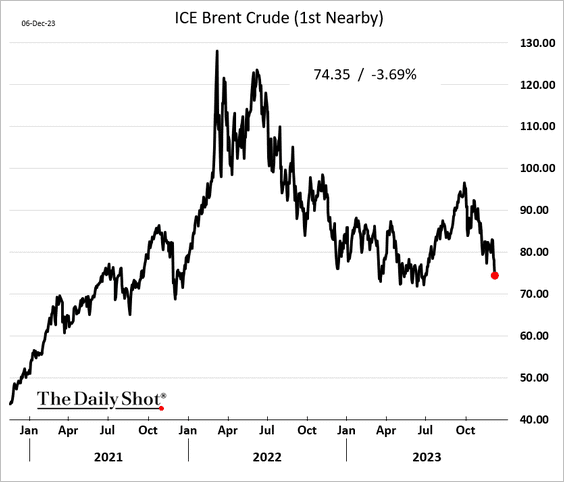

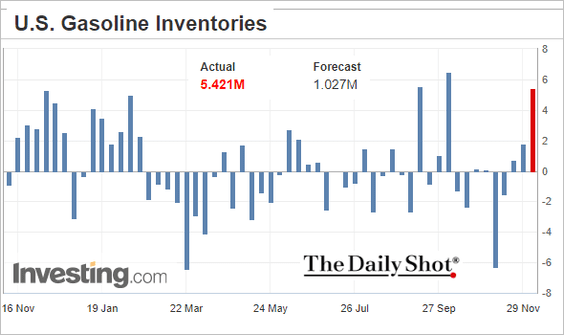

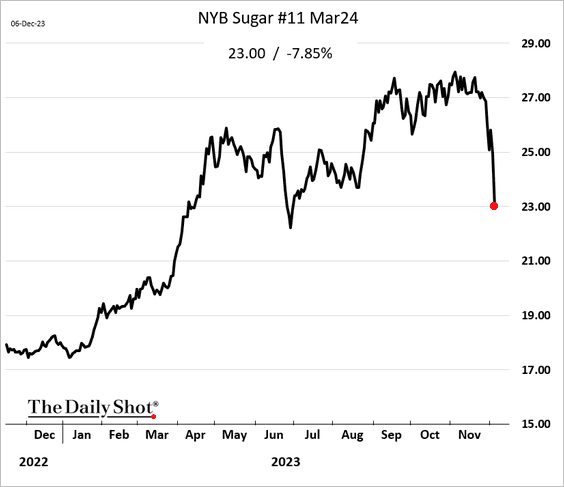

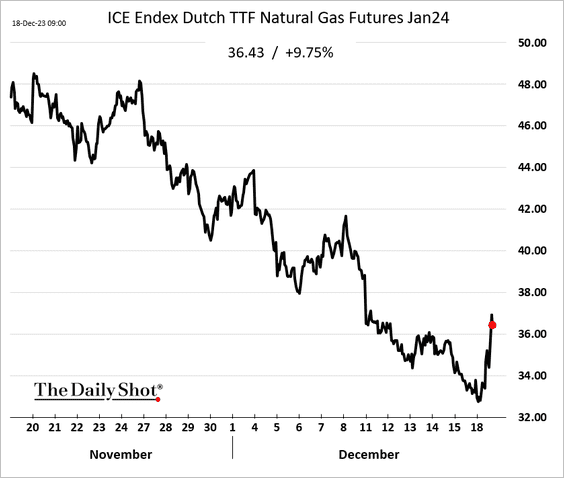

Energy: The Houthi threat is disrupting shipping markets, boosting natural gas prices in Europe.

