Greetings,

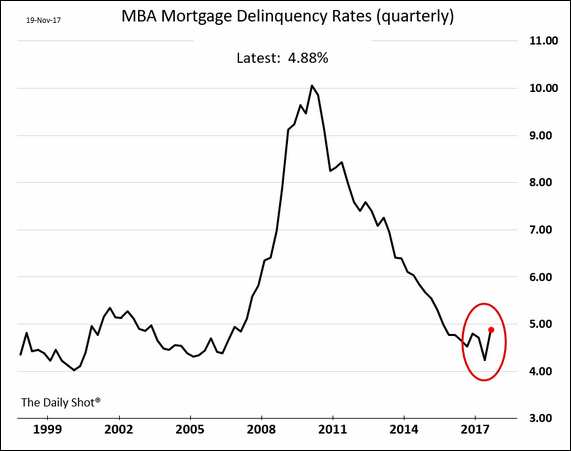

The United States: The Mortgage Bankers Association showed an increase in mortgage delinquency rates last quarter. Is this hurricane-related?

As a whole, US consumers’ balance sheets remain in good shape. Of course, the trends in the chart below are very different across the income levels.

The debt concern in this economic cycle is in the corporate sector.

The Eurozone: Kept alive by banks, “zombie” firms in Europe create a drag on investment and growth.

Credit: College debt continues to get downgraded. Some suggest that this could become a severe problem if the economy slows (colleges are no longer able to raise tuition at the rate they used to). Will we see colleges consolidating or even going under?

Equity Markets: Realized sector correlations remain remarkably low. Part of the reason is oil decoupling from stocks. Also, the carnage in the retail and consumer staples sectors was taking place just as tech, semiconductors, and homebuilders rallied.

Emerging Markets: The mess in Zimbabwe hasn’t been good for the nation’s stock market. Robert Mugabe “is out” according to his party, but he is not going anywhere according to him. What will the military do?

Alternatives: Uber valuations diverge across major holders.

Food for Thought: Which countries are most affected by terrorism?

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com