Greetings,

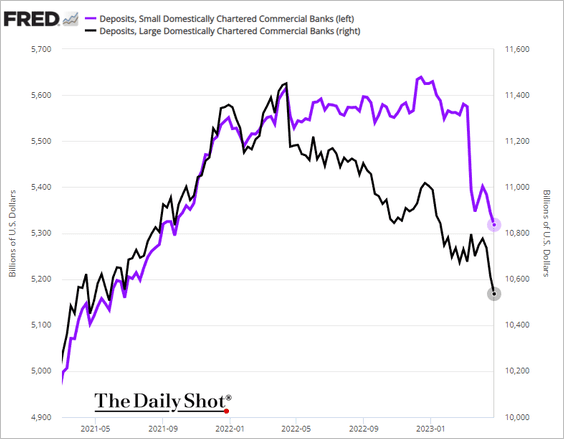

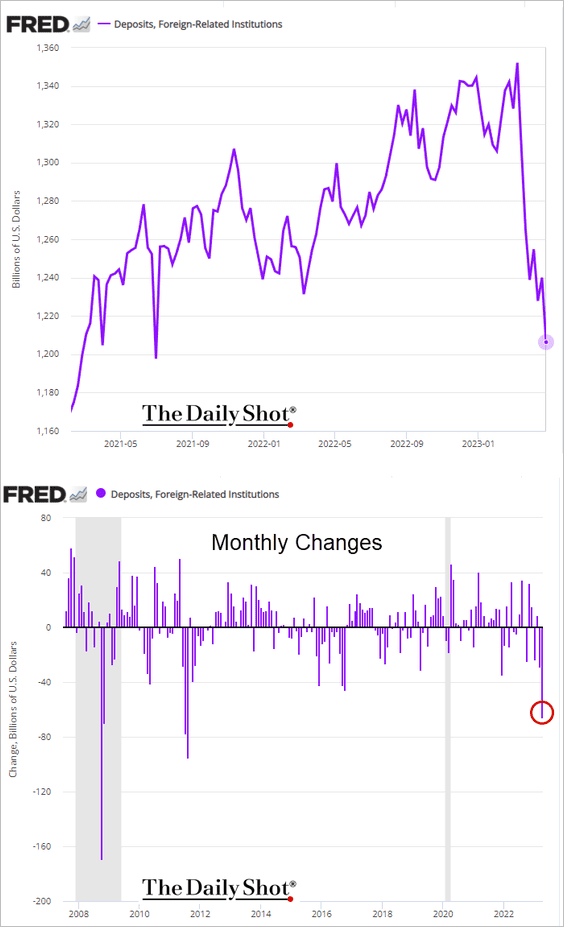

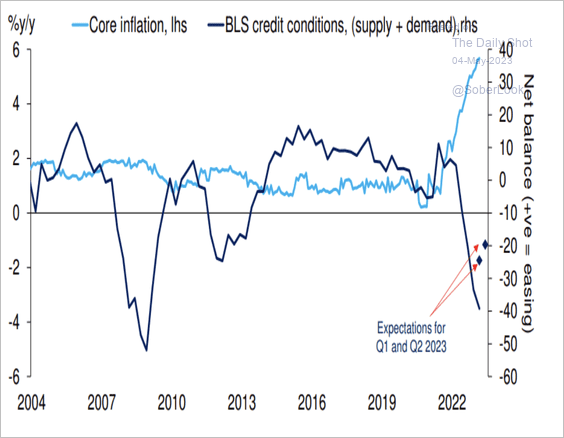

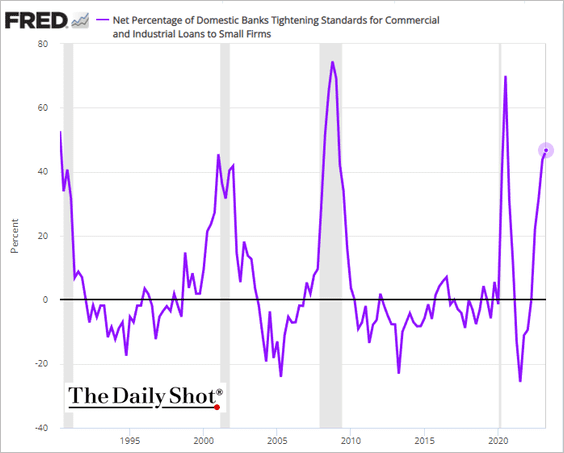

The United States: Banks continue to tighten lending standards. Here is the percentage of lenders tightening standards on loans to small companies.

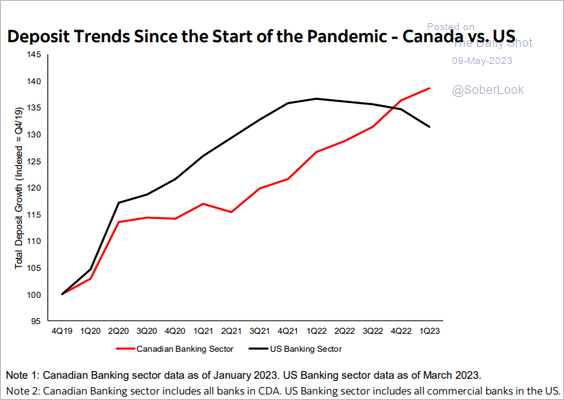

Canada: Canada’s banking sector has not experienced the declines in bank deposits seen in the US.

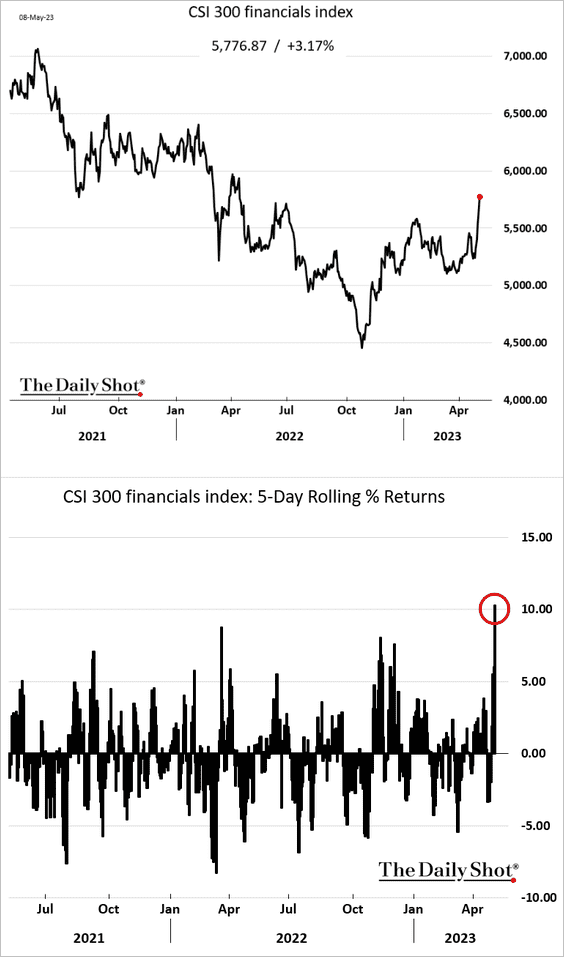

China: Bank shares have been rallying.