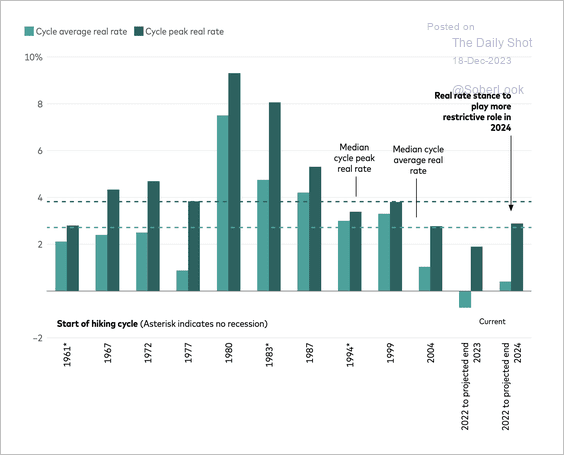

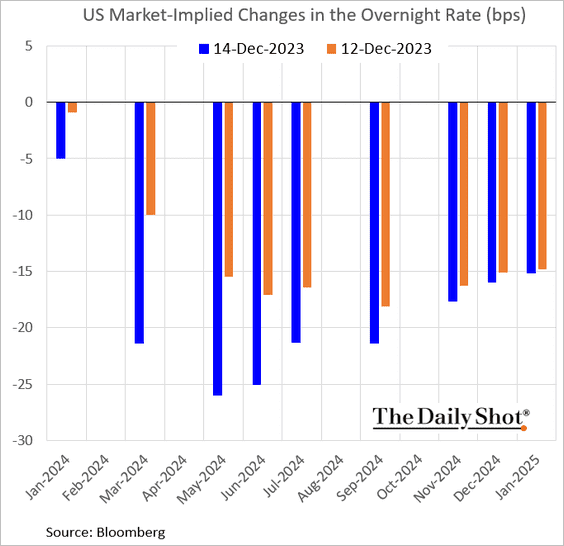

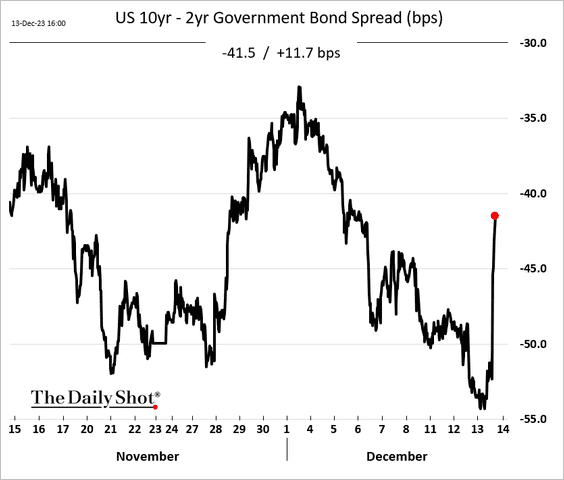

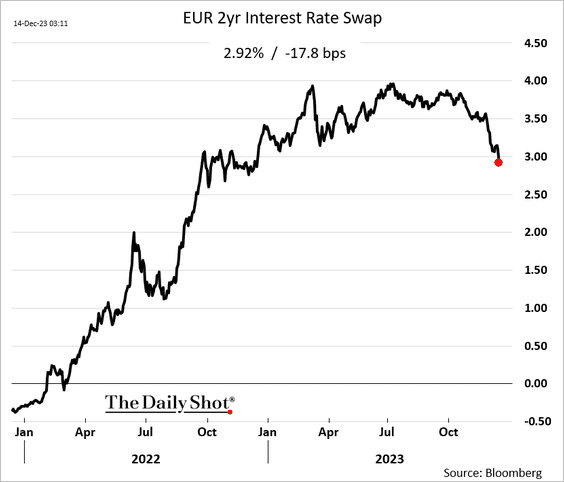

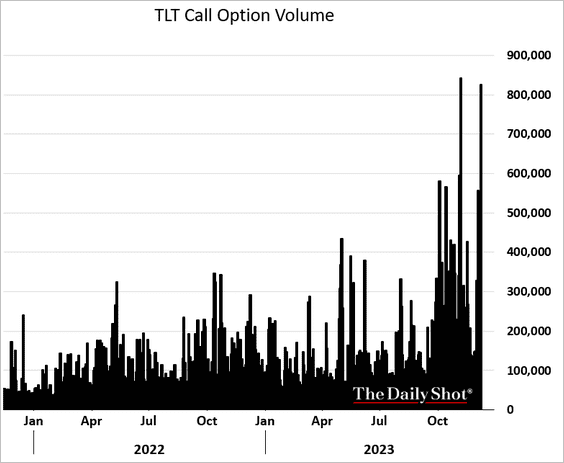

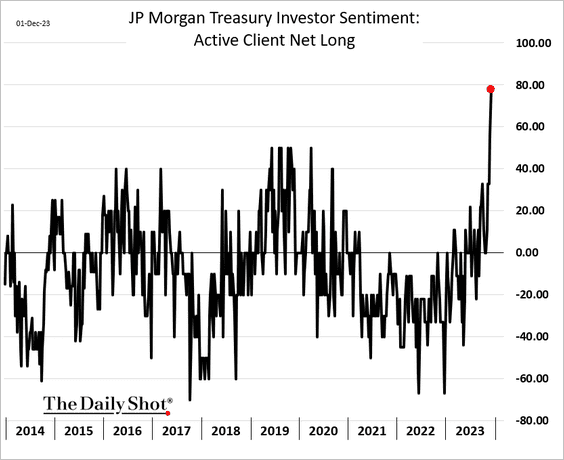

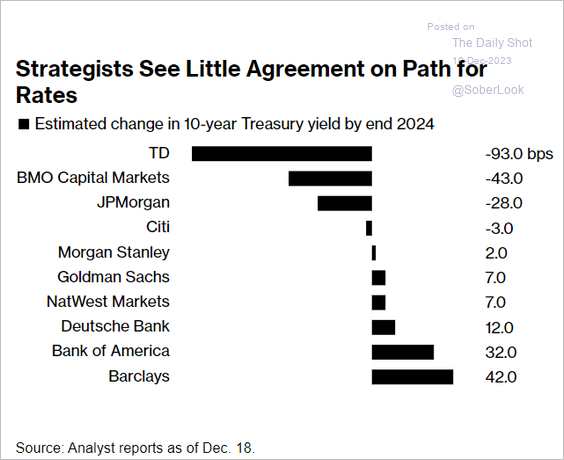

Rates: There is little agreement on the direction of Treasury yields next year.

