Greetings,

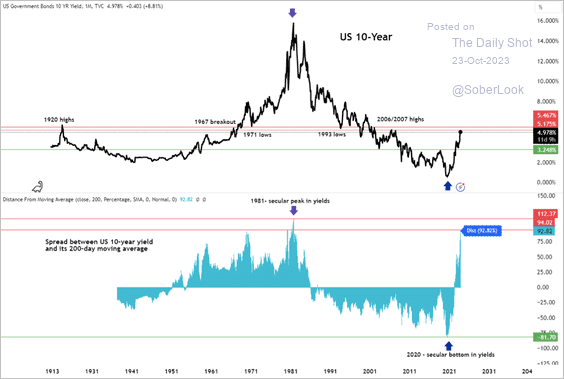

Rates: The spread between the 10-year Treasury yield and its 200-day moving average is the most extreme since its cycle peak in 1981.

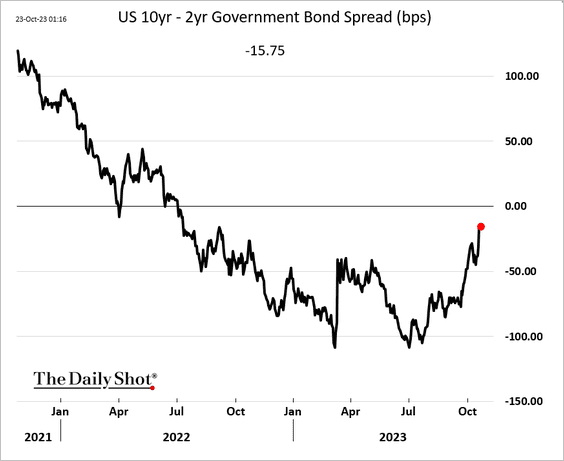

The Treasury curve continues to flatten.

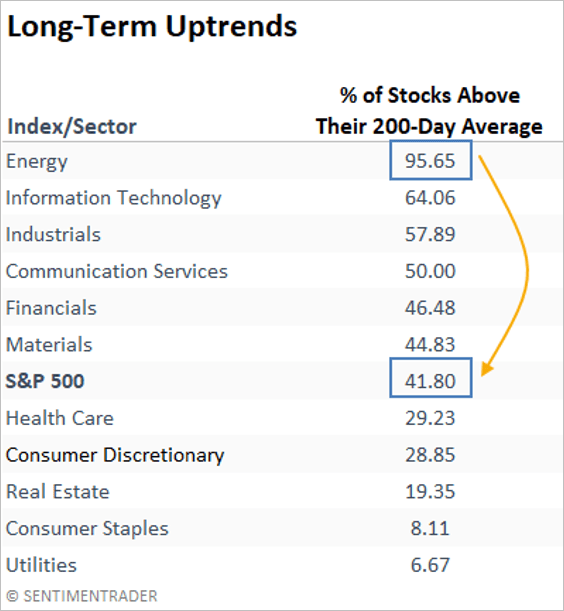

Equities: According to SentimenTrader, the S&P 500 sector breadth is at the widest spread in about 70 years.

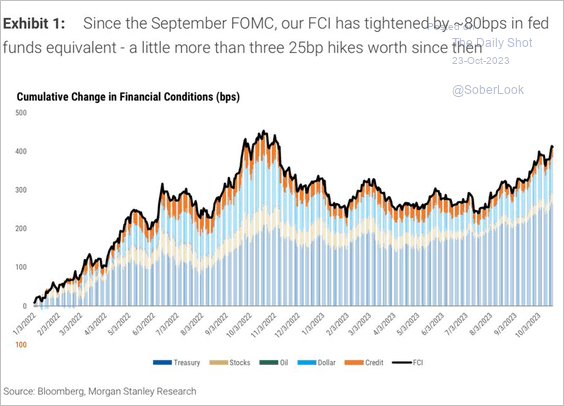

The United States: The tightening in US financial conditions since the September FOMC meeting is equivalent to some 80 basis points worth of Fed rate hikes, according to Goldman.

