Greetings,

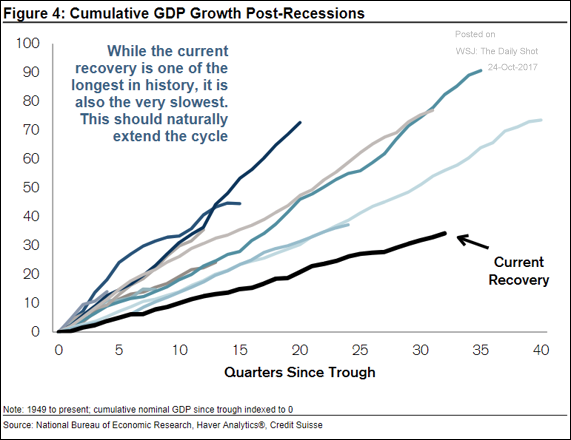

The United States: How close is the next recession? Credit Suisse says we are nowhere near the end of the cycle.

• This expansion has been quite long by historical standards. However, given how slow the recovery has been, the cycle could end up extending further (potentially creating even bigger asset bubbles?).

• While the yield curve has flattened significantly, it has not inverted.

• Here is what the key metrics looked like prior to the previous six recessions.

The Eurozone: The EUR-USD cross-currency swap basis is widening. It suggests tighter dollar funding conditions for European banks that don’t have access to US deposits.

Emerging Markets: Romania’s government hasn’t raised any debt this month, blaming “unacceptable” yield levels. Those greedy debt markets – how dare they demand a higher interest.

Equity Markets: Has regulation taken a toll on IBM and Microsoft? What does it mean for the current leading tech firms who could be facing fresh regulatory scrutiny?

Credit: CLO volume has spiked this year (a big portion of the increase has been all the refinancing deals).

Rates: Credit Suisse sees the tax-reform driven bond selloff as premature. Given the deteriorating budget deficit (see #3 here), any significant tax cuts that could justify the “reflation trade” are unlikely.

Food for Thought: Ivy league degrees at various institutions.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com