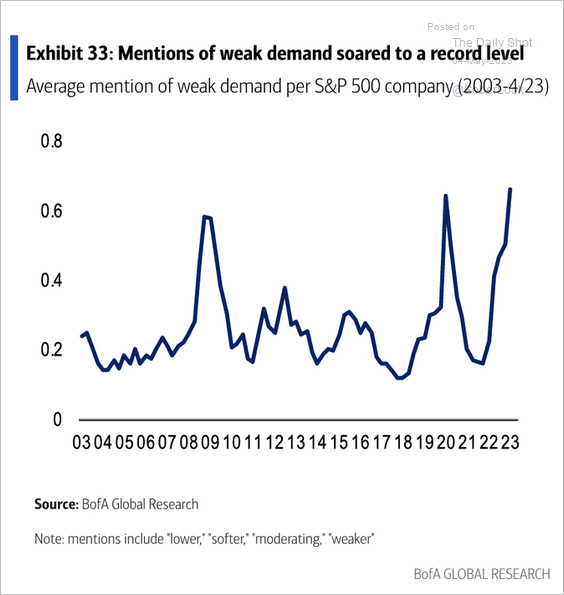

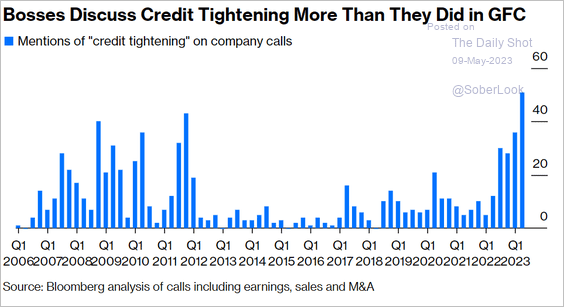

Credit: Credit tightening is increasingly discussed on earnings calls.

