Greetings,

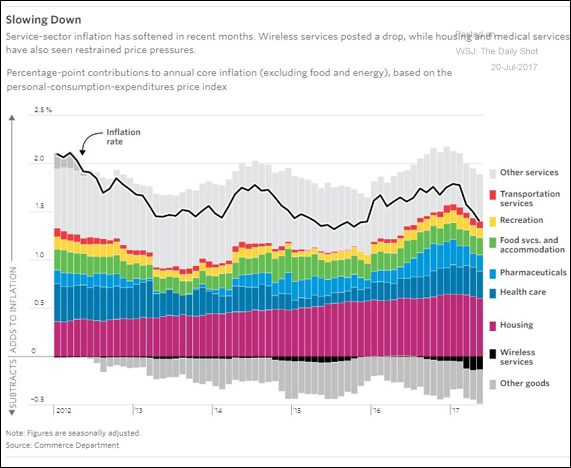

The United States: This chart shows the full breakdown of US core inflation.

Rates: Many fund managers view the start of the Fed’s balance sheet unwind (quantitative tightening) as a non-event.

Commodities: Sugar futures have bounced off the lows.

Equity Markets: Based on seasonal patterns, this is the time of the summer when the S&P 500 should peak.

Energy Markets: Here is the Department of Energy production forecast.

Emerging Markets: This summary chart shows the central bank policy rates and the forecasts for select Latin American economies.

The Eurozone: The next chart shows the population pyramids for the largest Eurozone economies. They will become highly inverted by 2050 (dashed lines) as the population ages.

Food for Thought: Average time spent per day with …

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com