Greetings,

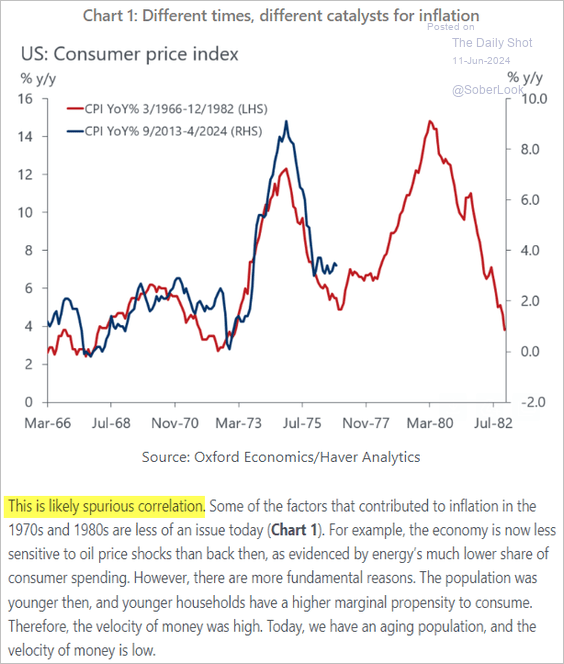

The United States: Are the fears of a second inflation wave overblown? Below is a comment from Oxford Economics.

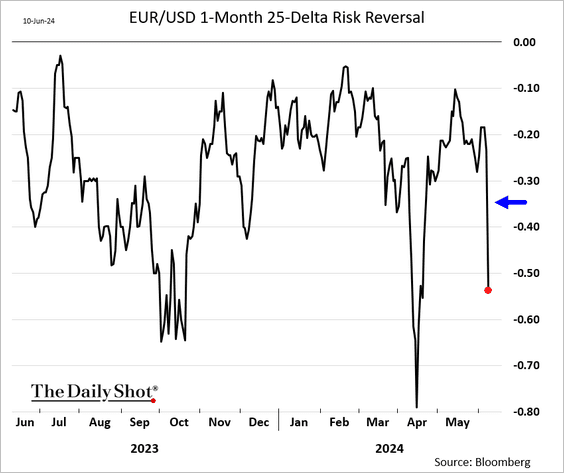

The Eurozone: The EUR/USD risk reversals show increased downside bias ahead of the French elections.

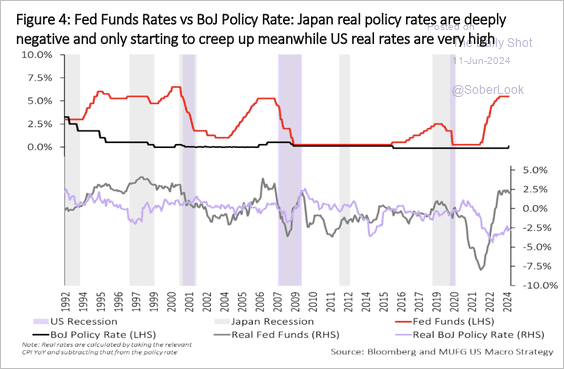

Asia-Pacific: The wide gap between US and Japanese real rates could narrow as both nations reverse unconventional monetary policies.

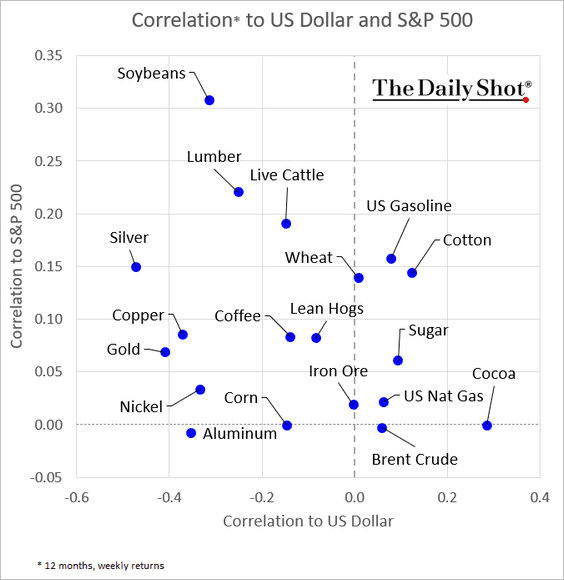

Commodities: Here is a look at commodity markets’ correlations to the S&P 500 and the US dollar.

