Greetings,

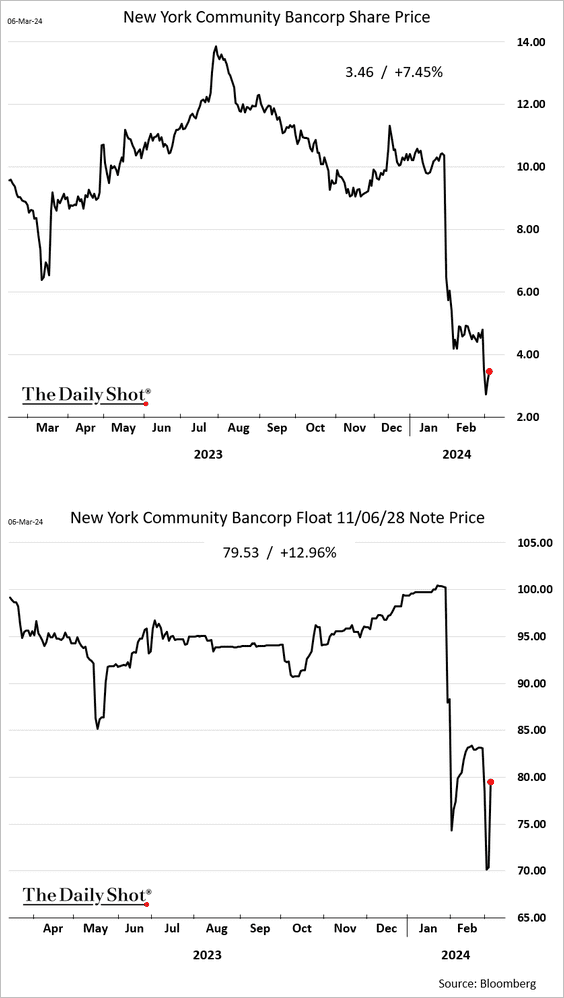

Credit: New York Community Bancorp’s assets bounced after the news of a capital injection.

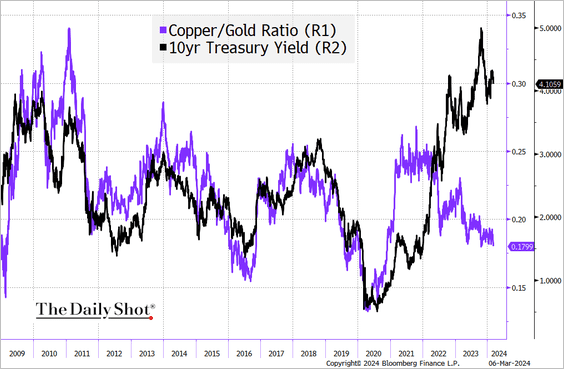

Rates: The copper-to-gold ratio suggests that Treasury yields should be lower.

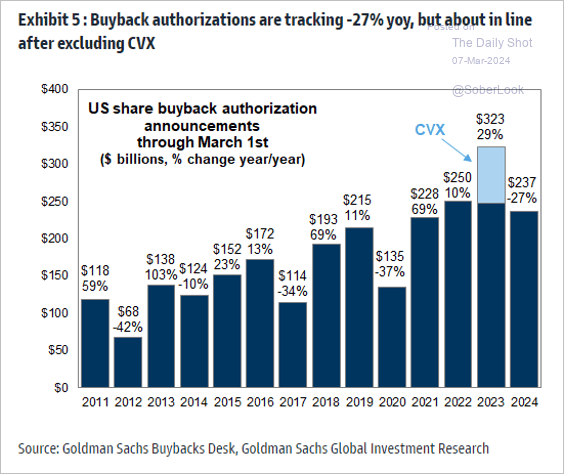

Equities: While share buyback activity remains well below the levels seen last year when excluding Chevron’s massive buyback from the previous year’s data, the current figures align more closely with last year’s trend.

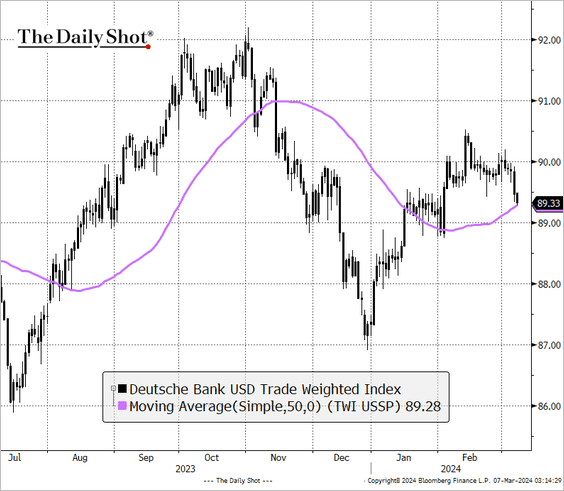

Global Developments: The dollar has been selling off, with the trade-weighted index back at its 50-day moving average.

