Greetings,

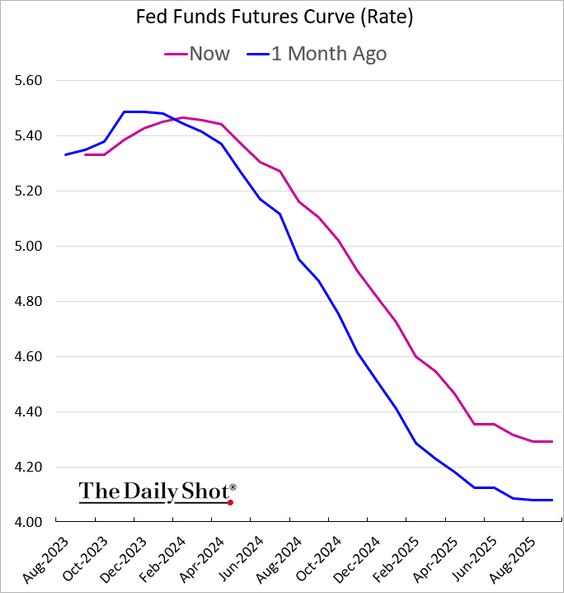

The United States: The market has repriced the expected longer-term fed funds rate trajectory in recent weeks.

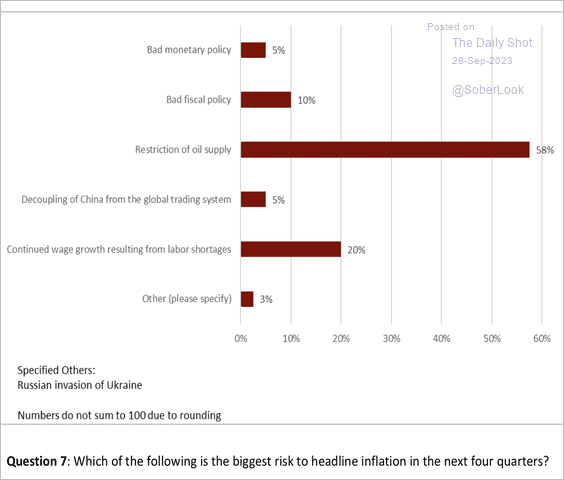

The restriction of oil supply is viewed as the largest upside risk to headline inflation.

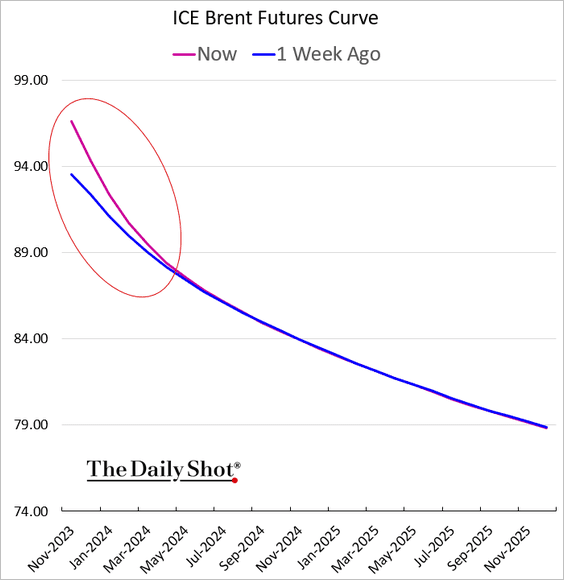

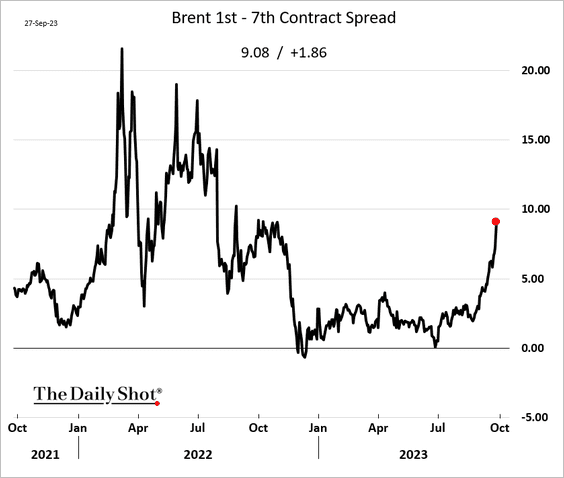

Energy: Crude oil backwardation is deepening amidst supply concerns (2 charts).