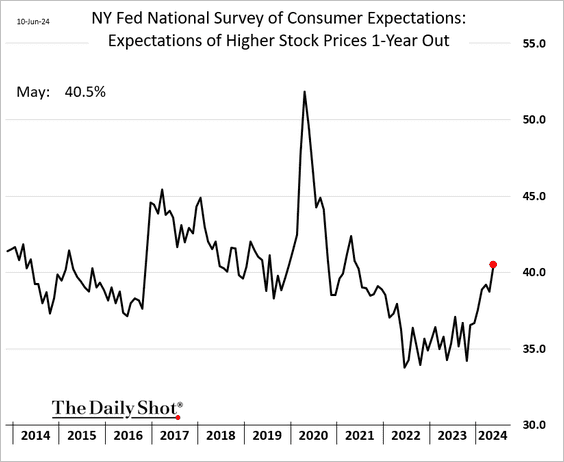

Equities: According to the NY Fed’s Survey of Consumer Expectations, US households are increasingly upbeat on stocks.

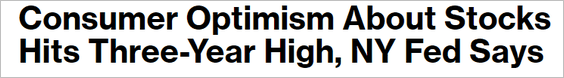

Credit: Investment-grade bond fund flows remain robust.

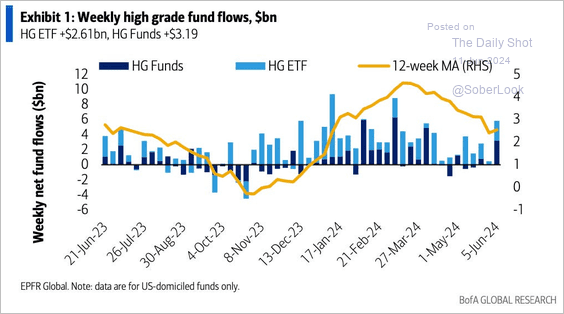

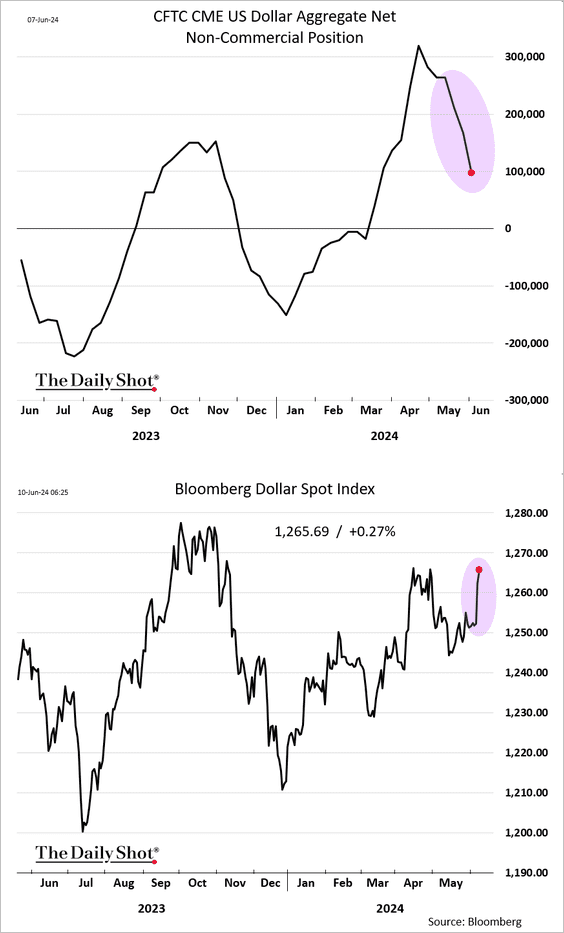

Global Developments: Speculative accounts have been cutting their US dollar exposure ahead of the rebound.

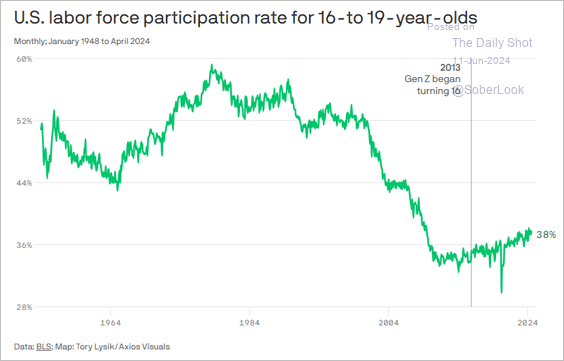

Food for Thought: US teens’ labor force participation:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief