Greetings,

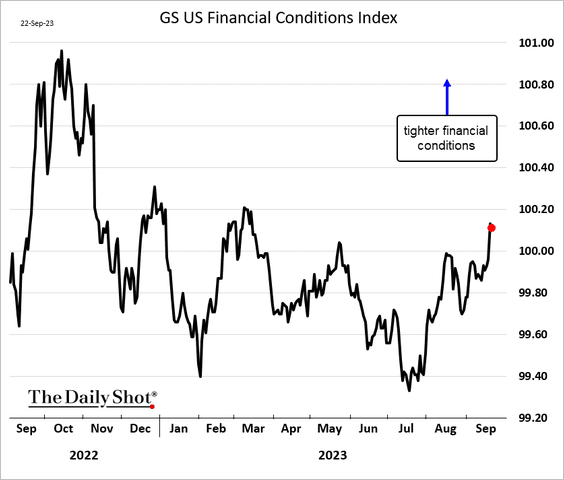

The United States: US financial conditions have been tightening, driven by a stronger US dollar, higher yields, wider credit spreads, and a pullback in stocks.

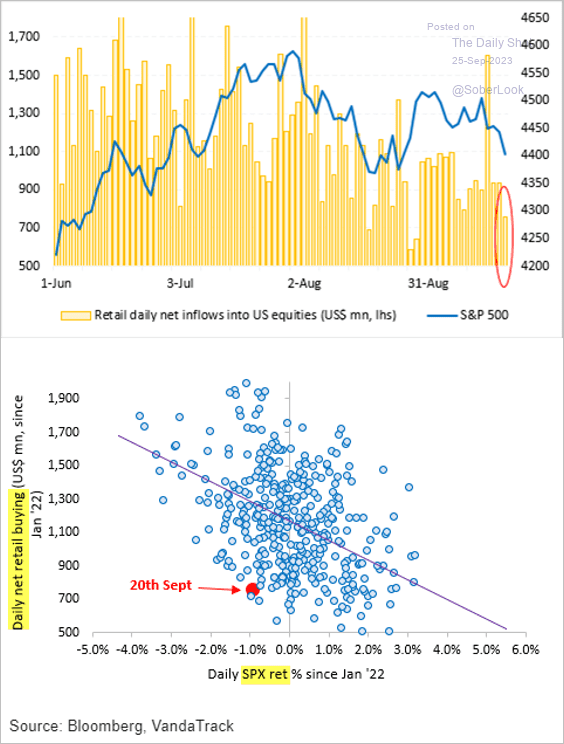

Equities: Retail investors are not as keen on buying the dip in the current selloff.

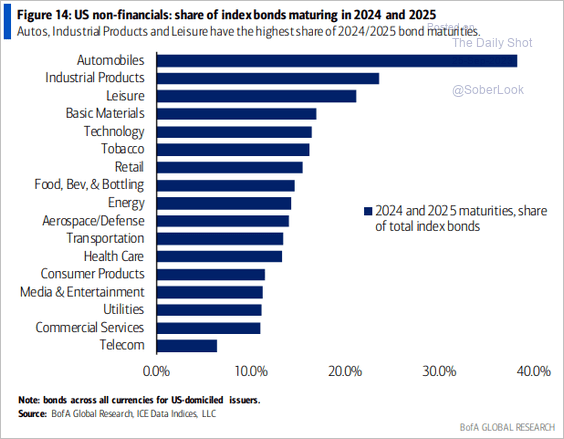

Credit: Which sectors have the highest share of 2024 and 2025 bond maturities?

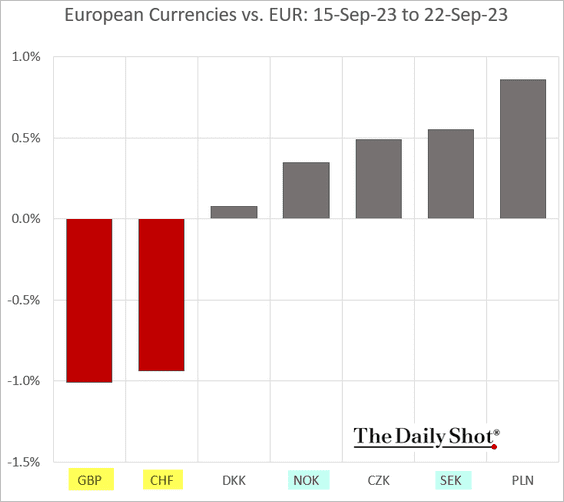

Europe: Switzerland and the UK, which held rates unchanged, saw their currencies underperform last week.

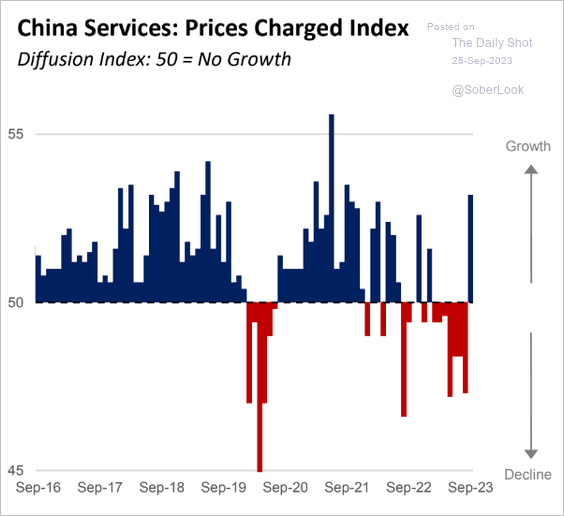

China: According to the World Economics SMI report, inflation has returned to China’s services sector.

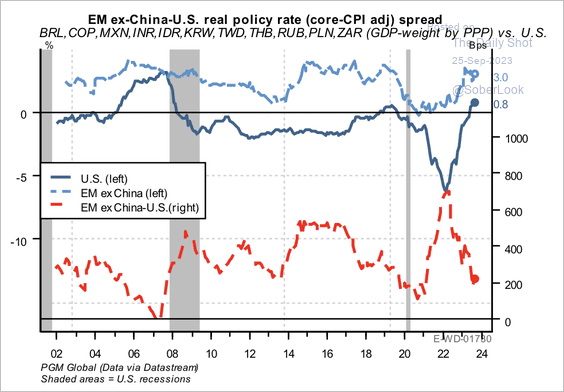

Emerging Markets: Real rate differentials are less supportive of EM carry trades.

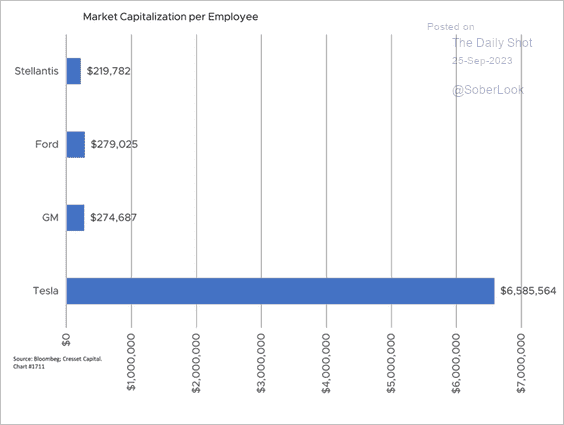

Food for Thought: US automakers’ market capitalization per employee:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief