Greetings,

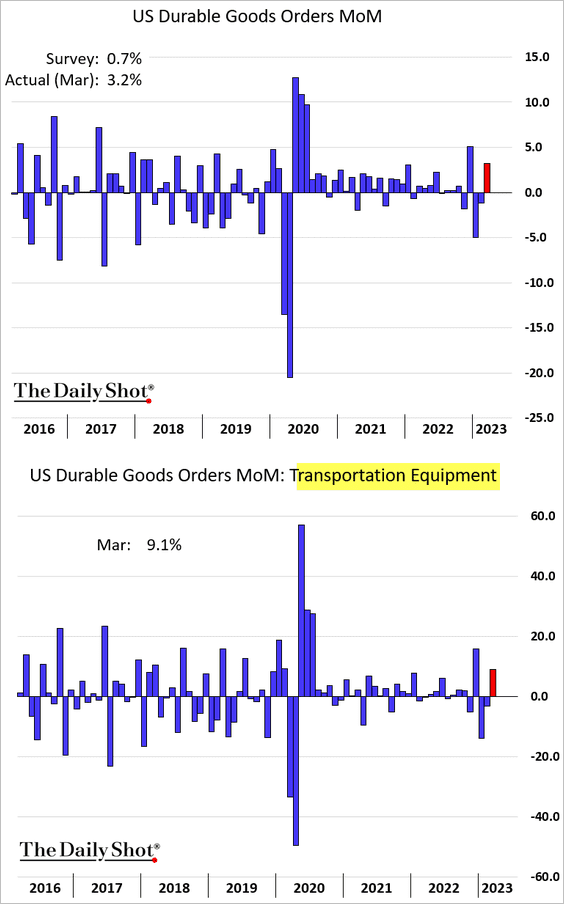

The United States: Durable goods orders jumped in March, boosted by aircraft purchases.

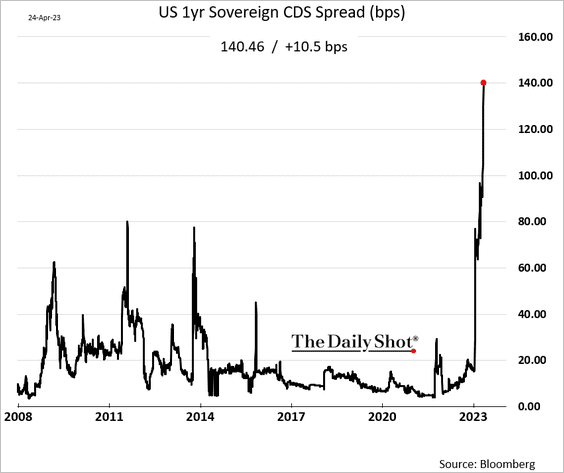

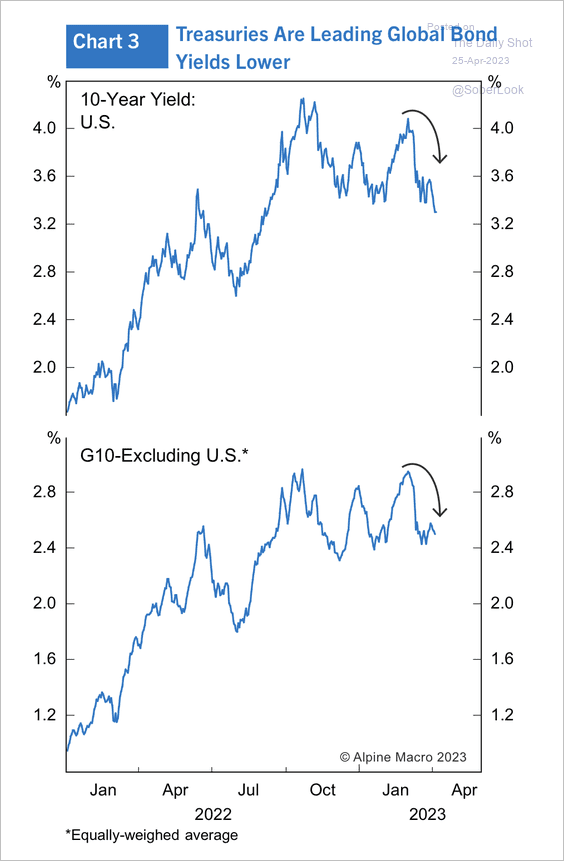

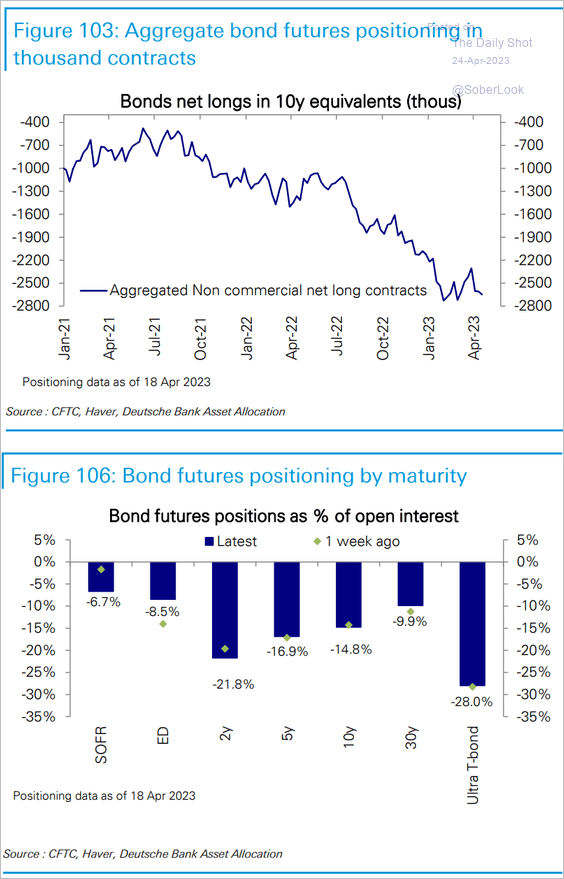

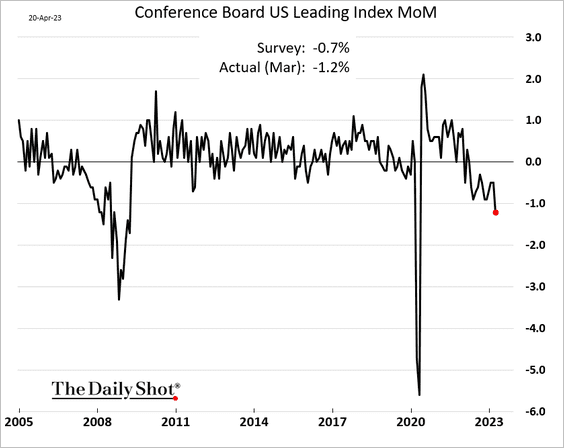

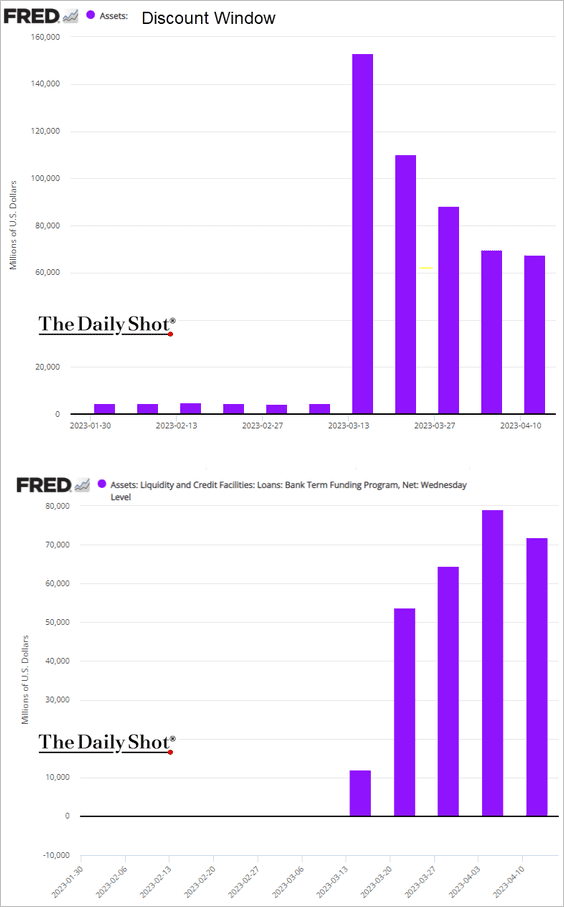

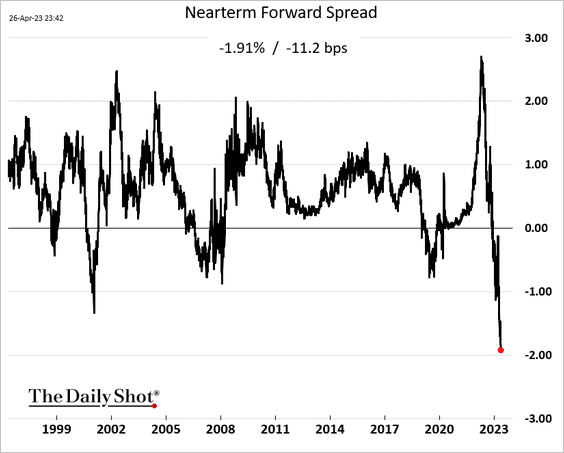

The market continues to price in deep rate cuts over the next 18 months amid concerns about the banking sector and the debt ceiling. This chart shows the near term forward spread of the three-month Treasury bill.

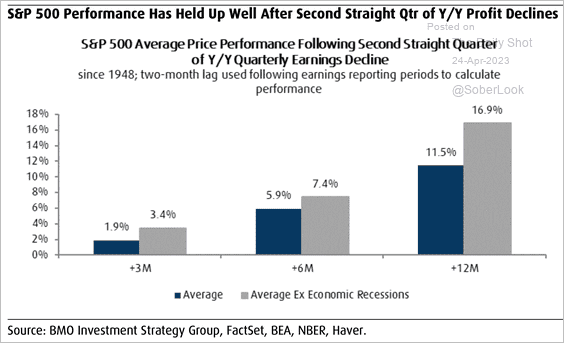

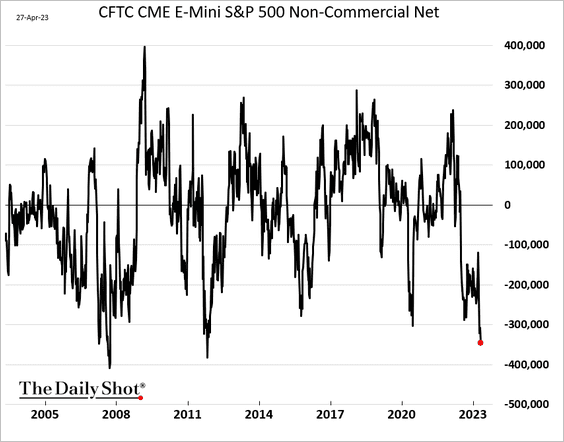

Equities: S&P 500 futures positioning is the most bearish in over a decade.