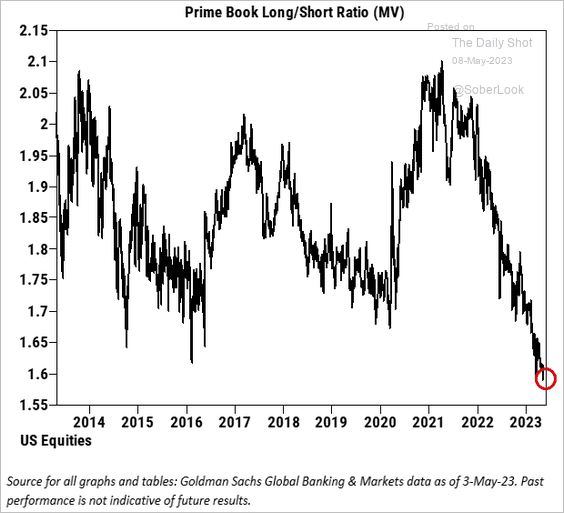

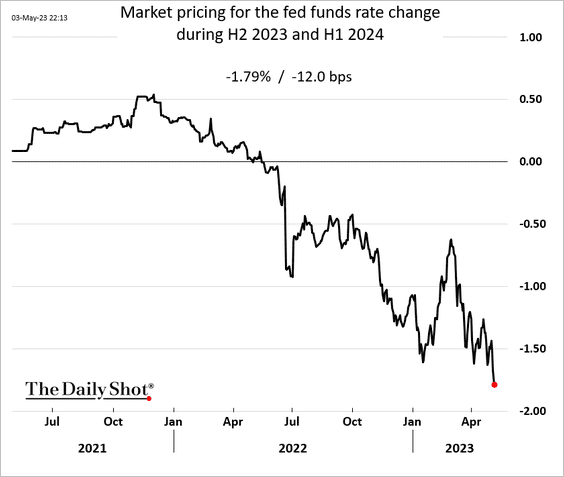

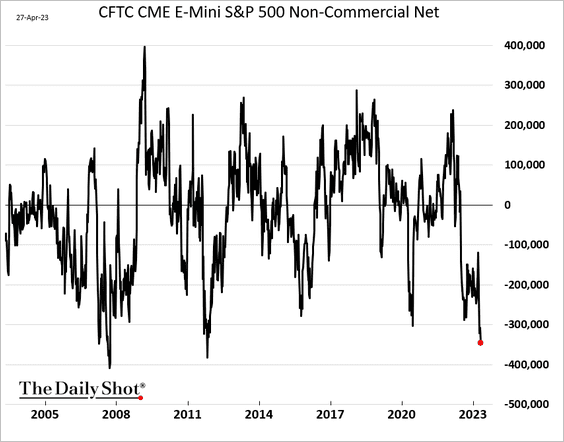

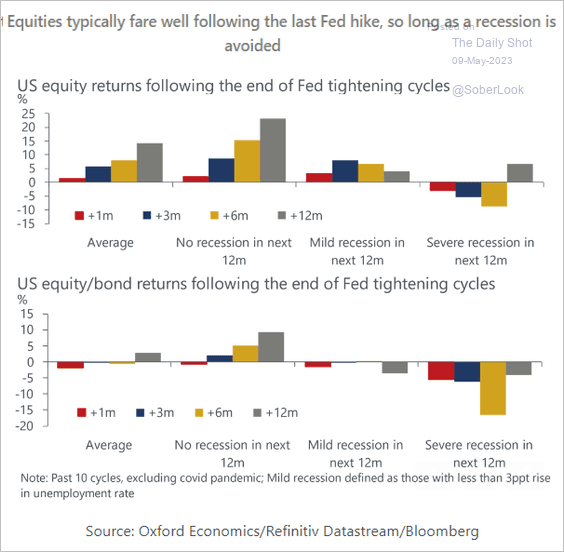

Equities: How do stocks perform after the Fed’s last hike?

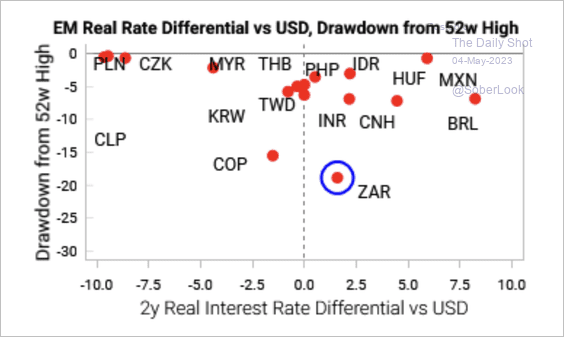

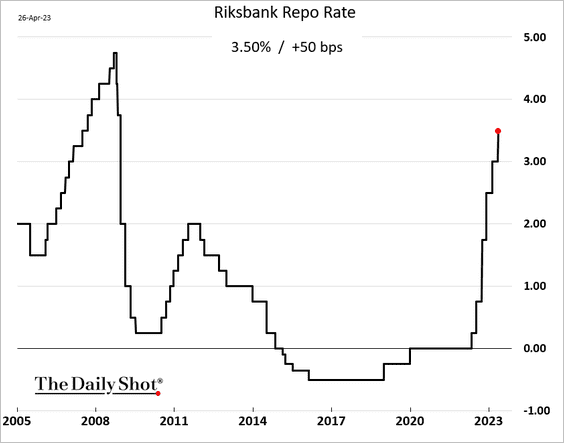

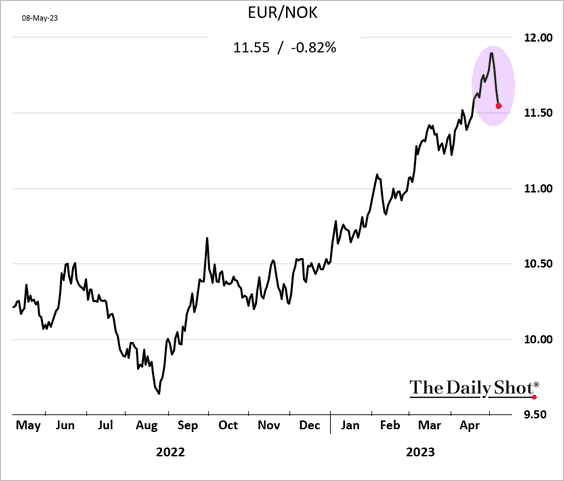

Europe: The Norwegian krone bounced from the lows after the rate hike. Will the rebound be sustained?

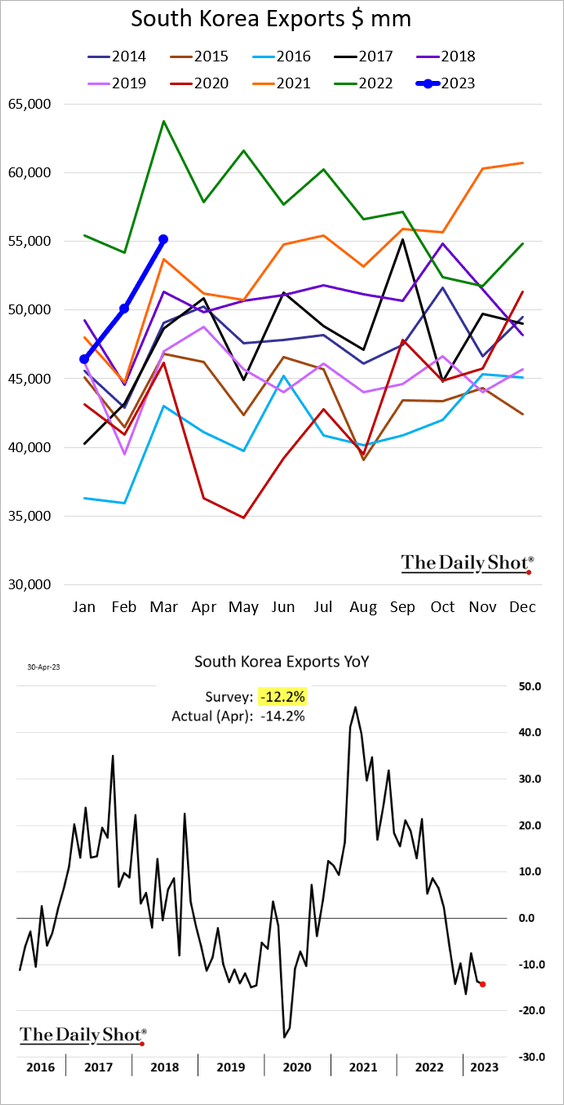

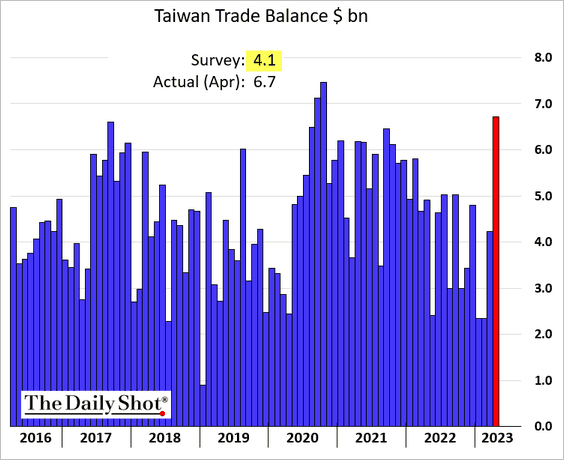

Asia – Pacific: Taiwan’s trade surplus surged last month.

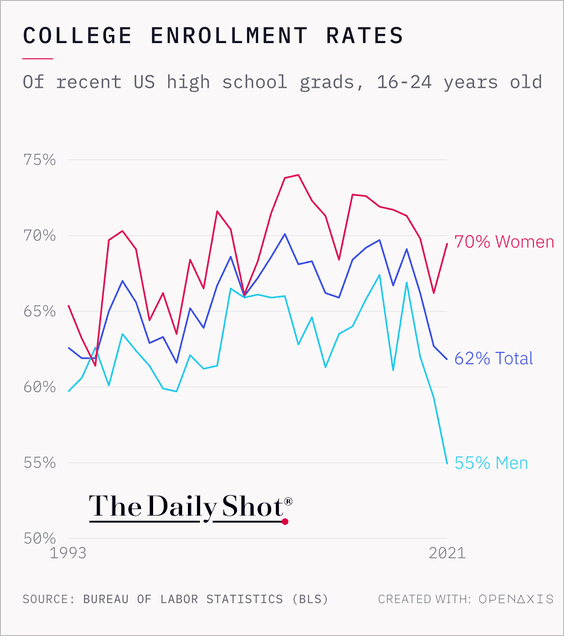

Food for Thought: Here are notable trends in US college enrollment rates:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com