Greetings,

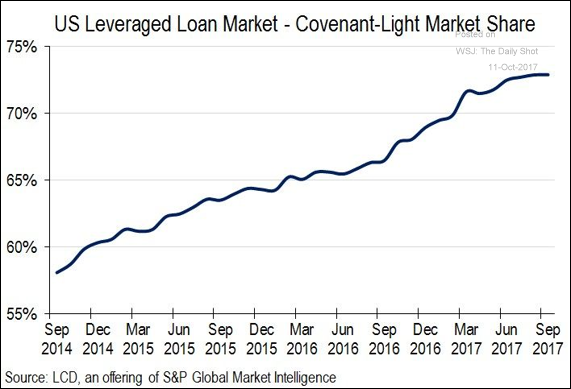

Credit: Here is the covenant-light share of the US leveraged loan market.

Japan: The Nikkei continues to climb.

The Eurozone: Investors have taken quite a bit of money out of the largest Spanish equity ETF.

The United States: Nomura sees the GOP succeeding in its efforts to cut US personal taxes by one trillion dollars over the next ten years (in Q1). The team, however, is skeptical about a corporate tax cut. Here is the impact of the tax legislation on the various economic metrics.

China: The renminbi bounced sharply after the holiday week on talk of Bejing widening the currency’s trading band.

Emerging Markets: This chart shows the satisfaction with each nation’s president for the largest Latin American economies.

Equity Markets: Here is an intriguing study pointing to mean-reversion in the stock market. Sharp declines are frequently followed by a bounce. So much for the Markov property assumptions.

Food for Thought: Education by age.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com