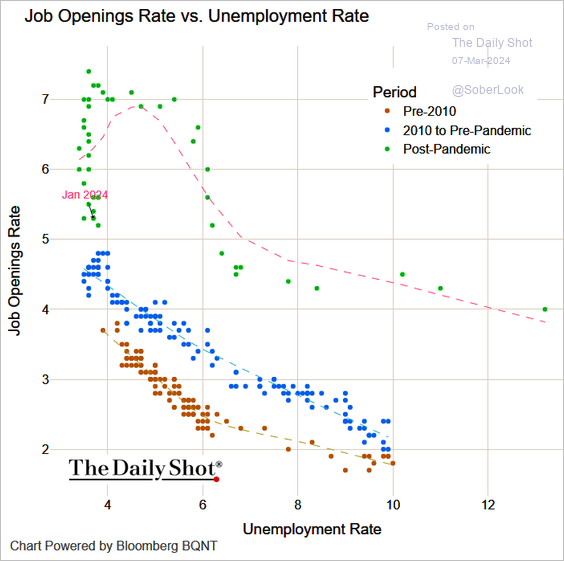

The United States: Here is the Beveridge curve, suggesting that the labor market is still tight.

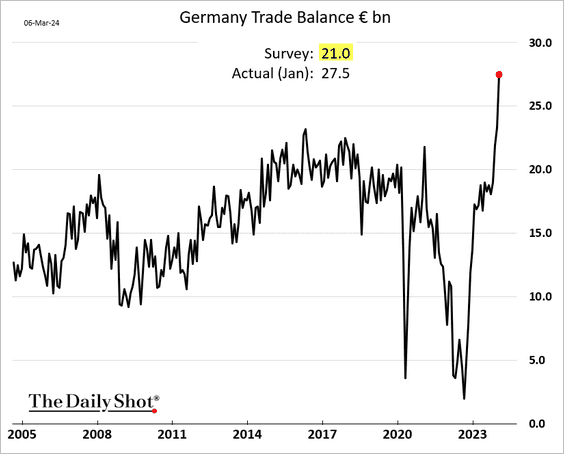

The Eurozone: Germany’s trade surplus surged to new highs as exports jumped.

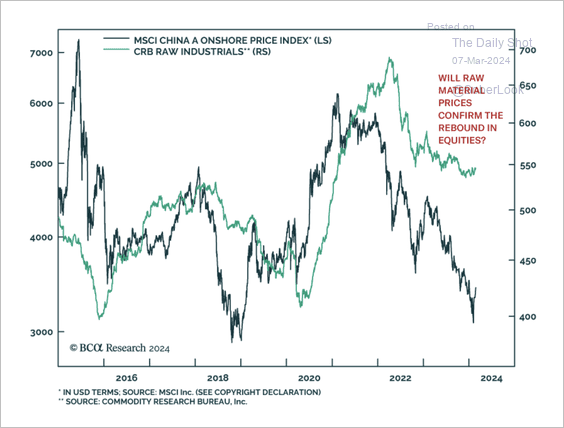

China: So far, raw material prices have not confirmed the rebound in Chinese equities.

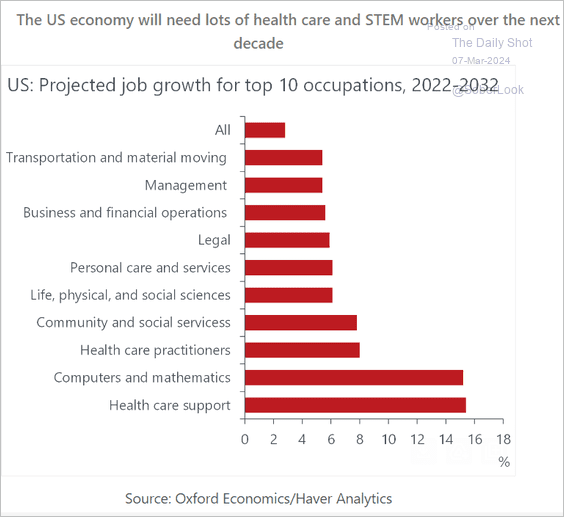

Food for Thought: Projected job growth for top 10 occupations:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com