Greetings,

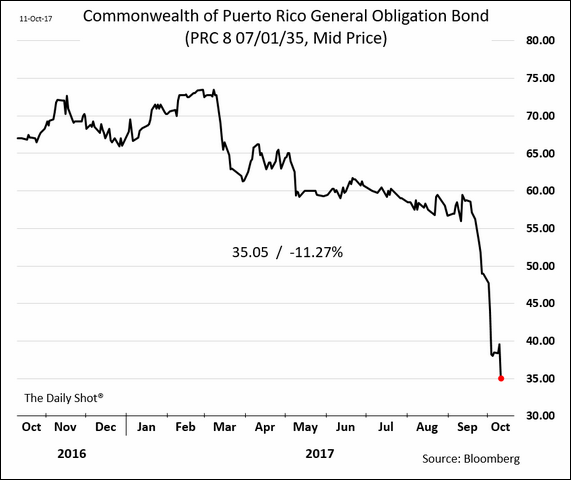

Credit: Puerto Rico’s general obligation debt took another leg down.

Here are the updated Moody’s ratings for each state’s general obligation debt.

Europe: The Catalonia jitters had generated record levels of trading in Spanish government bonds.

But the concerns appear to be easing now as the bond curve flattens (investors roll into longer maturities).

Asia: This chart compares the internet penetration by age group between China and the US.

Emerging Markets: Overall, EM shares continue to advance.

And EM corporate high-yield bonds have become quite popular.

Equity Markets: The semiconductor sector is having an amazing year.

There is more pain in the retail sector.

Food for Thought: Paper money transaction volume is shrinking (relative to total transactions).

The age distribution for US religious groups.

Edited by Paul Menestrier

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com