Greetings,

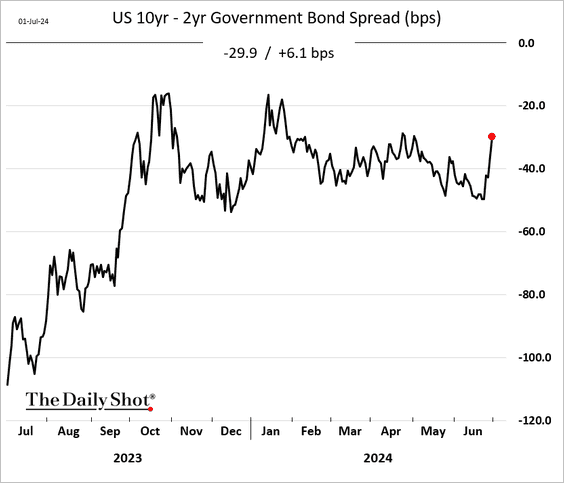

The United States: The CPI report surprised to the downside as inflation continued to cool in June, bolstering the case for rate cuts starting in September.

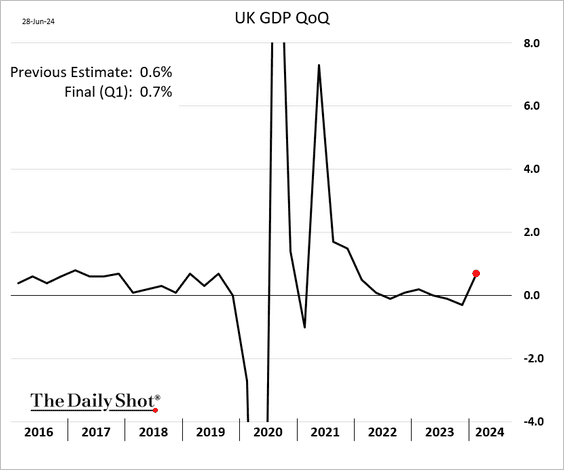

The United Kingdom: The trade deficit narrowed.

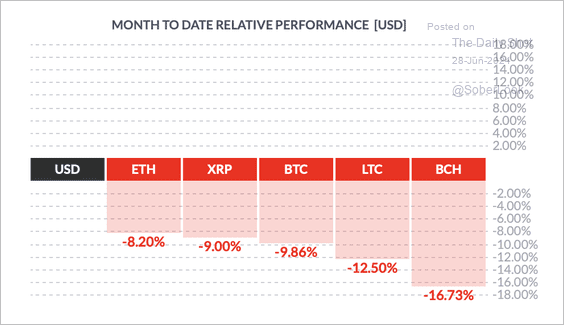

Cryptocurrency: Bitcoin is holding below its 200-day moving average.

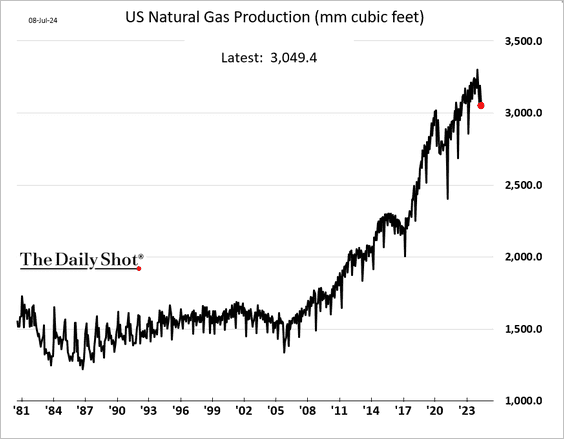

Energy: Here is a look at US natural gas production.

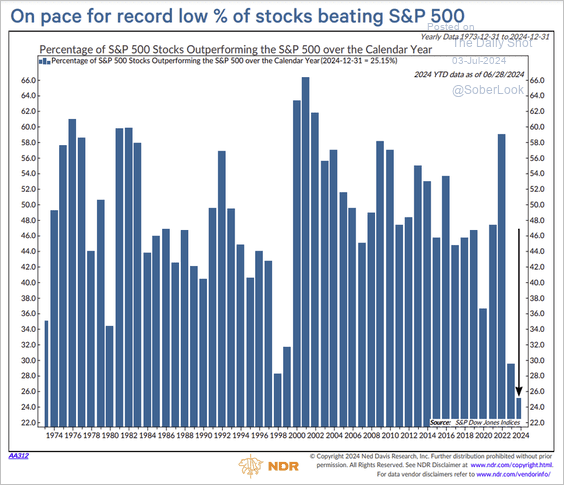

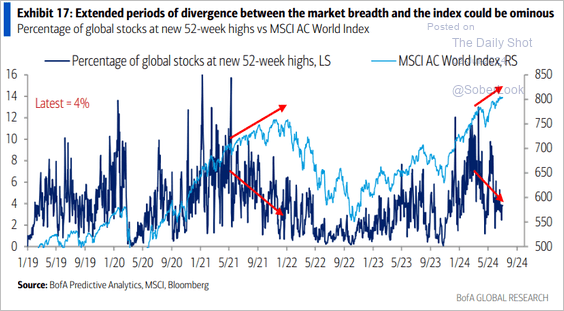

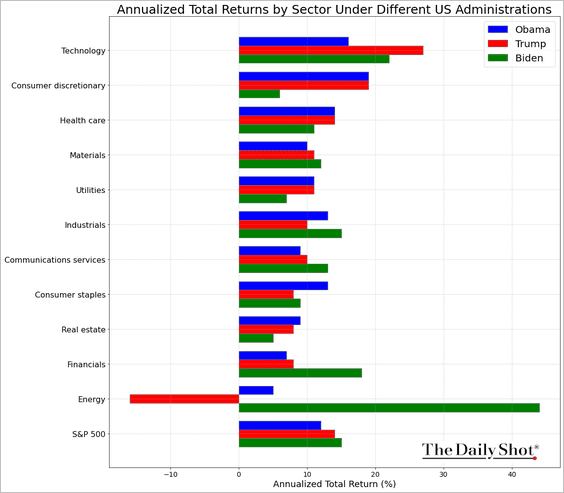

Equities: The CPI report triggered a rotation from tech mega-caps to other sectors.

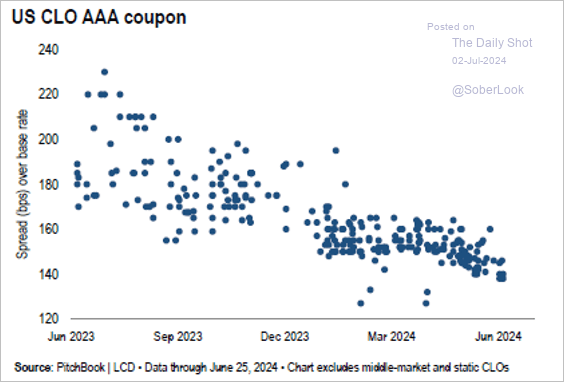

Credit: How do BDC portfolio loan yields compare to public market yields?

Food for Thought: States reporting the most burglaries:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief