Greetings,

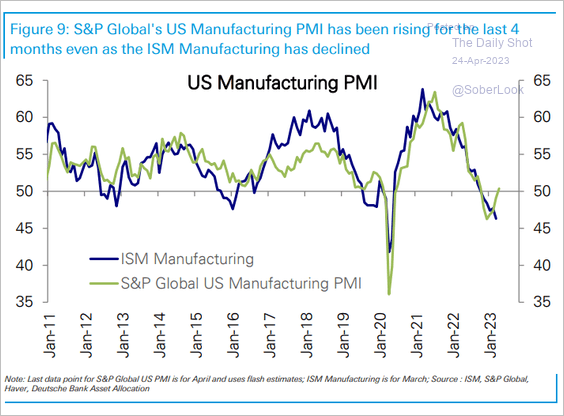

The United States: The PMI Manufacturing index from S&P Global is back above 50, signaling a rebound in US manufacturing. Will we also see a bounce in the ISM Manufacturing PMI this month?

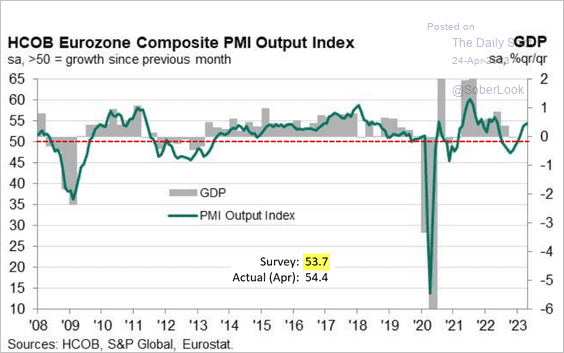

The Eurozone: The composite PMI (manufacturing + services) is in growth territory, driven by services.

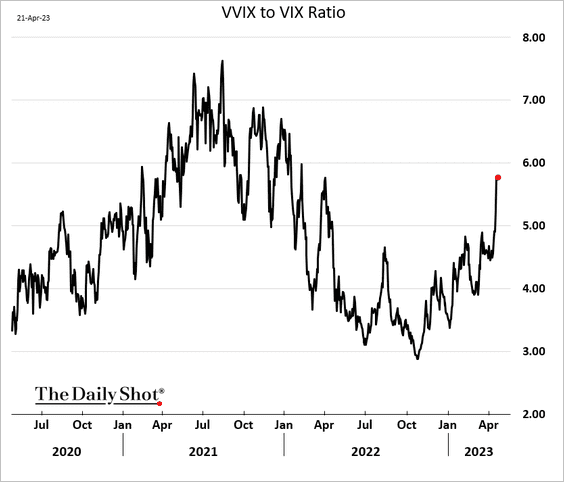

Equities: VVIX (implied volatility index of VIX options) has risen even as VIX declines. It indicates increased demand for VIX call options.

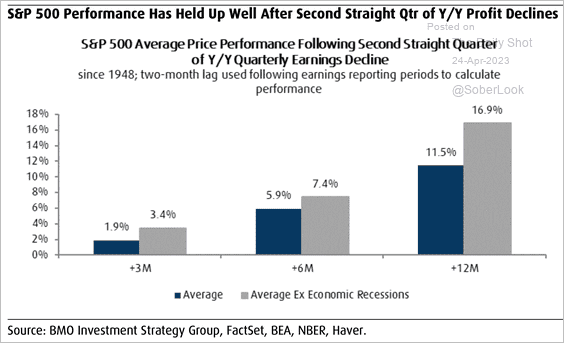

A second straight quarter of year-over-year profit declines is not necessarily a headwind for stock prices.