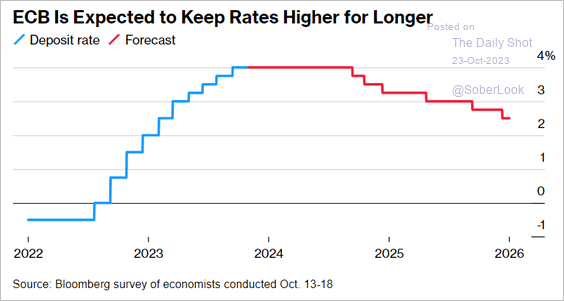

The Eurozone: Forecasters expect the ECB to keep rates higher for longer.

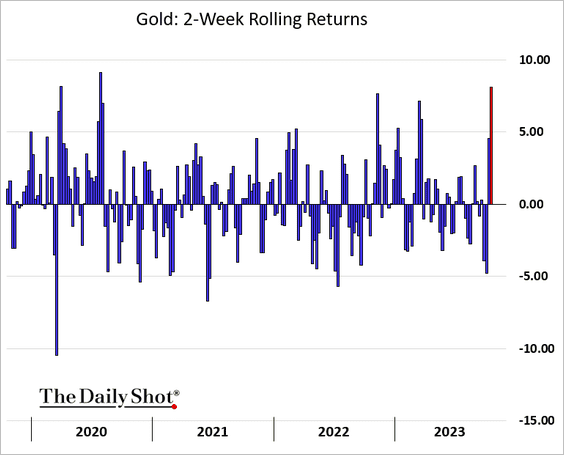

Commodities: It’s been a great couple of weeks for gold.

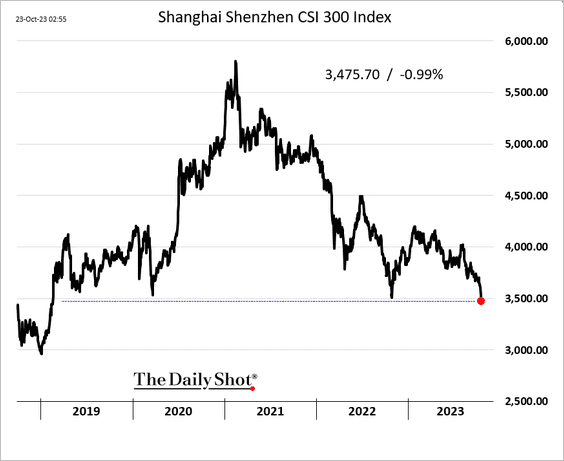

China: The Shanghai Shenzhen CSI 300 Index hit its lowest level since 2019.

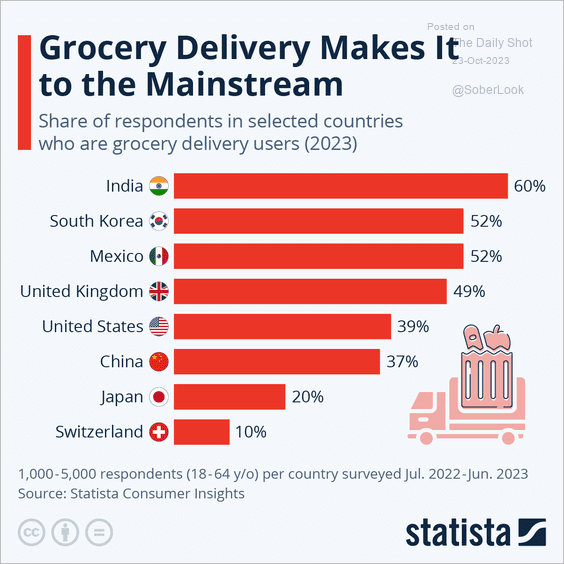

Food for Thought: Grocery delivery users:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief