Greetings,

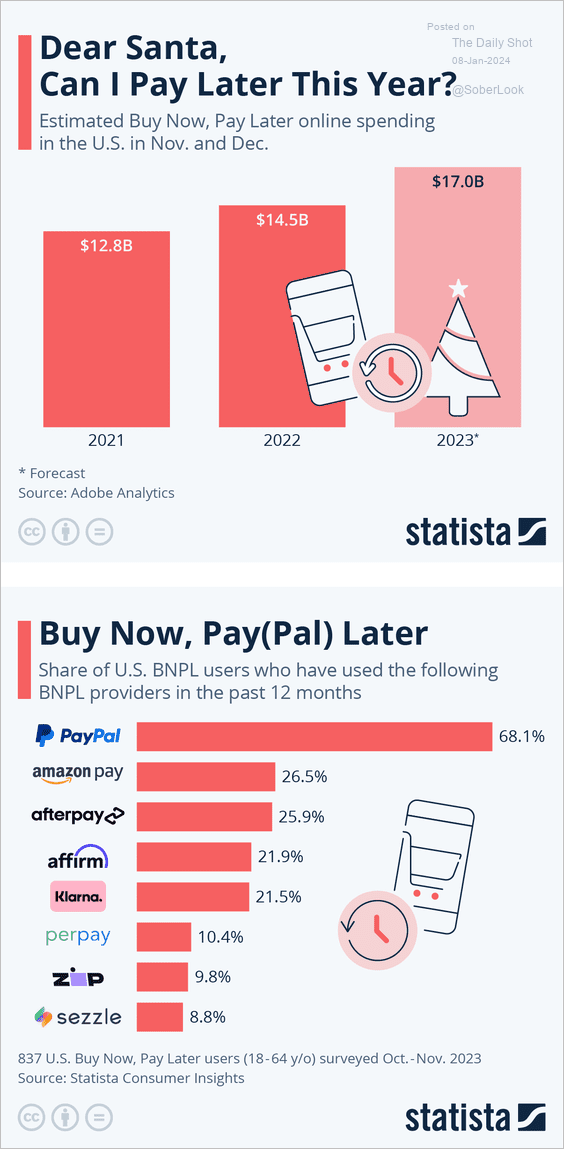

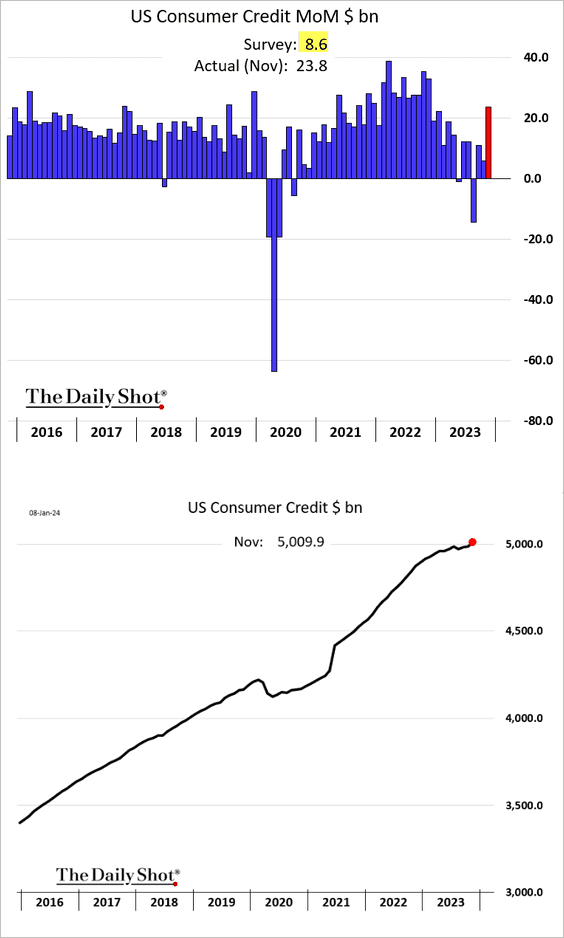

The United States: US consumer credit rose sharply in November, exceeding $5 trillion for the first time.

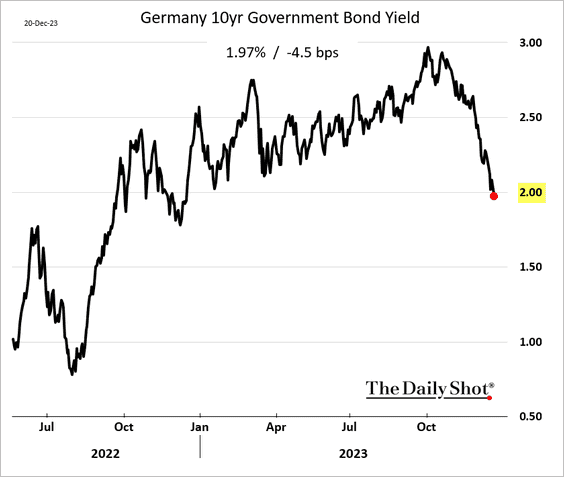

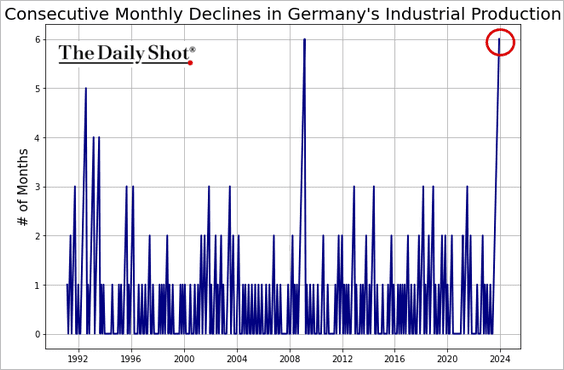

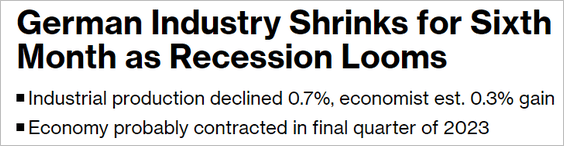

The Eurozone: Germany industrial production continues to tumble (six consecutive declines in a row).

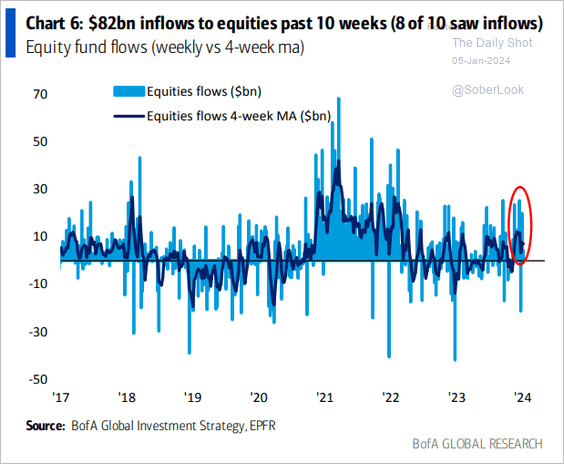

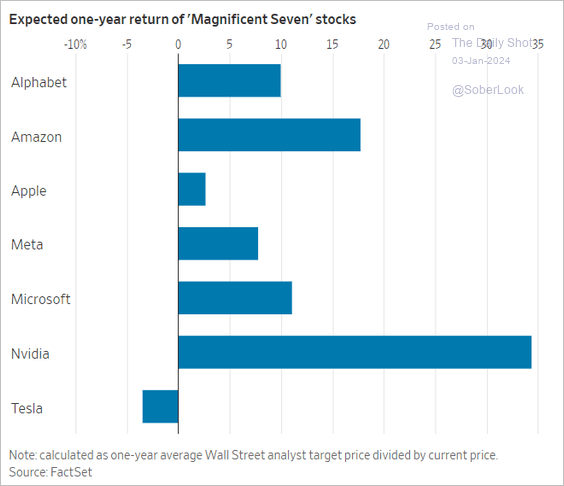

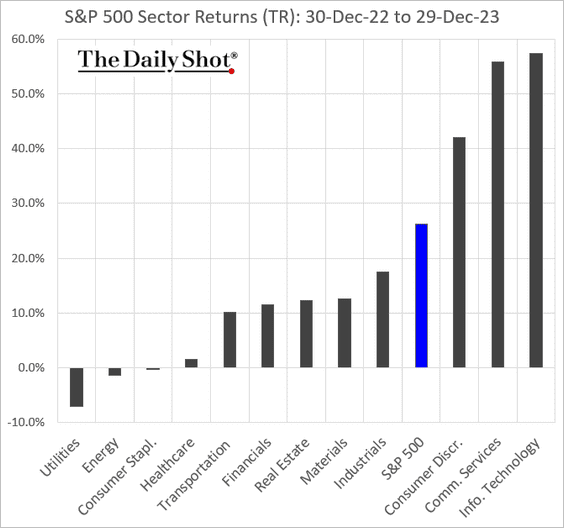

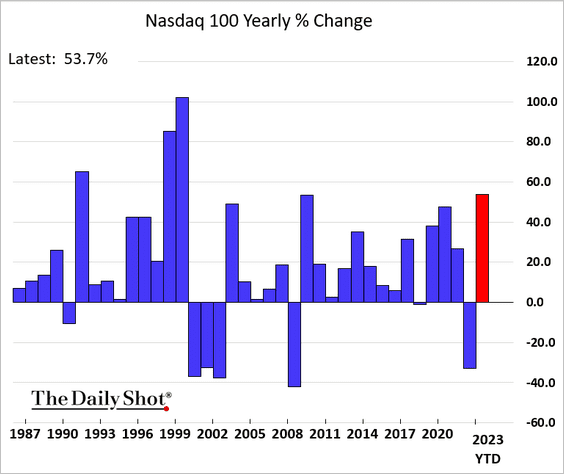

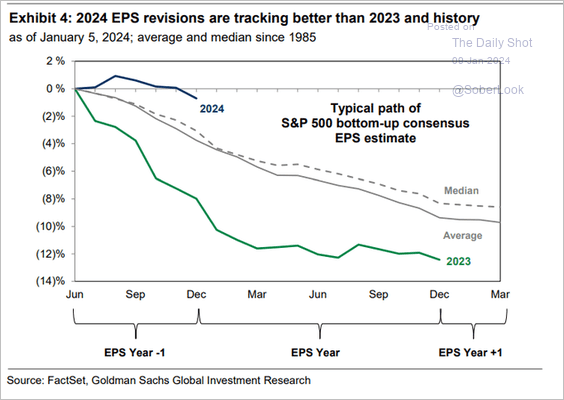

Equities: The scale of downward earnings revisions for 2024 has been notably less severe compared to the usual trend.

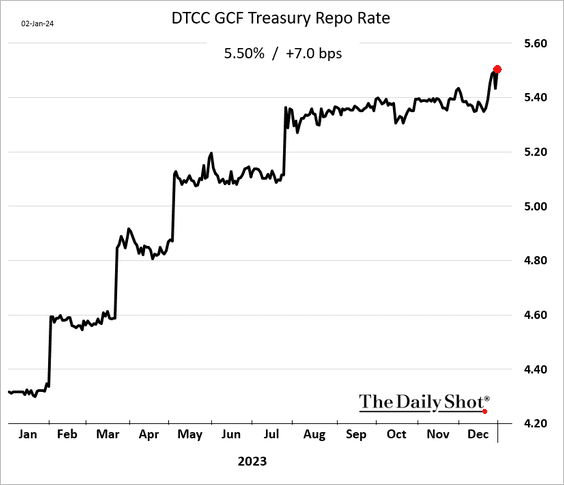

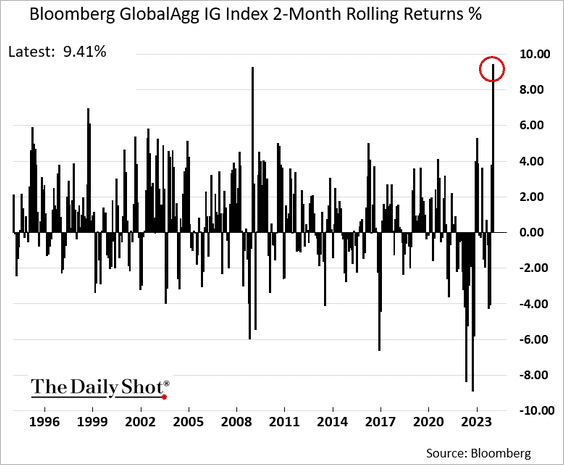

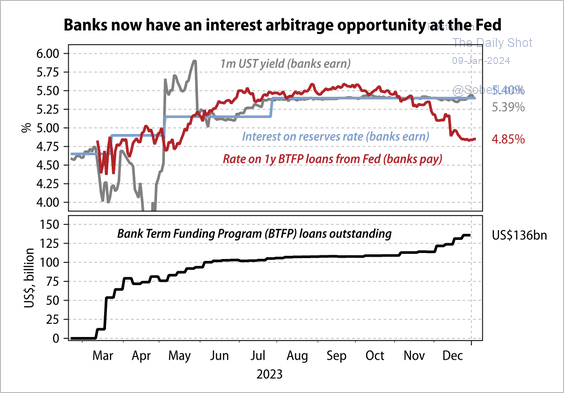

Credit: Banks can borrow from the Fed’s term funding program (BTFP) for less than what the Fed pays on their reserves.

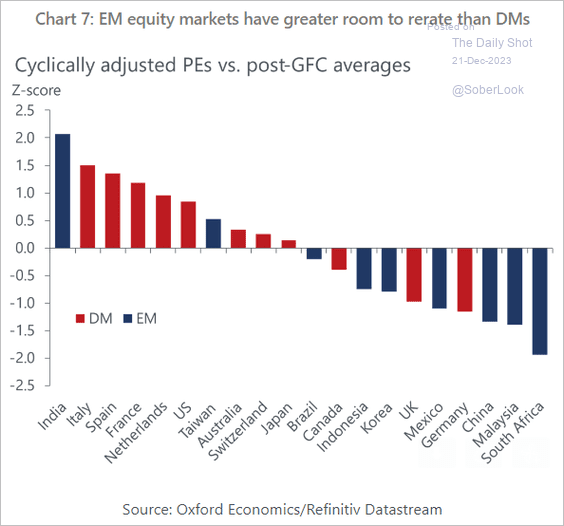

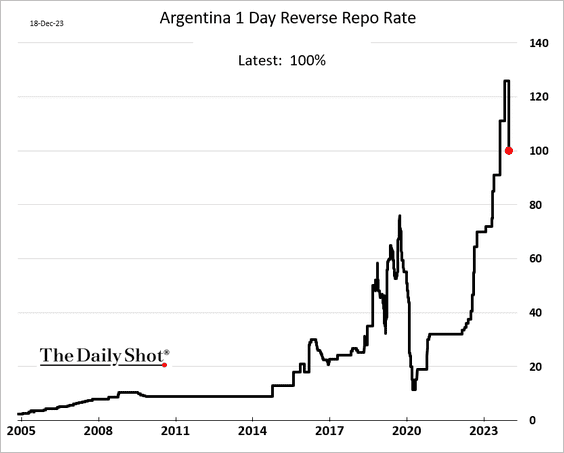

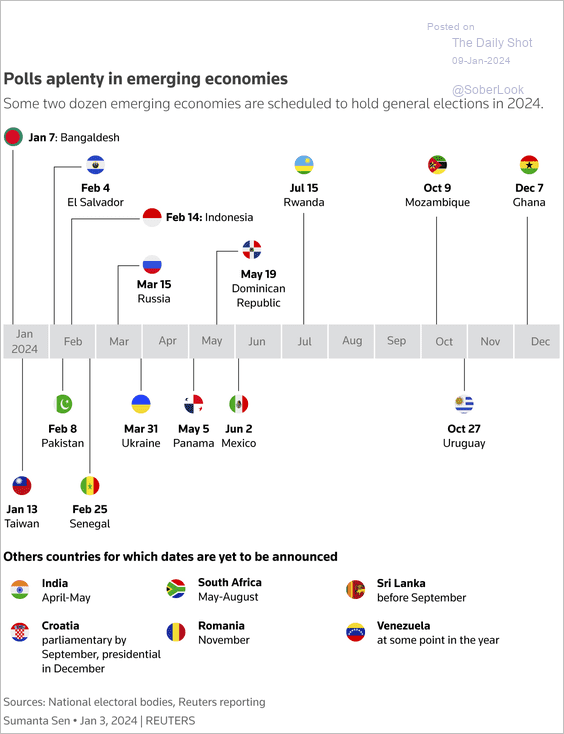

Emerging Markets: Here is a look at this year’s elections across EM economies.

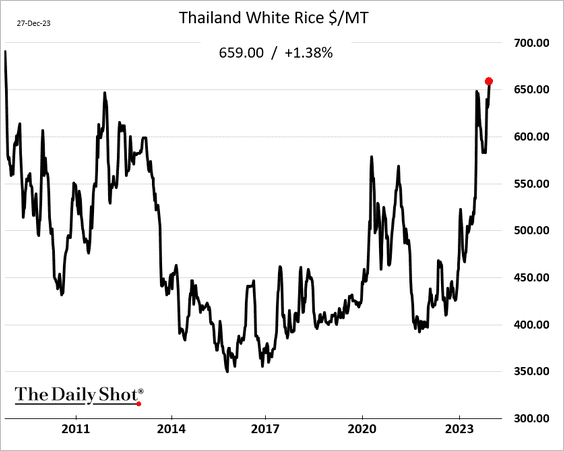

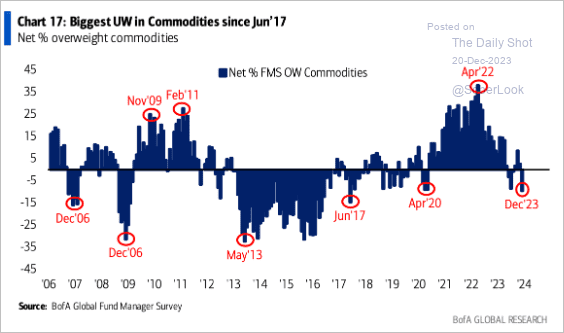

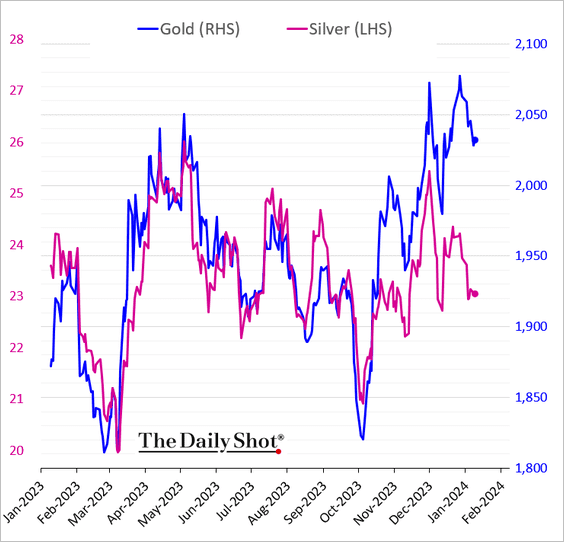

Commodities: Gold and silver have diverged sharply in recent weeks.

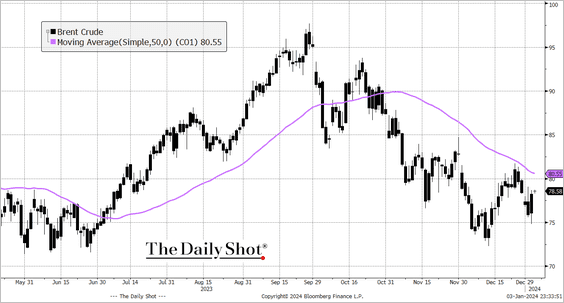

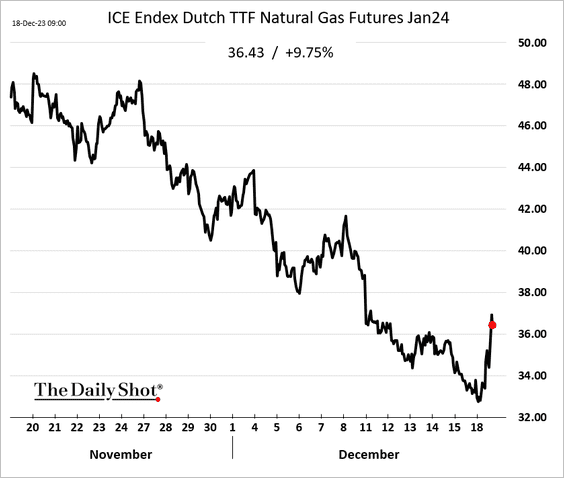

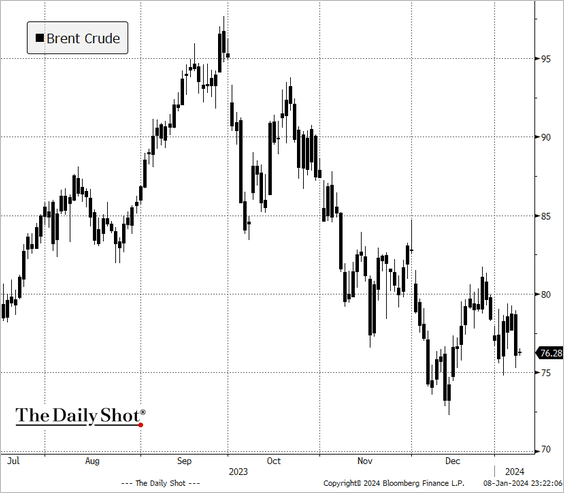

Energy: Crude oil futures softened on Monday, influenced by Saudi Arabia’s decision to reduce prices for their Asian customers.

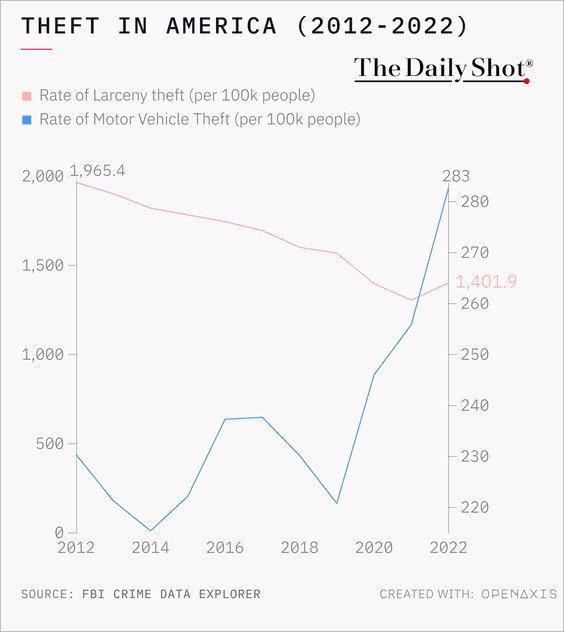

Food for Thought: Theft rates:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com