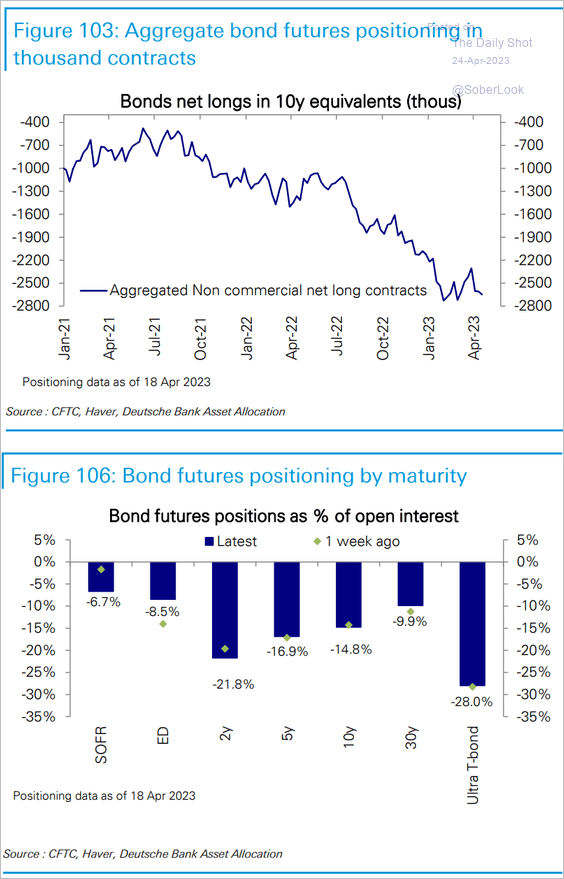

Rates: Speculative investors’ net-short positioning in interest rate futures is still near extreme levels.

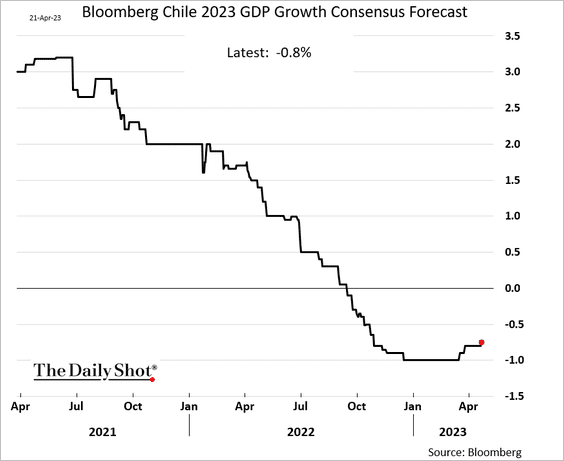

Emerging Markets: Economists continue to boost Chile’s GDP forecast, but a 2023 recession remains in the cards.

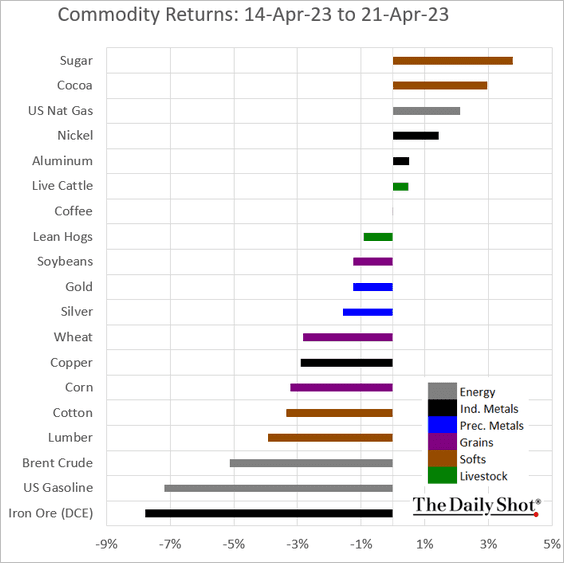

Commodities: Here is last week’s performance across key commodity markets.

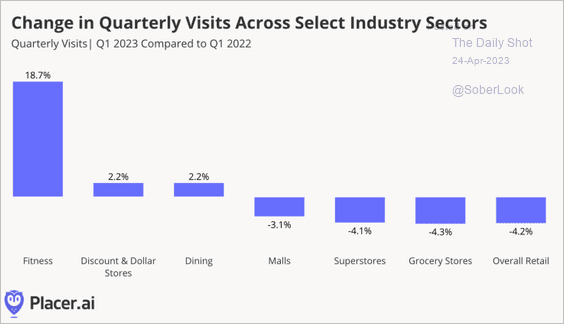

Food for Thought: Here are year-on-year changes in visits to retail and services establishments:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com