Greetings,

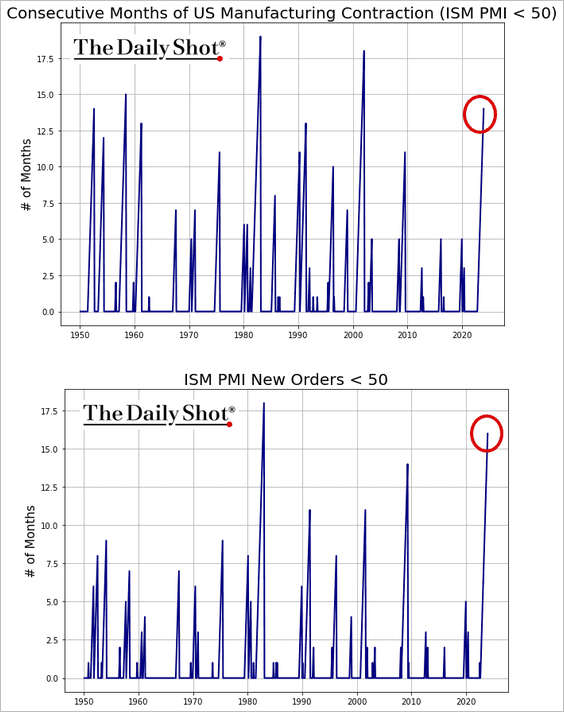

The United States: The ISM manufacturing index has been in contraction territory for 14 months in a row, while new orders have declined for 16 consecutive months.

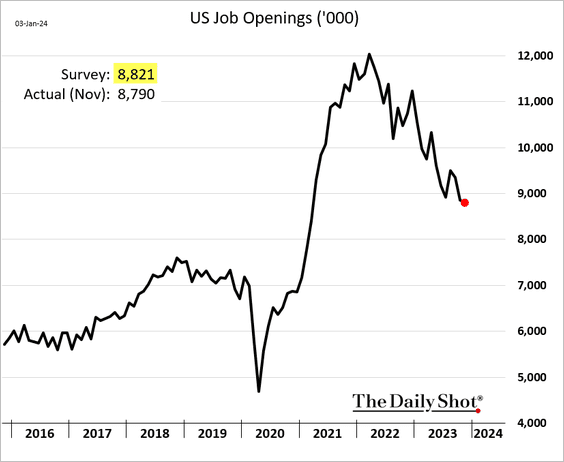

Job openings continue to fall, supporting the Fed’s goal of slower demand.

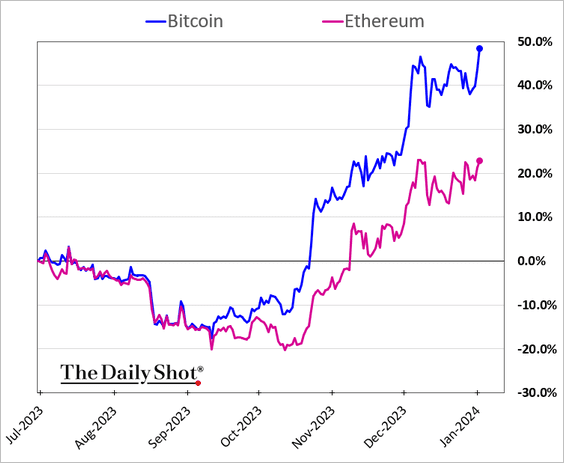

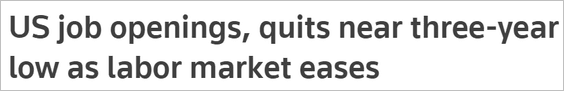

Cryptocurrency: Bitcoin declined sharply as volatility surged ahead of the ETF decision.