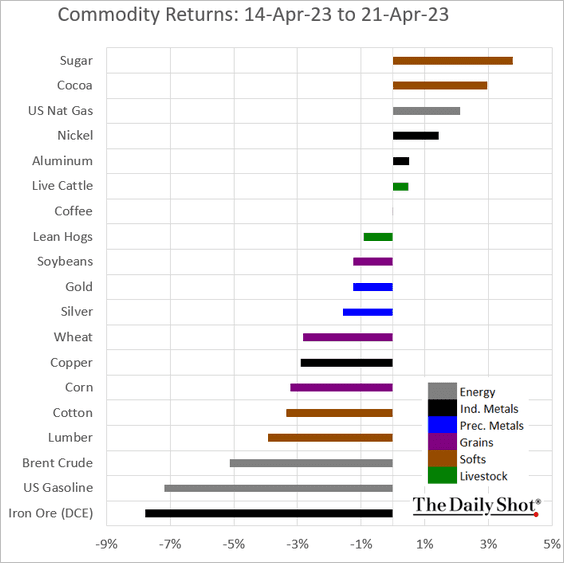

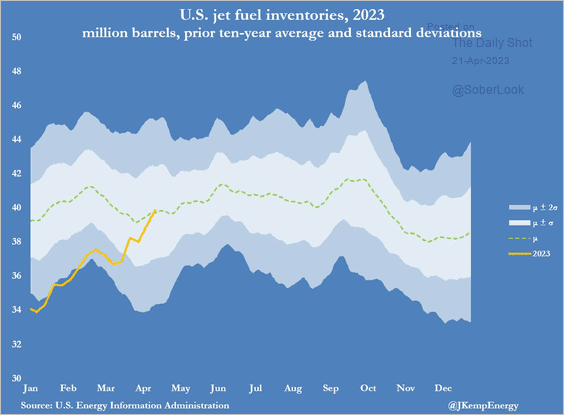

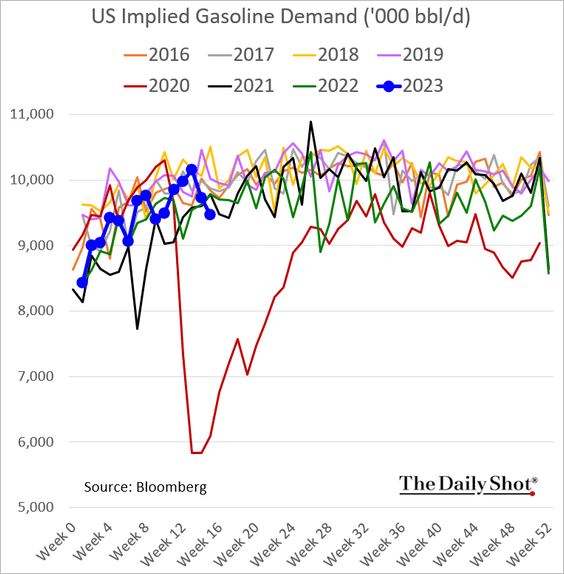

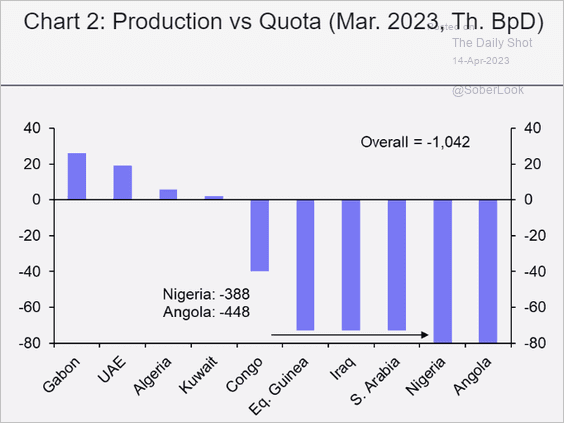

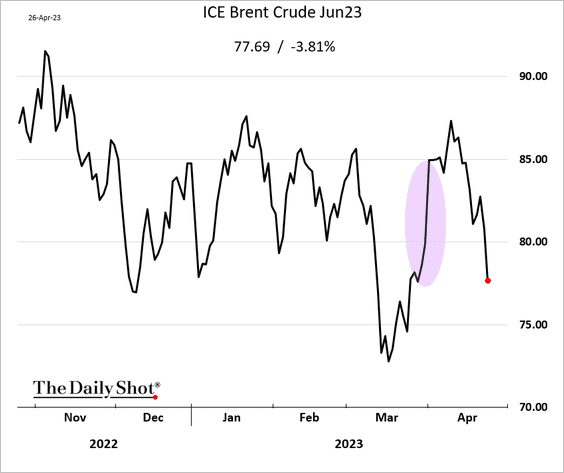

Energy: Crude oil has reversed all of the gains from OPEC’s surprise production cut amid concerns about demand.

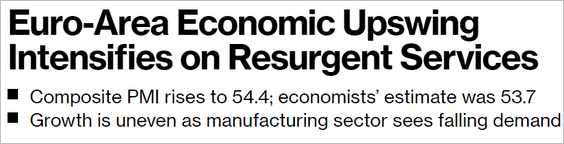

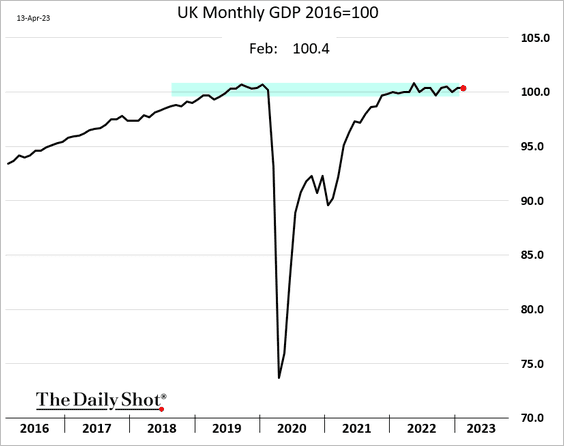

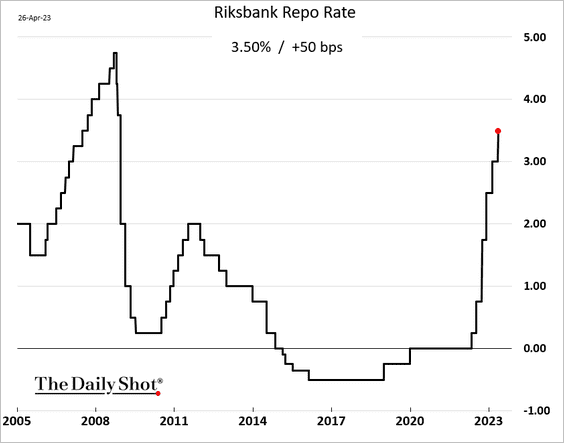

Europe: Riksbank hiked rates by 50 bps (as expected) and signaled a pause.

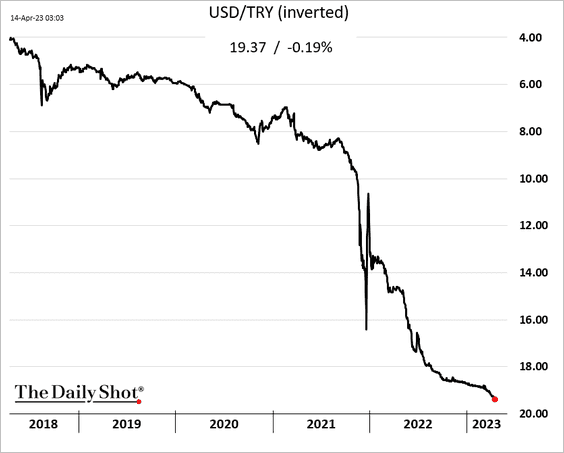

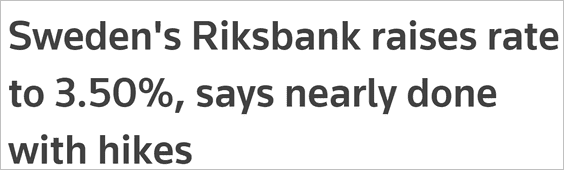

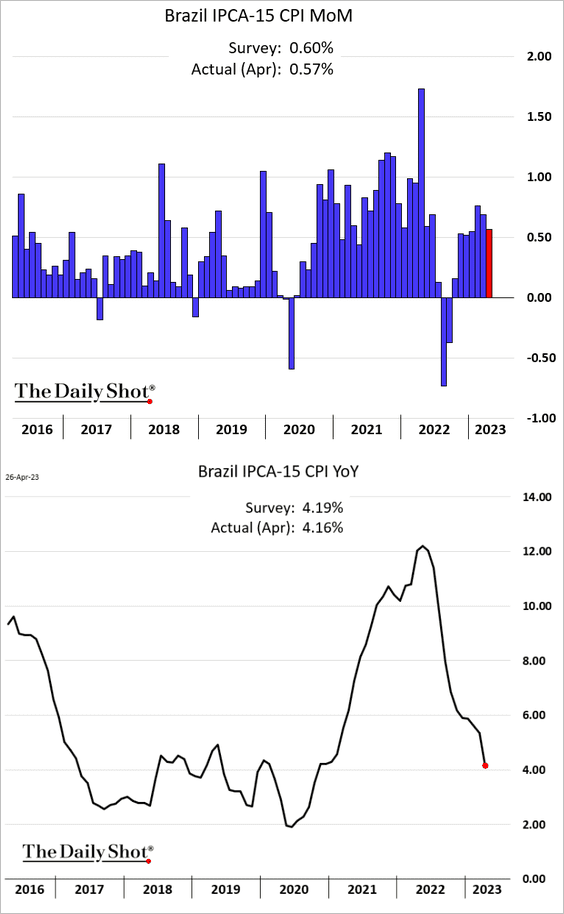

Emerging Markets: Brazil’s inflation is moderating.

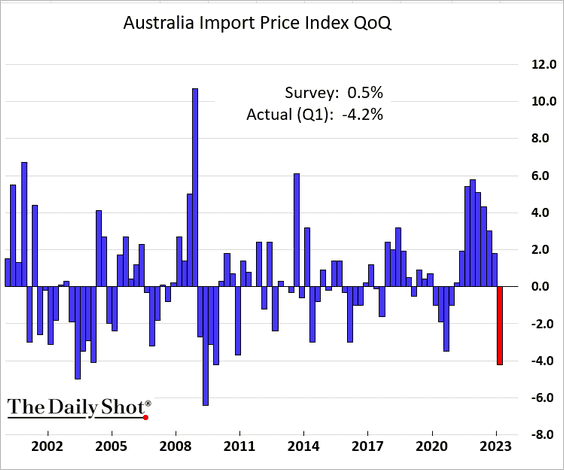

Asia – Pacific: Australia’s import prices unexpectedly tumbled in the first quarter.

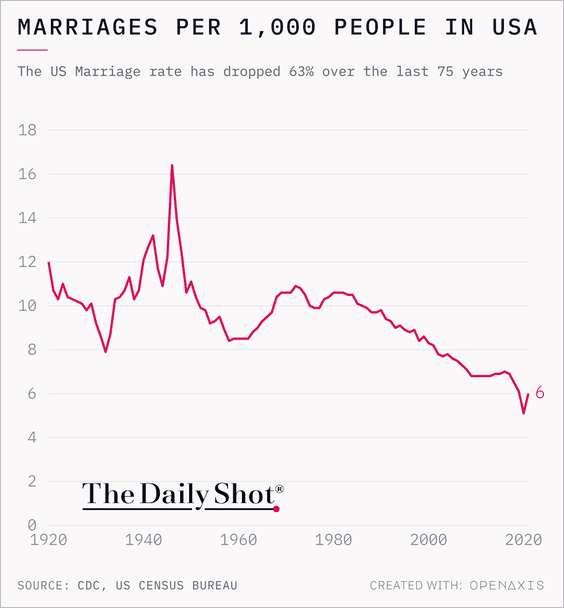

Food for Thought: To conclude, here is the US marriage rate over time:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com