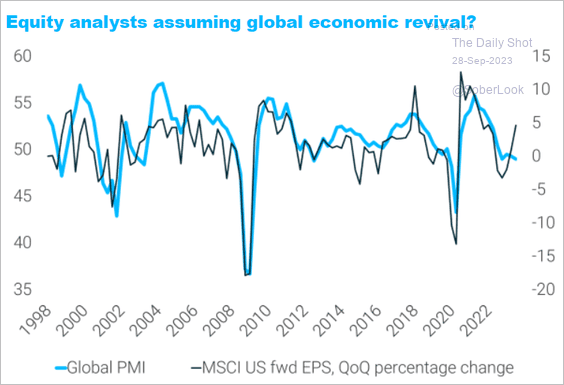

Equities: Equity analysts are assuming a rebound in business activity ahead. However, surging bond yields (driving up mortgage rates), the resumption of student loan payments, and the looming government shutdown will be a headwind for the US economy.

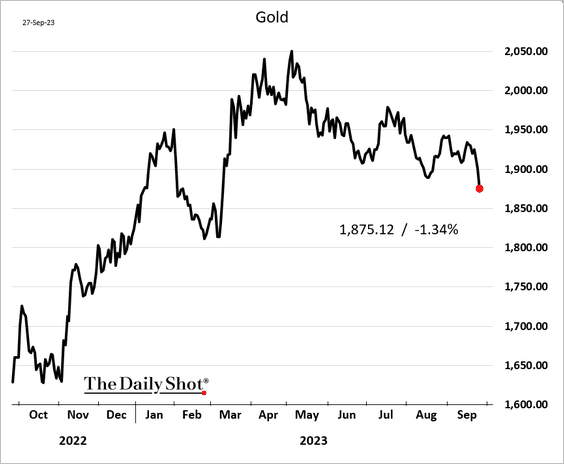

Commodities: Gold is finally succumbing to surging real rates.

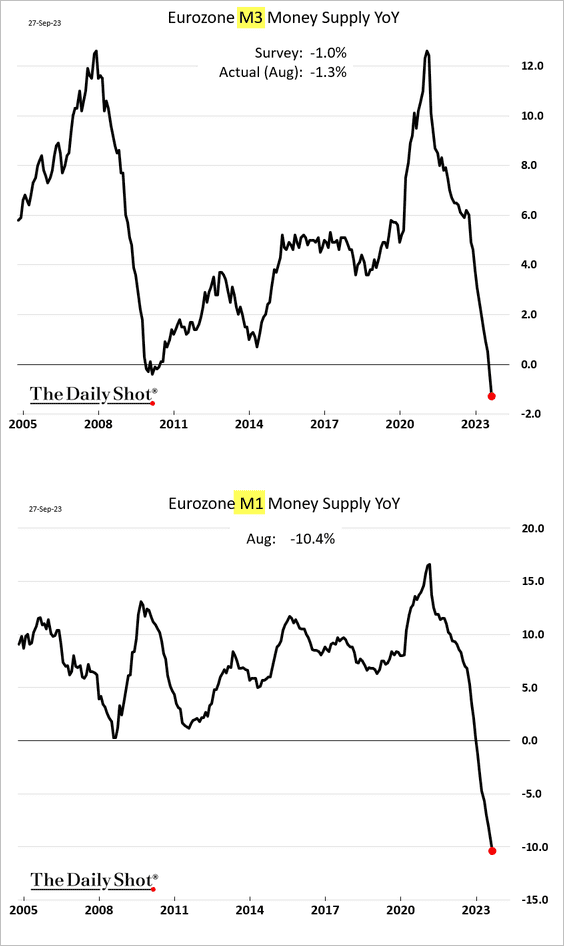

The Eurozone: The contraction in the money supply has accelerated.

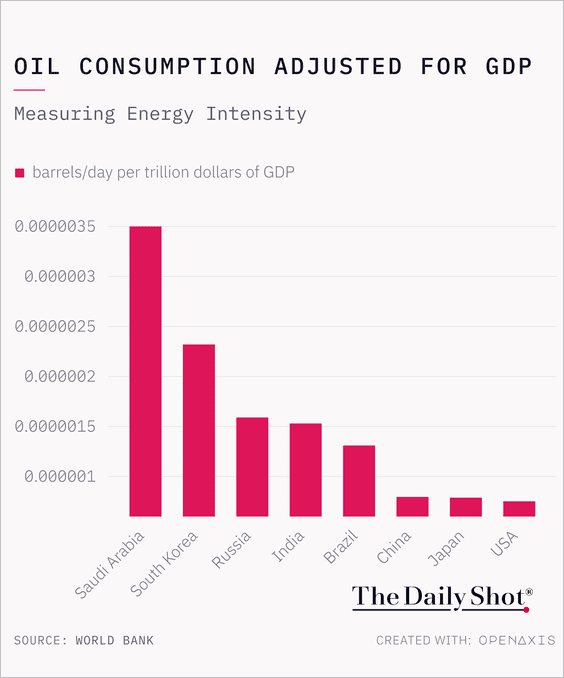

Food for Thought: Oil consumption adjusted for GDP:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief