Greetings,

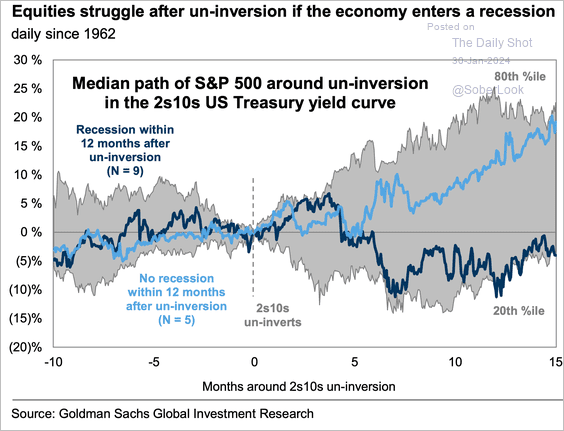

Equities: What happens to stock prices after the yield curve “un-inverts”?

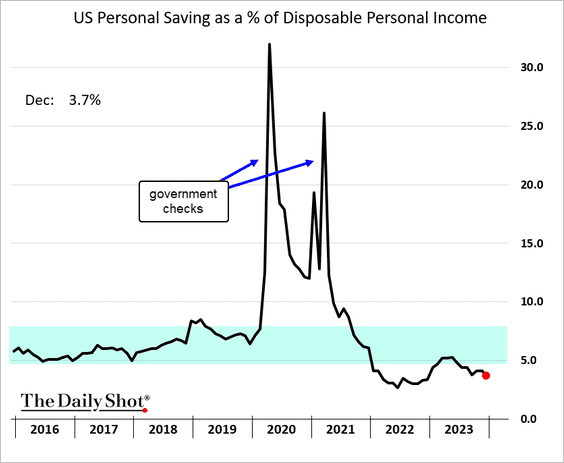

The United States: Consumers continue to save less than they did prior to the pandemic (relative to their disposable incomes). The rate has been trending lower since last spring.

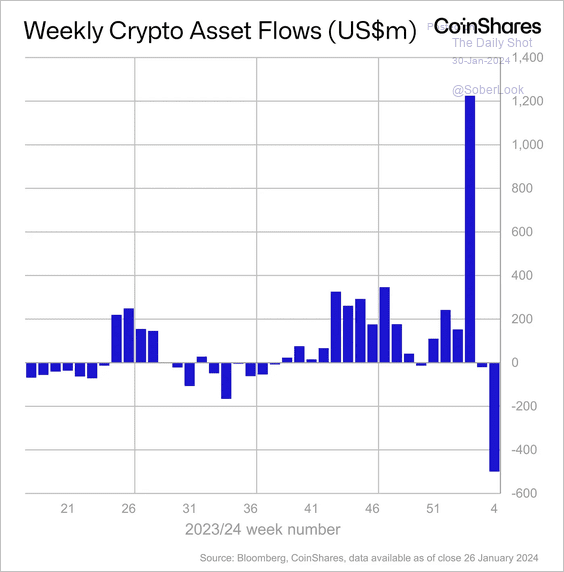

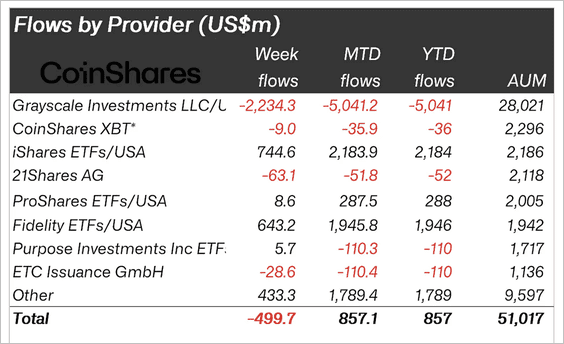

Cryptocurrency: Crypto funds saw significant outflows last week, mostly driven by incumbent bitcoin ETF issuer Grayscale.

Rates: The average real Fed funds rate at the first rate cut is 3% (median 2.8%). In this cycle, the real rate could exceed the historical average if inflation continues to decline.

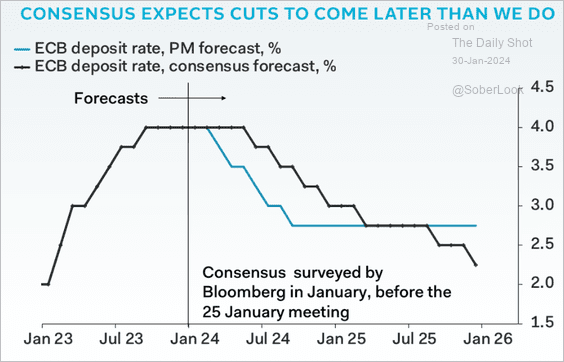

The Eurozone: Falling inflation and soft economic activity point to ECB rate cuts, which could arrive sooner than the market expects.

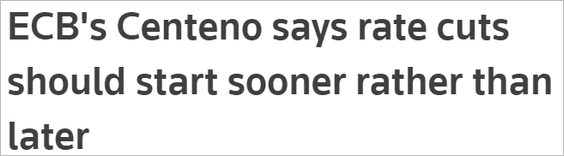

Global Developments: The recent rise in global supply chain bottlenecks could slow the decline in inflation.

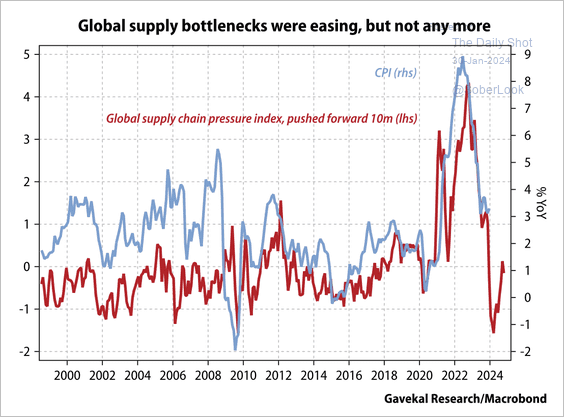

Food for Thought: The US federal budget:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com