Greetings,

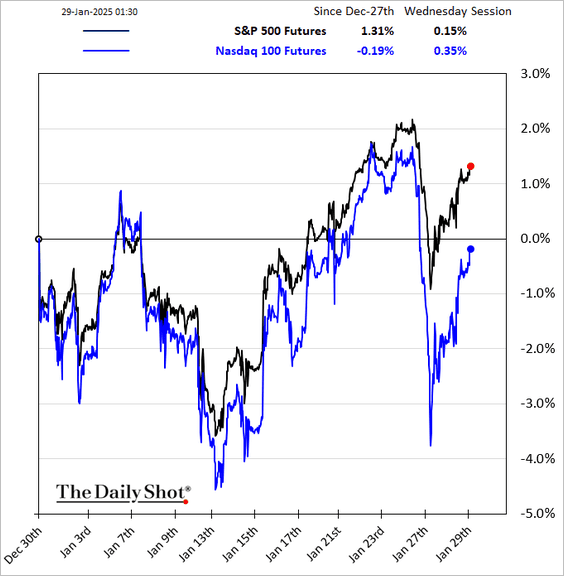

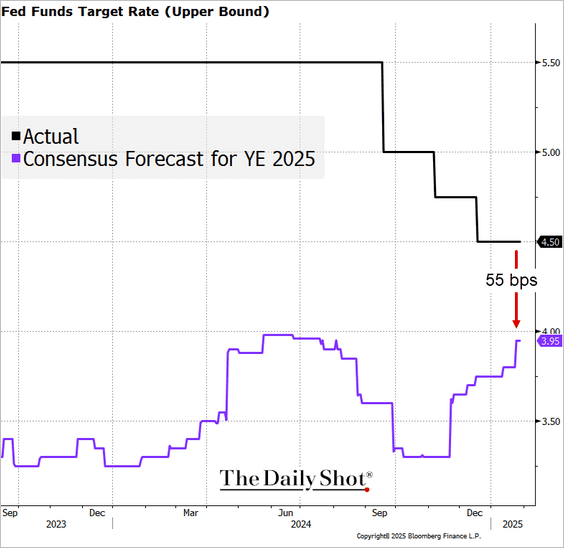

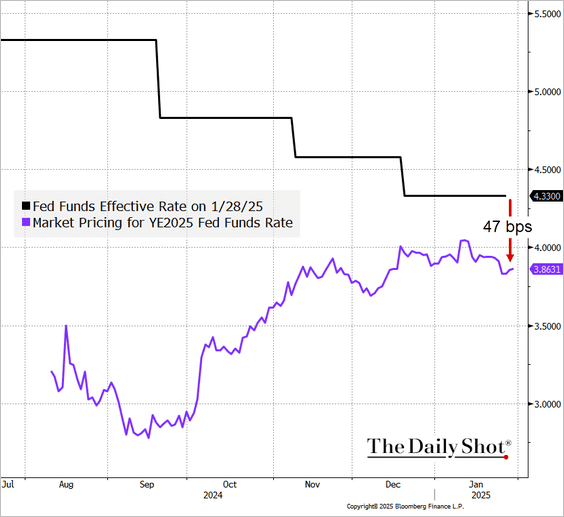

The United States: Economists and the market anticipate two Fed rate cuts this year.

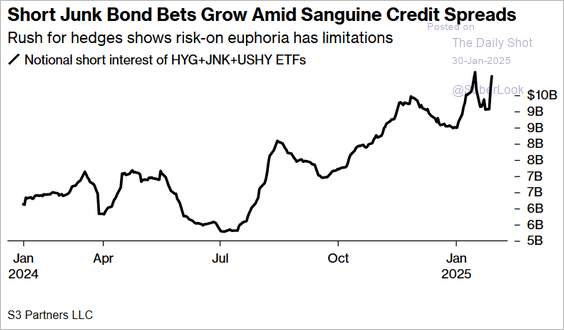

Credit: Short bets on HY ETFs have been rising.

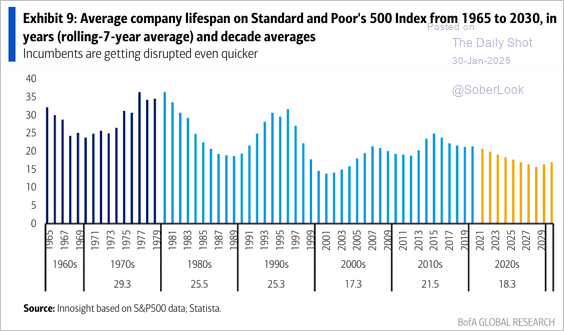

Equities: The average lifespan of companies in the S&P 500 has been declining, dropping from nearly 35 years in the late 1960s to just over 18 years projected for the 2020s. This trend underscores the accelerating pace of disruption and turnover among market leaders.

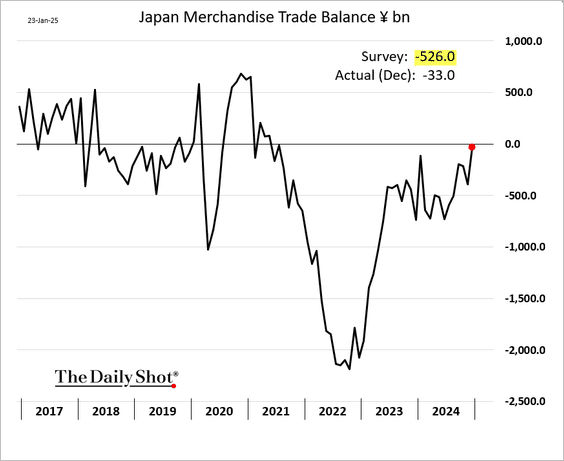

Japan: The BoJ’s lending program has steadily expanded, reaching ¥80 trillion, but is now set to wind down as part of its broader balance sheet reduction. This marks a significant step toward policy normalization after years of aggressive monetary easing.

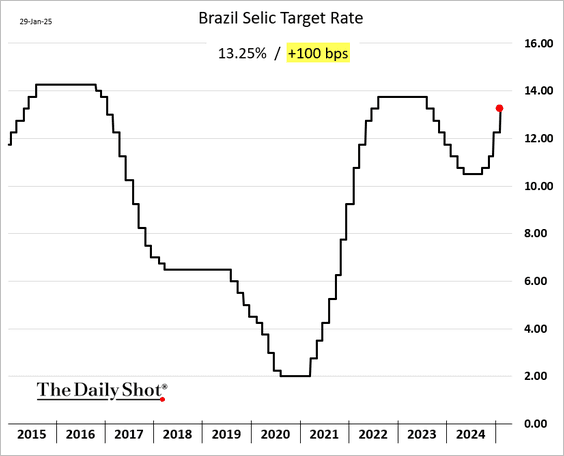

Emerging Markets: Brazil’s central bank delivered another 100 bps rate hike.

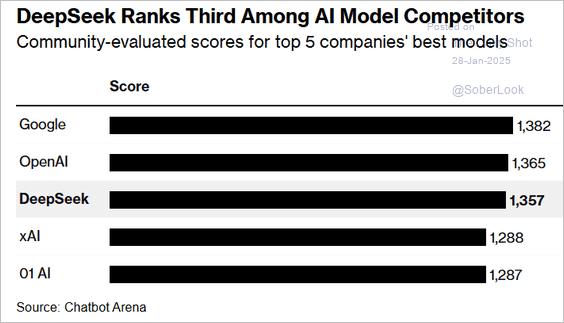

Food for Thought: DeepSeek app downloads:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief