Greetings,

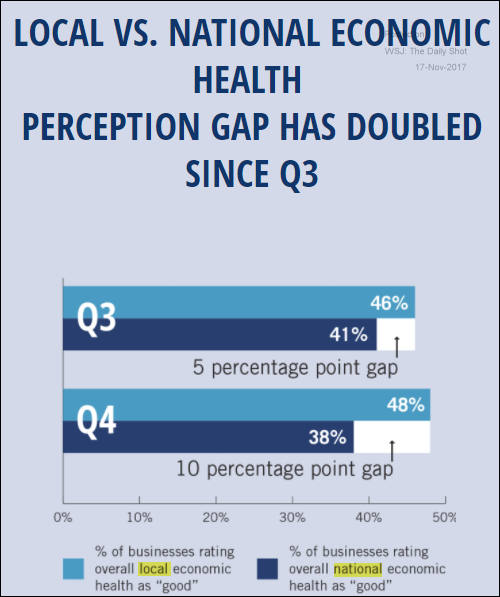

The United States: Small businesses increasingly see their local economic conditions as being better than the national situation.

Unrelated: The probability of two Fed rate hikes between now and the end of the first quarter rose above 50%.

China: China’s outbound investment dipped, as Beijing clamps down on large foreign acquisitions.

Credit: Many leveraged loan documents these days permit big dividend payments by the company. While it’s not usually an issue in this economy, lenders will regret this development when cash flow becomes more constrained. The green line represents the “restricted payment” score (which is very loose now).

Equity Markets: The US market looks massively overvalued relative to the rest of the world.

That’s why flows into non-US ETFs have been so brisk.

Energy Markets: Last quarter, China drove the bulk of the global oil demand growth.

Global Developments: This table shows the demographic risks (aging population) around the world.

Food for Thought: Alexa, Siri, Cortana, and Google compared.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com