Greetings,

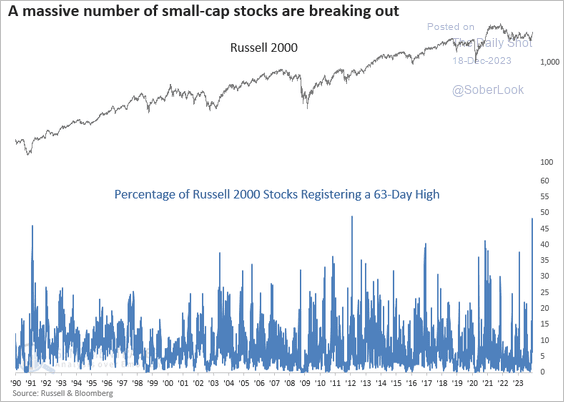

Equities: Roughly 48% of Russell 2000 stocks made a 63-day high, reaching the fifth-highest level in history.

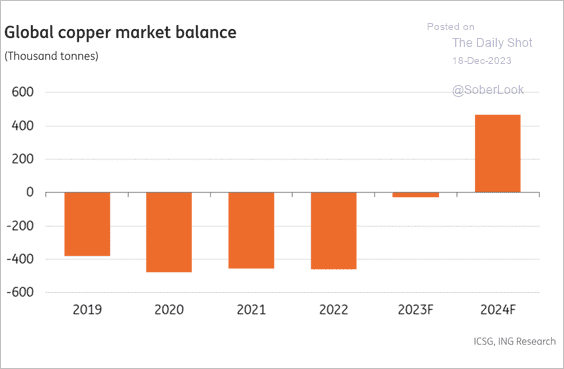

Commodities: The copper market is expected to be in surplus next year.

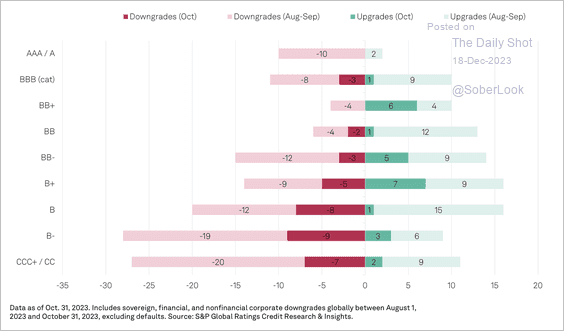

Credit: Downgrades continue to outnumber upgrades at lower rating levels.

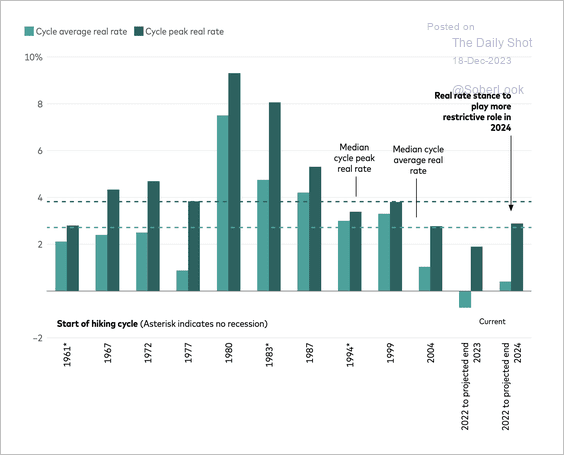

Rates: US real rates have only recently turned positive and are not yet at restrictive levels by historical standards.

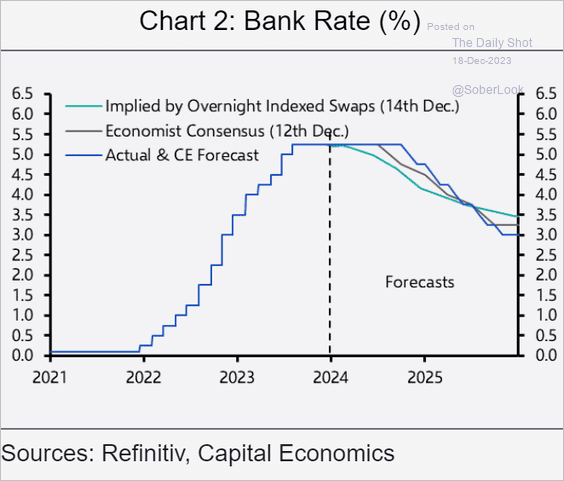

The United Kingdom: Capital Economics sees the BoE on hold longer than the Fed or the ECB due to elevated inflation. But once the BoE begins cutting rates, it will do so faster than the market expects.

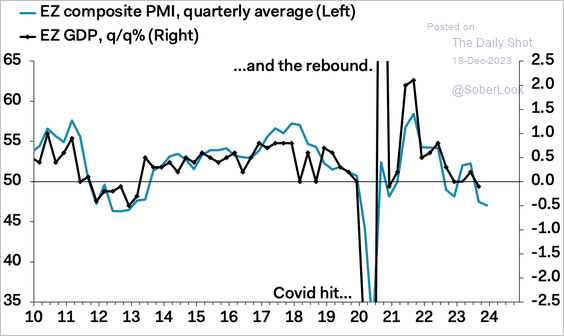

The Eurozone: The euro-area composite PMI index is firmly in contraction territory signaling a recession.

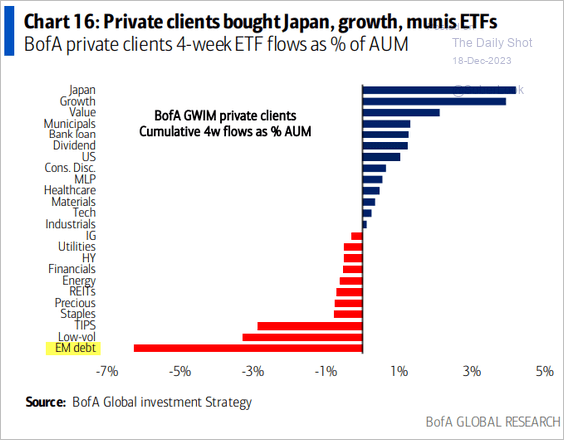

Emerging Markets: BofA’s private clients have been dumping EM debt.

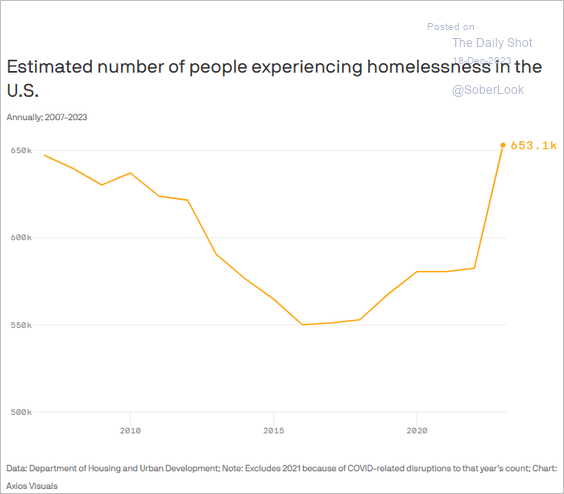

Food for Thought: Homelessness in the US:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com