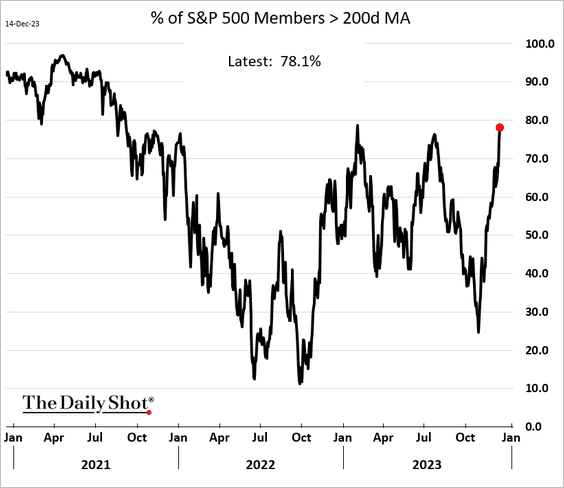

Equities: Here is Goldman’s positioning indicator.

Credit: US multi-family debt delinquencies continue to rise.

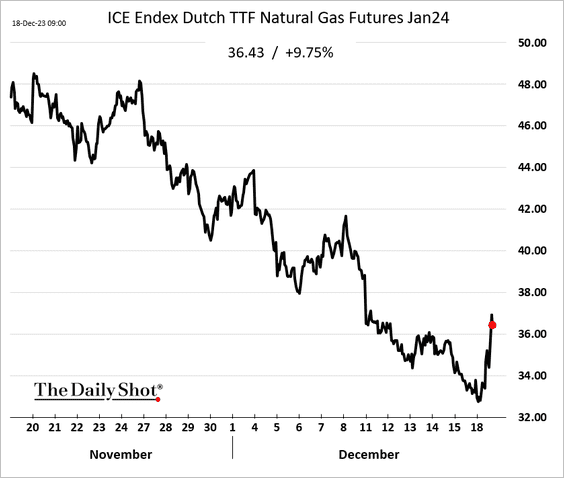

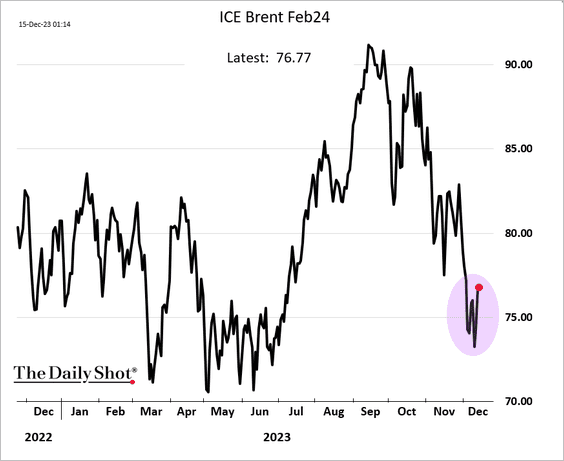

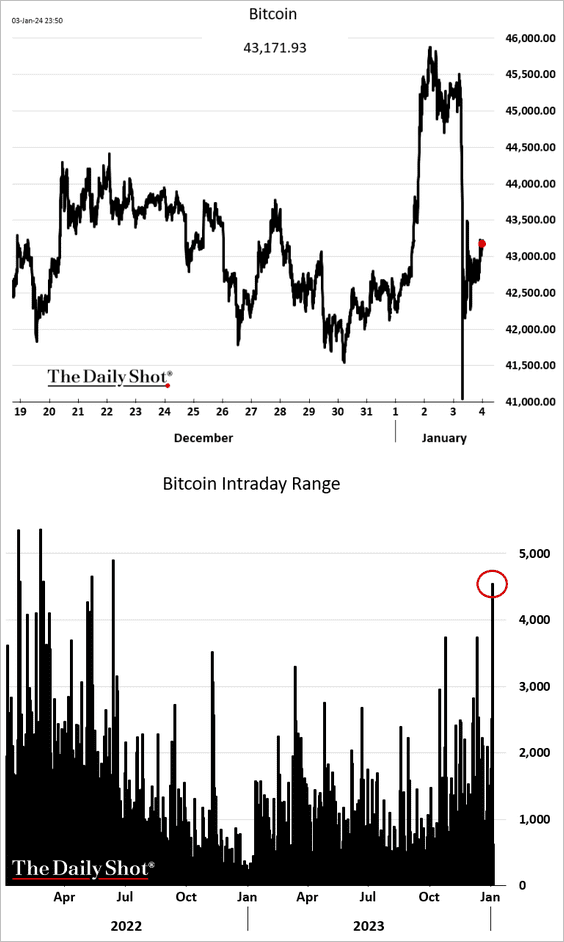

Energy: Crude oil is firmer amid tensions in the Middle East and the Libya oilfield shutdown.

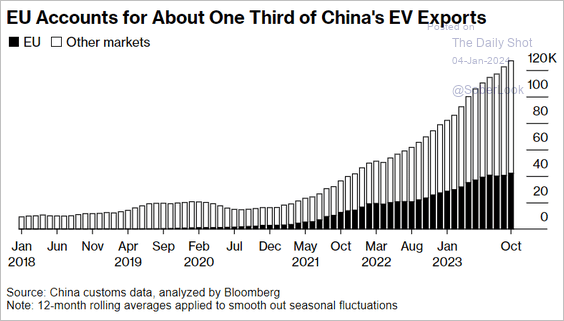

Europe: The EU is a key market for China’s EV exports.

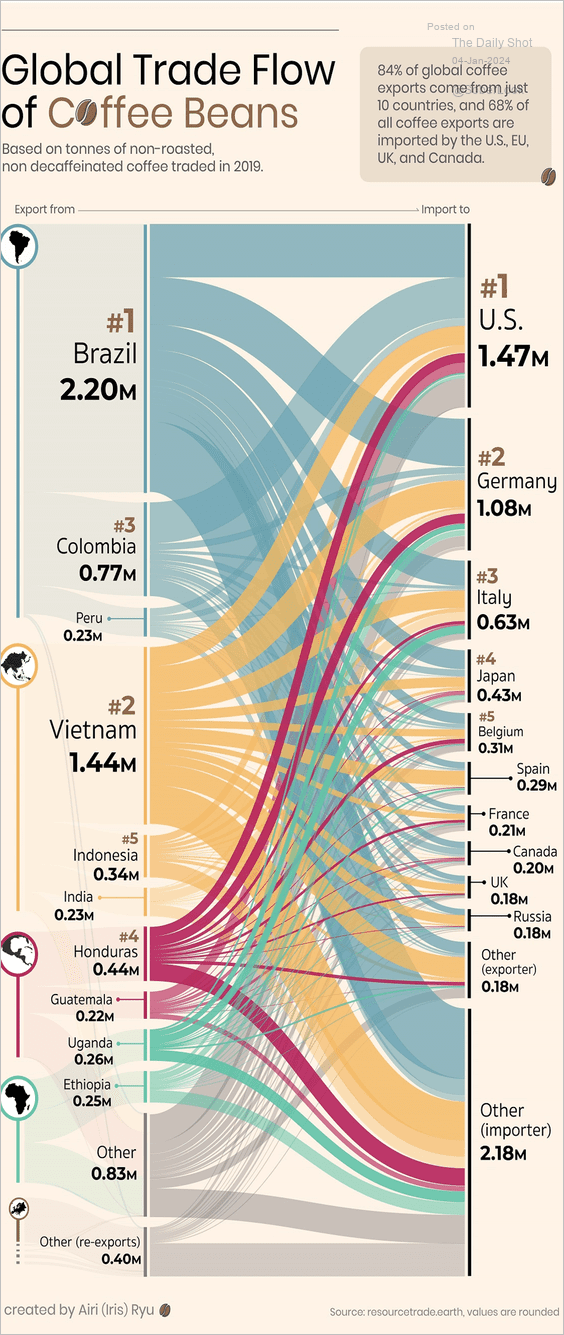

Food for Thought: Coffee bean trade flows:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com