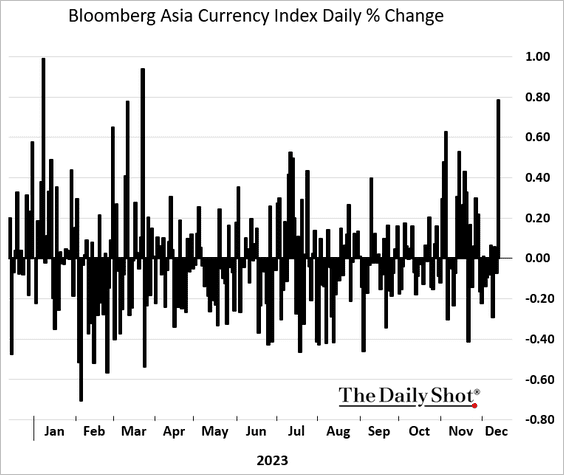

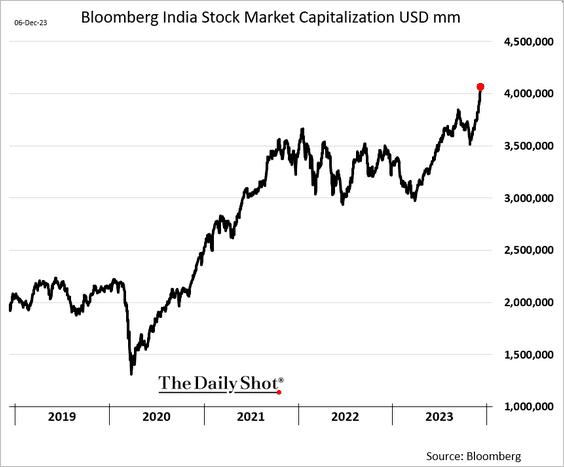

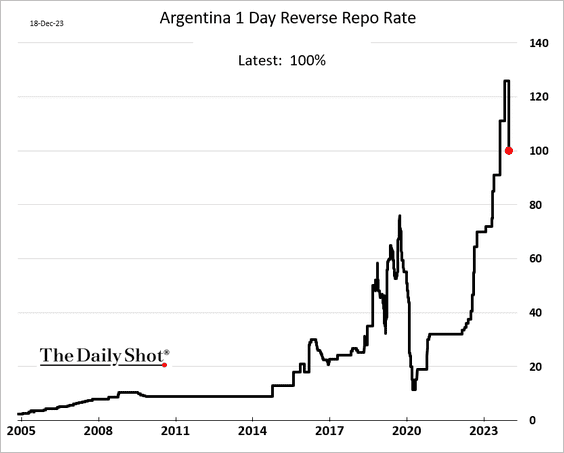

Emerging Markets: Argentina cut rates after the massive currency devaluation.

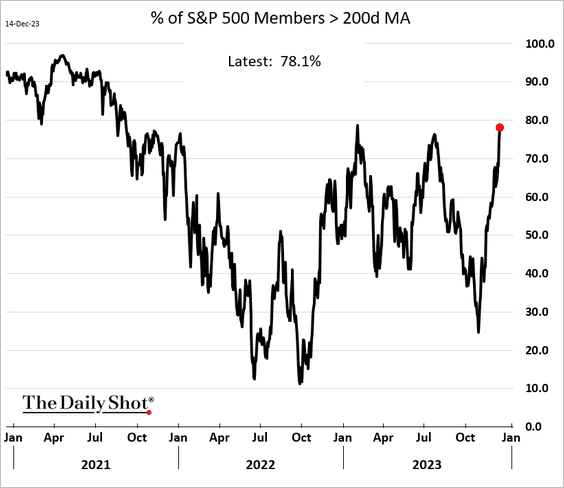

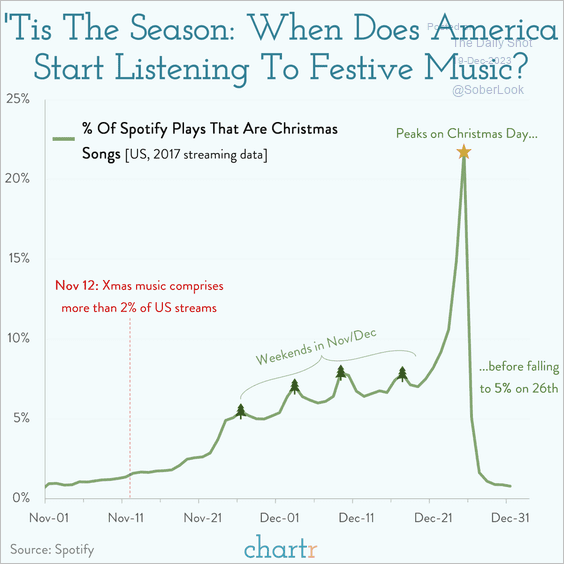

Food for Thought: Listening to festive music:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com